CCH Axcess Data Methodology Overview

This information will help you prepare for syncing data using the CCH Axcess integration and will provide guidance on what to expect when you send data to CCH.

This information will help you prepare for syncing data using the CCH Axcess integration and will provide guidance on what to expect when you send data to CCH.

What happens when the integration is initiated?

When you initiate the integration for an investment in K-1 Analyzer, we receive a packet with all data that exists in the passthrough section of the return from CCH.

This packet is then appended with relevant data stored in K-1 Analyzer. We then send the packet back to the CCH return.

Possible duplication of data

Because we receive the entire passthrough packet from CCH Axcess, duplication can happen when we send the packet back to CCH Axcess. It still exists in the appended packet for parts of the passthrough section in CCH that are ignored by K-1 Analyzer (because we don't support that data). However, since we don't overwrite those rows in CCH, it appends a new row.

Breakdown of the potentially affected sections:

Worksheet numbers are in [brackets]

-

Basic Data Worksheets

- Dependents [2]

- Direct Deposit/Electronic Funds Withdrawal [4]

Passthrough Entity Worksheets [1065/1120S K-1, 1041 K-1]

- Depreciation and Amortization (Form 4562) [7,6]

- Property and Cost Depletion [9,9]

- Property Production Income and Expenses [10,10]

- Depreciation and Amortization â Depletion â Property [11,11]

- Business Use of Home (Form 8829) [13,12]

- Form 8586 Low-Income Housing Credit [28,23]

- Form 8826 - Disabled Access Credit [30,25]

- Form 8835 - Renewable Electricity Production Credit [31,26]

- Form 8844 - Empowerment Zone Employment Credit [32,27]

- Form 8845 - Indian Employment Credit [33,28]

- Form 8882 - Credit for Employer-Provided Child Care Facilities and Services [38,32]

-

Basic Data Worksheets

- Ownership By Other Entities in Partnership [4]

- Other Entities Owned by Partnership [5]

- Direct Deposit/Electronic Funds Withdrawal [7]

-

Basic Data Worksheets

- Direct Deposit/Electronic Funds Withdrawal [3]

Passthrough Entity Worksheets [1065/1120S K-1, 1041 K-1]

- Depreciation and Amortization (Form 4562) [6,6]

- Property and Cost Depletion [8,9]

- Property Production Income and Expenses [9,10]

- Depreciation Property/Overhead Depreciation and Amortization [10,11]

- Form 5884 - Work Opportunity Credit [16,14]

- Form 6765 - Credit for Increasing Research Activities [19,17]

- Form 8586 - Low-Income Housing Credit [20,18]

- Form 8826 - Disabled Access Credit [21,19]

- Form 8994 â Employer Credit for Paid Family and Medical Leave [27,25]

-

Basic Data Worksheets

- Group Return Information [5]

- Direct Deposit/Electronic Funds Withdrawal [8]

- Disaster Relief Information [14]

-

Basic Data Worksheets

- Direct Deposit/Electronic Funds Withdrawal [4]

- 20% or More Directly/50% or More Owned by Another Entity [5]

- Owns 20% or More Directly/50% or More of Any Other Entities [6]

-

Basic Data Worksheets

- Direct Deposit/Electronic Funds Withdrawal [4]

- Owns 20 or More Directly/50% or More of Any Other Entities [5]

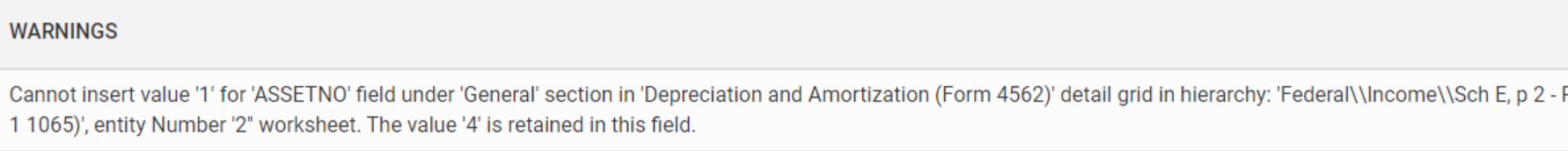

Warning Responses

When return packets include data from any of these worksheets, you may see a warning after a successful sync. This is not an error from K-1 Analyzer, it is a response from CCH Axcess and does not indicate a failed integration request. We encourage you to review your return data in CCH Axcess for any possible duplicates.

Here is an example of a warning for a return that included data in the Depreciation and Amortization grid: