990 Tracker Guide | Master Compensation Module

OVERVIEW The Master Compensation Module (MCM) allows you to enter compensation in a single place for all entities within your organization.

OVERVIEW

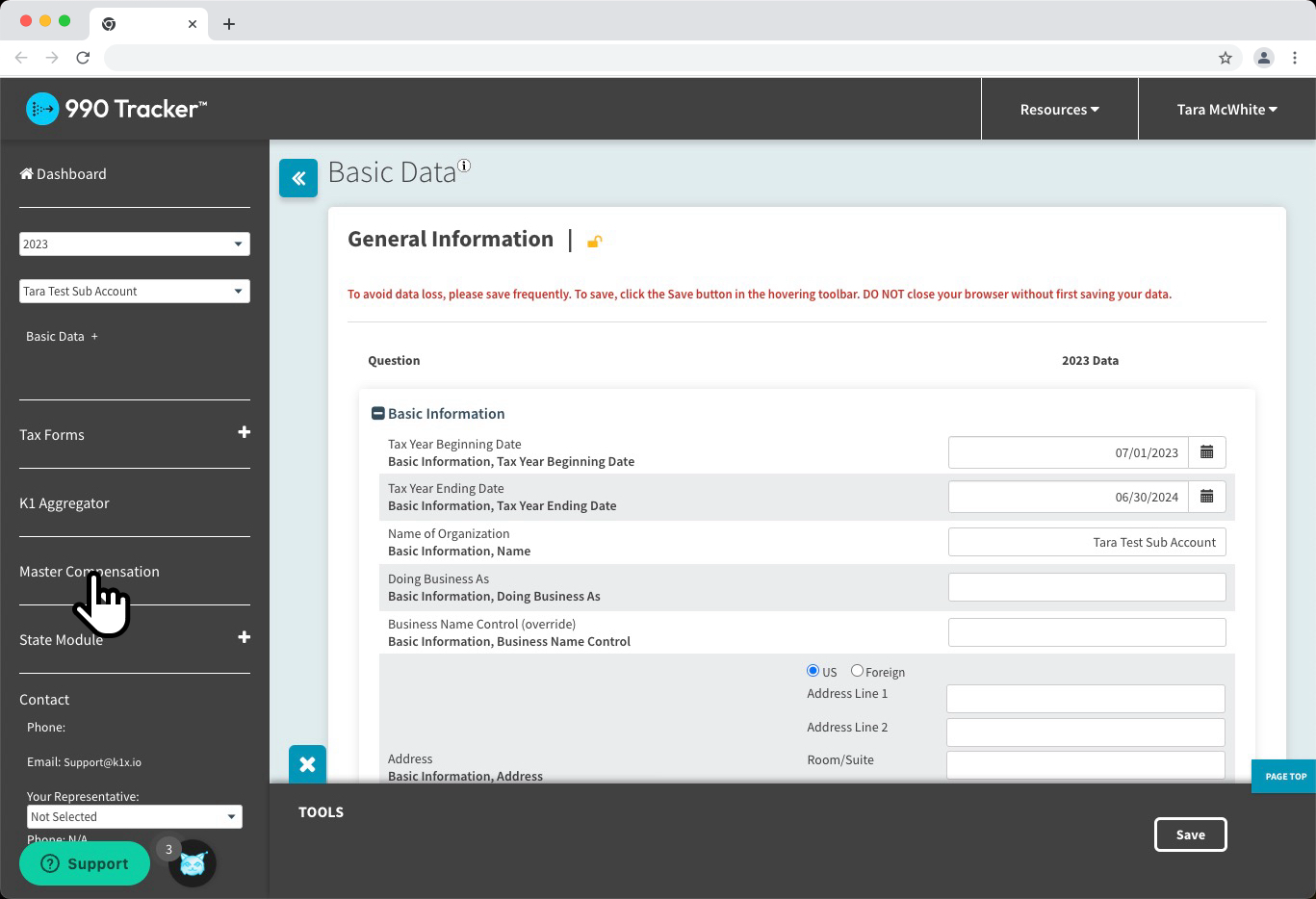

The Master Compensation Module (MCM) allows you to enter compensation in a single place for all entities within your organization. The Master Comp module will automatically determine the reporting requirements for each individual depending on the setup. To access the module, click on the Master Compensation link in the left-hand navigation panel.

ADDING INDIVIDUALS

Current and Former persons can be added to the MCM by adding them individually or by importing a list from Excel.

ADD PERSONS INDIVIDUALLY

- Open the MCS Current or Former Tab

- Select 'Add Person'

- Enter the name of the person you are adding formatted as Last Name, then First Name

- Click OK

- Provide the remaining general information (prefix, middle, suffix, email. etc.), for the person on the next input screen and select 'Update Individual Information'

- Under Organization Compensation select 'Add Compensation'

- Select the Organization the recipient received compensation from*

- Complete the personâs title, position, average hours worked per week, etc.*

- Complete the compensation columns*

* Repeat the last three steps for as many organizations the persons received compensation from or provides services to.

ADD PERSONS VIA IMPORT

- Open the MCM Current or Former Tab

- Select 'Import from Excel'

- Download the template by clicking 'Get Excel Template' (importing using any file other than the 990 Tracker MCS template will cause your import to fail)

- Add your person data to the excel template per the instructions within the template and saveto your desktop (not a network drive)

- Click 'Browse', choose the saved file and select 'Import'

- The import may take a few moments to load

KEY FEATURES

DO NOT REPORT ON FORM 990 OPTION

In some instances, an individual may be paid by a related organization, but is not considered an interested person required to be reported on Part VII of the Form 990 for the related organization. By checking 'Do not Report' the individual will not be reported on the organization's Form 990, but their compensation detail will be included on other entities for amounts paid by a related organization.

OTHER NON-APP ENTITIES

Not all related organizations must use this application to take advantage of MCMâs capabilities. For this reason, users can add Non-App entities in the MCM to report compensation received or time spent at related organizations. Non-App entities can be added from the 'Other Non-App Entities Tab' or from within an individual's entry.

Related Organizations

Organizations may be considered related in application, for financial statement purposes, or as part of a system as a whole, however for purposes of reporting on the Form 990, organizations may not be considered related. MCM has a Related Organizations feature that enables users to select organization relationships for reporting and specifically identify which entities are related and which are not.

To access the Related Organizations feature:

- Select the tab

- Choose an entity from the dropdown list

- Indicate whether the Organization is related to all organizations in its family

- If 'No', select the organizations the entity is related to

Form 990 Reporting

Here, you can preview the compensation as it will be reported on Part VII or Schedule J, Part II of the Form 990 for any organization within the organization structure.

To access the reporting section:

- Select the tab 'Form 990 Reporting'

- Select the organization you want to preview.

- Select whether you want to preview the Part VII of the Form 990 or Schedule J, Part II

- To view former persons, click 'Former'

PERMISSIONS

Full Access - Users set up as Tax Directors will have full access to the MCM for all entities within a family of organizations

Limited Access - Limited access restricts a user from accessing the MCM tool, however access can be granted to the information reported in Part VII and Schedule J, Part II of a filing organization's Form 990.

Limited access consists of:

Full Access - Allows a user to view, add, and edit compensation detail

Read-Only - Allows users to view only compensation detail.

Hide Comp - Allows users to view the listing of individuals, however all compensation detail is hidden.

To set the permissions for the MCM:

- Select the permissions tab from the organization home screen

- Select the permissions type 'Specific Forms and Features'

- Select the Form 990 and scroll down to Part VII

- Select Full Access, Read Only or Hide Comp