990 – PF Part VI – A, Question 5 Statement Not Flowing to the Return

Problem When preparing Form 990-PF, the statement required for Part VI-A, Question 5 is not automatically flowing into the return.

Problem

When preparing Form 990-PF, the statement required for Part VI-A, Question 5 is not automatically flowing into the return.

Solution

To resolve this issue, you must manually attach the required statement as outlined in the IRS instructions under General Instruction T.

How to attach the statement:

-

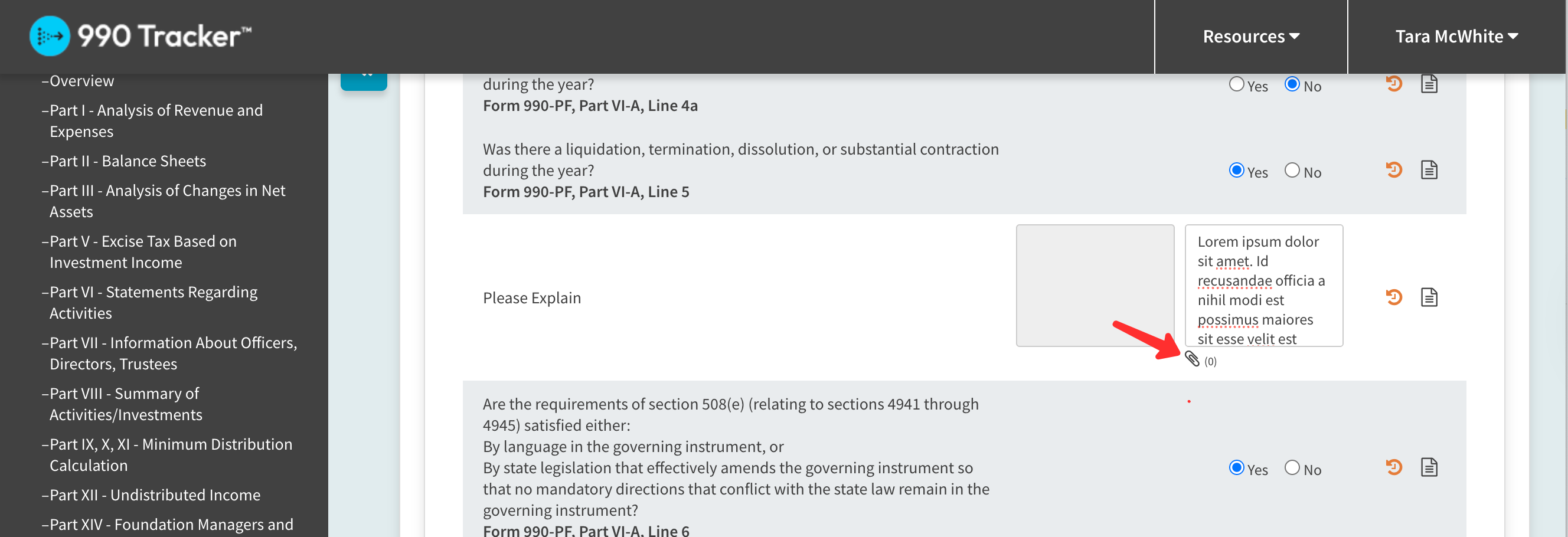

Locate Line 5 on Part VI-A of the 990-PF form within the software.

-

Click the paperclip icon next to Line 5 to upload your attachment.

-

Attach the complete statement as required (see details below).

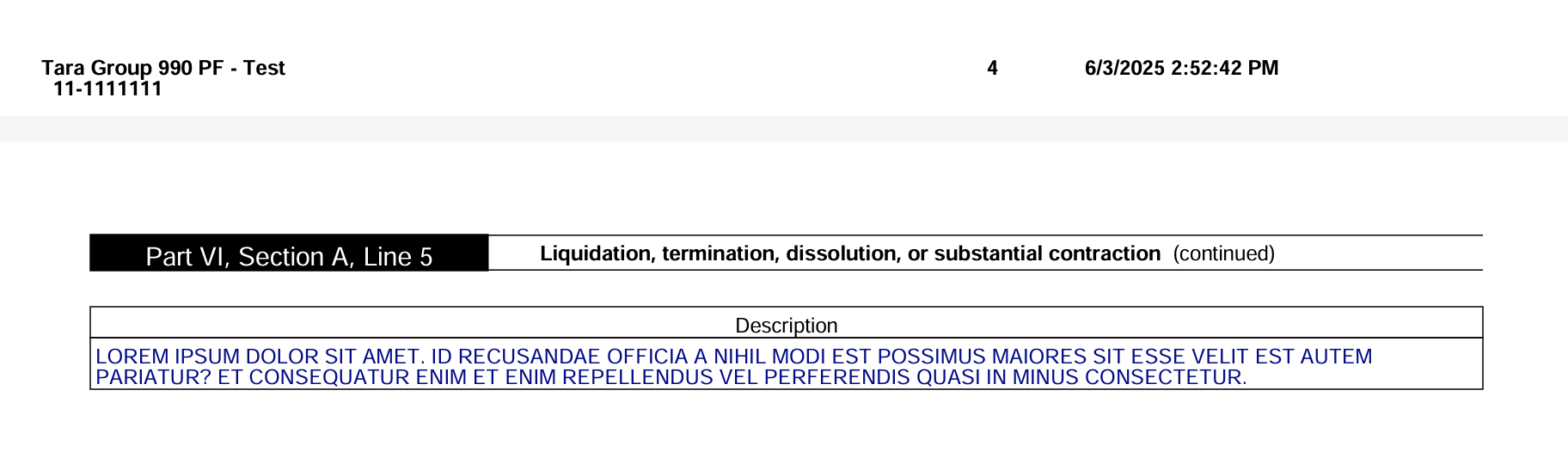

Once the statement is attached, the corresponding footnote will automatically be included in the return.

What to Attach

Per IRS instructions in Section T â Liquidation, Dissolution, Termination, or Substantial Contraction, you should attach the following to the return if applicable:

-

A statement describing the liquidation, dissolution, termination, or substantial contraction transaction.

-

A certified copy of the liquidation plan, resolution, or similar document, including any amendments or supplements not previously filed.

-

A schedule listing the names and addresses of all recipients of assets.

-

An explanation of the nature and fair market value of the assets distributed to each recipient.

Reference

For detailed IRS guidance, see:

T. Liquidation, Dissolution, Termination, or Substantial Contraction â IRS Instructions 990-PF