990 Tracker Guide | State Module

OVERVIEW

The State Module provides a powerful tool to prepare and analyze state forms and extensions. The data grid provides the ability to quickly import data from the Form 990-T and the Investment Module to analyze all of your filing states at once.

DATA GRIDS

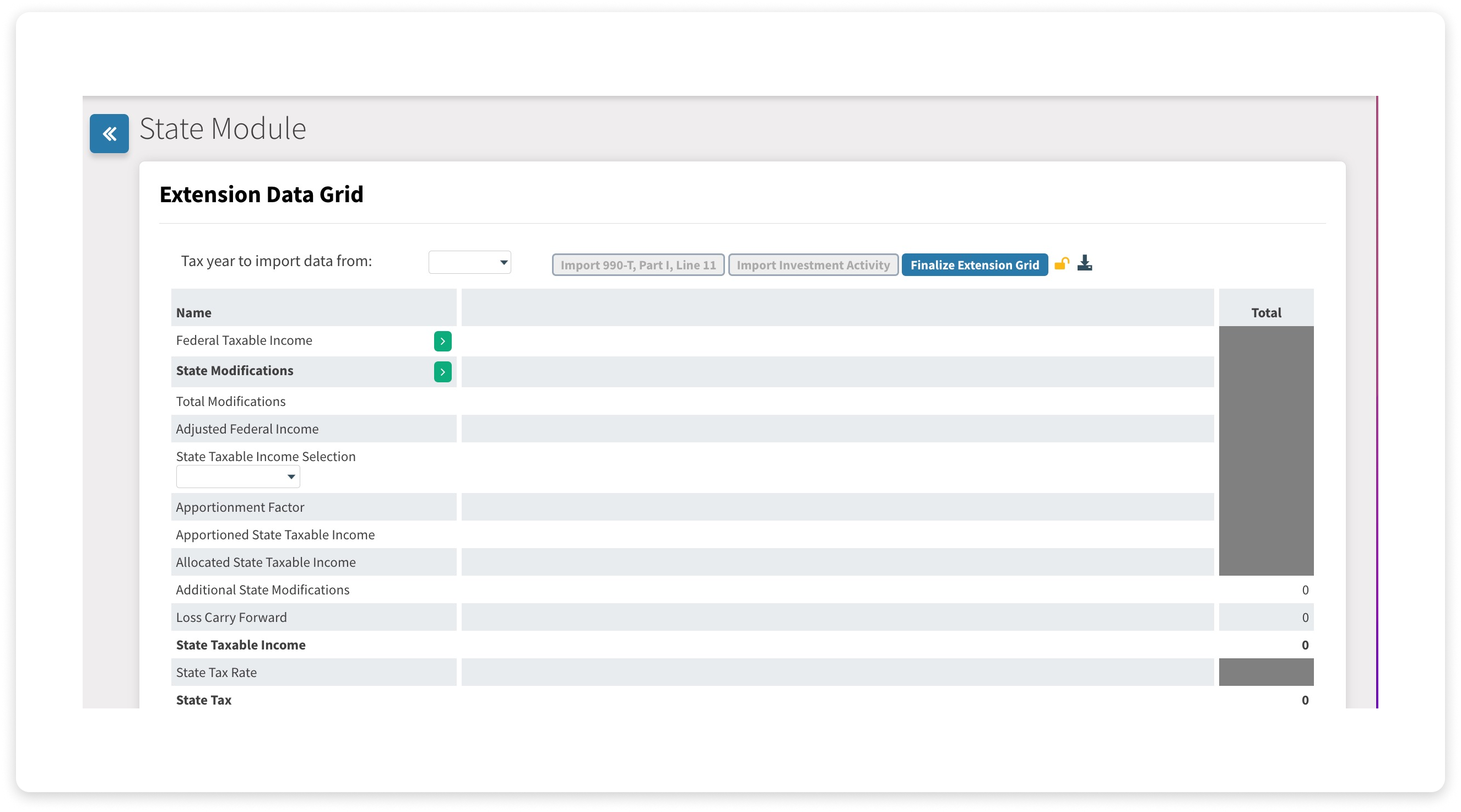

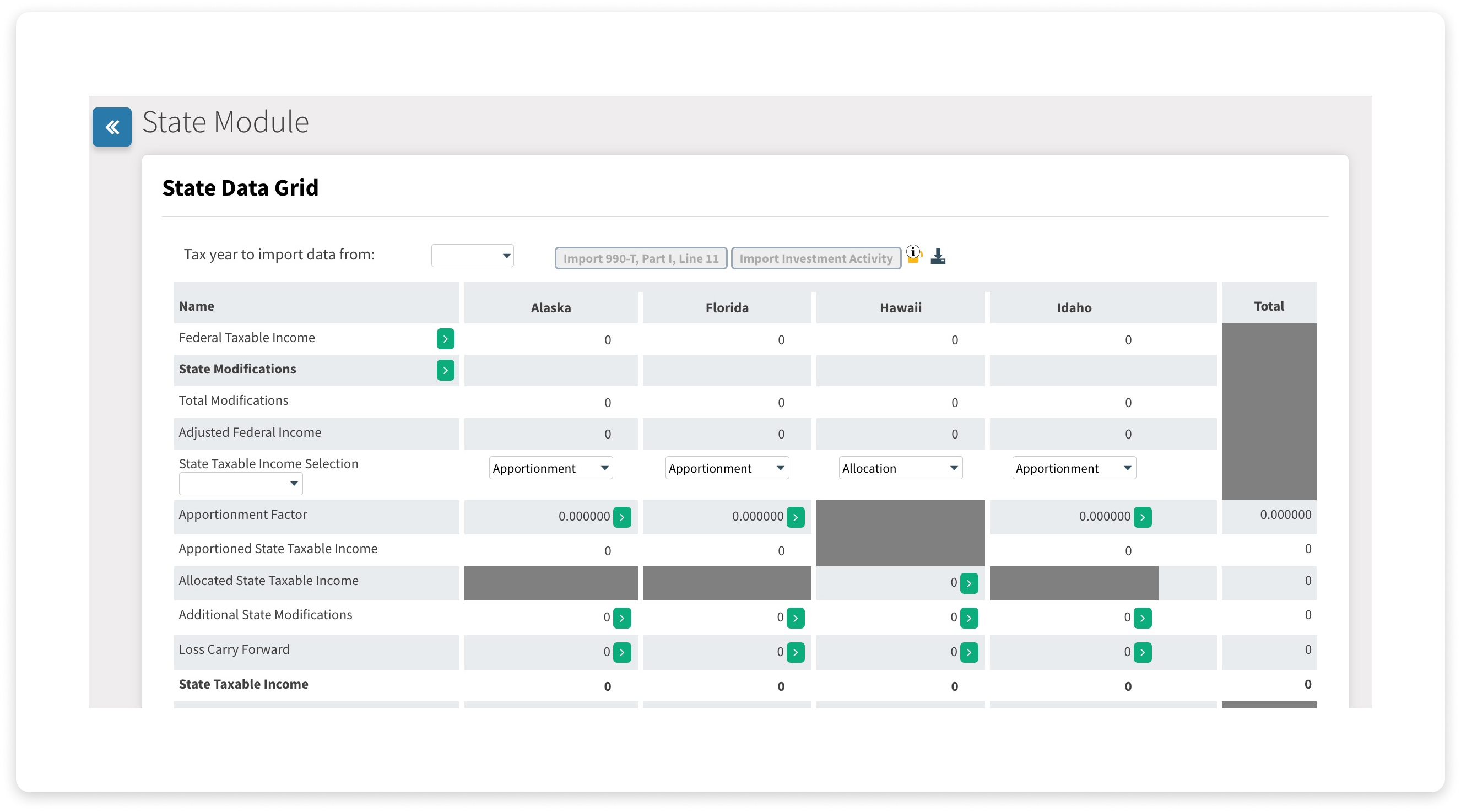

There are two data grids available for analyzing your state forms - an Extension Data Grid to be used at extension time and a State Data Grid for filing your State forms.

When you first access the State Module, only the Extension Data Grid is active. You must finalize the Extension Data Grid to activate the State Data Grid.

Extension Data Grid

IMPORTING FORM 990-T DATA

|

|

Use the dropdown to select the year you wish to import data from, then click the 'Import 990-T' button to import data. This will populate the Taxable Income line on the Data Grid with the amount from Form 990-T. |

IMPORTING INVESTMENT MODULE DATA

|

|

To import data from the Investment Module, click on the dropdown to select the year you wish to import data from and click the 'Import Investment Activity' button. This will populate the Allocated State Taxable Income, Apportionment Factor (from Investment Activity), Payments, Credits, and Withholding lines with the relevant information from the Investment Module. |

WORKING WITH THE DATA GRID

The data grid contains all the information you need to work from Federal Taxable Income all the way down to your state liability.

Data entered into the Extension Data Grid will automatically populate the Extension form, and data entered in the State Data Grid will automatically populate the State form(s).

To use the Data Grid, follow these steps:

-

Import your completed Form 990-T and Investment Module data into the Extension Data Grid using the steps outlined above. You must FINALIZE the Extension Data Grid to launch the State Data Grid.

-

Modify your Federal Income by clicking on the green arrow button labeled State Modifications. Here you can choose from a list of additions and subtractions commonly used to adjust federal income.

-

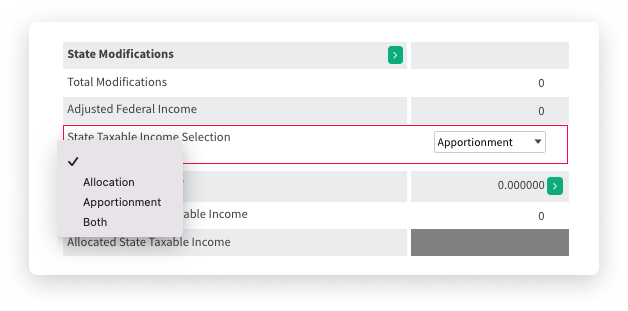

Determine whether you will file each state using the Apportionment Method, the Allocation Method, or a combination of Both. The Data Grid's default is Apportionment.

Use the State Taxable Income Selection dropdown to make any changes.

-

Adjust the Loss Carry-Forward for the amount to be used in the current year by clicking on the green arrow.

-

Make any adjustments to the Payment, Credit, and Withholding information by clicking on the green arrow.

Extension payments are automatically updated when you finalize your extension grid (see details below).

-

For the Extension Data Grid, check the box "Extend State?", for the extensions you wish to file and type in the amount to pay in the field.

-

For the State Data Grid, check the box "Form Filed" for the forms you wish to file and complete additional tax and overpayment information if applicable

ACTIVATING THE STATE DATA GRID

You must finalize the Extension Data Grid before the State Data Grid will be activated. To do so, click the 'Finalize Extension Grid' button located on the top of the page. This will prevent further edits to the Extension Data Grid and copy all your information into the State Data Grid so you can continue your work.

ACCESSING INDIVIDUAL STATE FORMS

To access a State Form or Extension, navigate to the State Module using the left-hand navigation panel and expand the "States" menu.

Within each State form are several options:

General Information: Contains any additional state-specific data such as account numbers that may be entered. Not all states have state-specific information.

Instructions: Access the Form instructions

Extension: Access the State Extension form

State Form: Access the applicable State form or forms

STATE FORM PREPARATION

The appearance of each State Form and Extension within the application mirrors the layout of the PDF. This makes input intuitive and easy. Each form is pre-populated with data gathered from General Information, Paid Preparer, and Federal forms 990 Tracker.

There are four different types of input fields:

-

Data that appear as grey read-only fields are pre-populated from the organization's Basic Data section. To change the information in these fields, visit the Basic Data section for your organization.

-

Data that appear as blue text indicate that a value is coming from elsewhere in 990 Tracker. Most information will come from the State Data Grid (not the Extension Data Grid), however, some information may pull directly from the federal form if applicable. These fields can be overridden, so if you disagree with the value, you can edit directly in the field to override it. The new value will then appear in RED. Overridden values can be reverted to their original values by highlighting the value and pressing the delete key on your keyboard. This should return it to the original value with blue text.

-

Fields that appear as empty white boxes indicate that you can type information directly into them as needed.

-

Fields that are required to be calculated as per the instruction on the form also appear as grey, read-only boxes.

Edits are not allowed in these fields.

STATE FORM FEATURES

There are additional tools available within each Extension and State Form found at the top of the page.

| Allows you to navigate to the prior and next page of the form easily. | |

| Click to create or edit statements to be appended to the end of the State Form or State Extension. Each statement requires a return reference, identifier, and text. | |

| Click to upload your own PDF statements to be appended to the end of the State Form or Extension. If you are using Internet Explorer version 10 or higher, you can simply drag and drop into the window. If not, you can use the upload button to select your attachments. | |

| Click to view a final version of your prepared form. It will provide you with a PDF of the State Form or Extension along with any custom statements you have created and any attachments. | |

| Allows you to lock or unlock your entire State form. |