199A Input, Aggregation and Integration

K1 Aggregator includes functionality to track 199A information for each investment, aggregate it across the portfolio and integrate it into a CCH Axcess 1040.

K1 Aggregator includes functionality to track 199A information for each investment, aggregate it across the portfolio and integrate it into a CCH Axcess 1040.

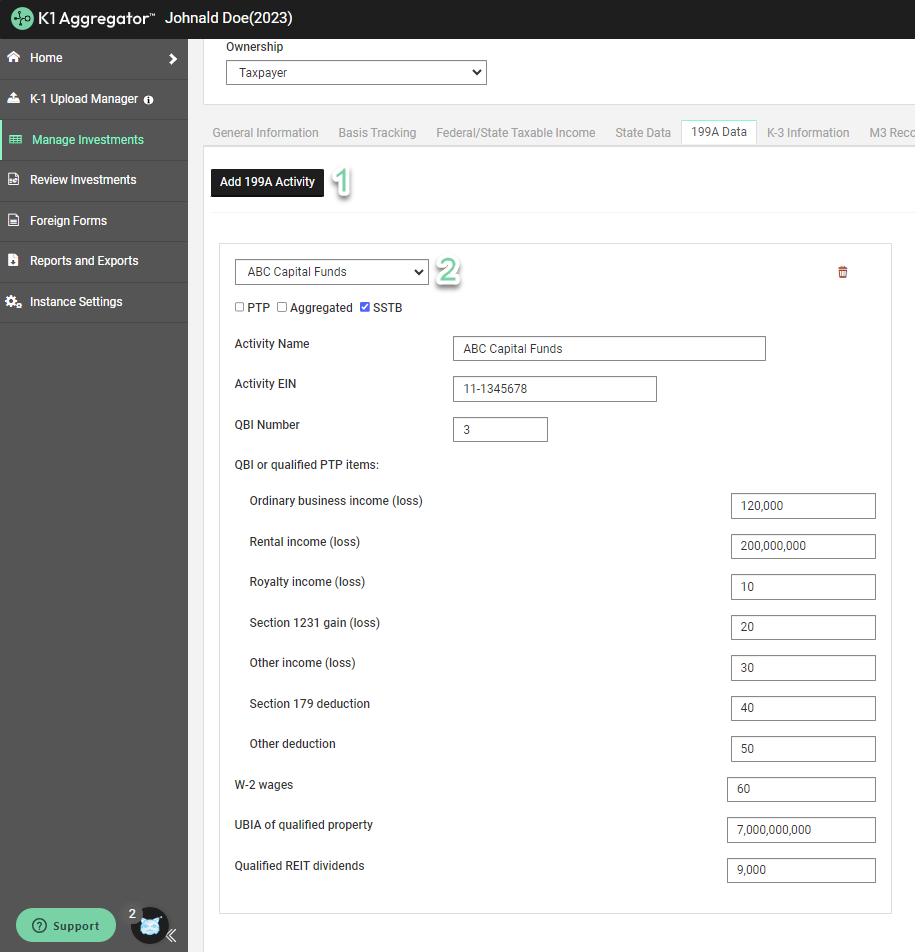

199A Data Input

199A information from K-1s can be recorded on the 199A Data tab inside an investment. The Add 199A Activity button in the top left corner of the tab [1] will allow you to add activity-level 199A detail. The dropdown in the top left corner of the activity [2] will enable you to link this record to an investment-level activity.

Newly created activities will appear at the bottom of the list. They will also be linked automatically to the main investment-level activity.

You can change the dropdown menu selection to link the 199A activity to any investment-level activity. This linking will determine which activity in the CCH Axcess return the 199A information will be mapped to.

The other piece of information used to determine CCH Axcess mapping is the QBI Number field, which will route 199A data to a particular column within the chosen activity's 199A grid.

Once you've entered 199A data for all applicable investments, head over to the Review Investments page to view portfolio-level data!

199A Data Aggregation

On the Review Investments page, you'll find the 199A Data Overview panel, providing a portfolio-level summary of all 199A data. Right click anywhere within the table to export to Excel!

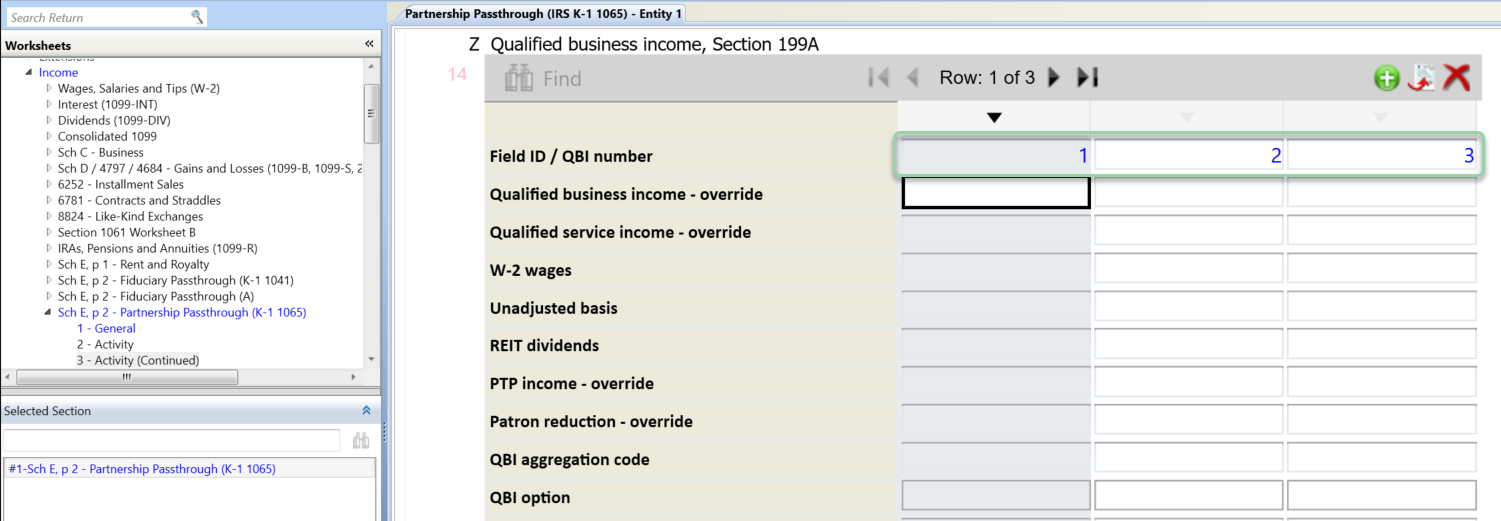

199A CCH Axcess Integration

For 1040 return types, 199A data will be included in data integration requests by default. Routing is determined by the activity number of the linked investment-level activity and the QBI Number field.