COI Rollover Instructions

Follow the steps below to rollover your COI to a new tax year.

Follow the steps below to rollover your COI to a new tax year.

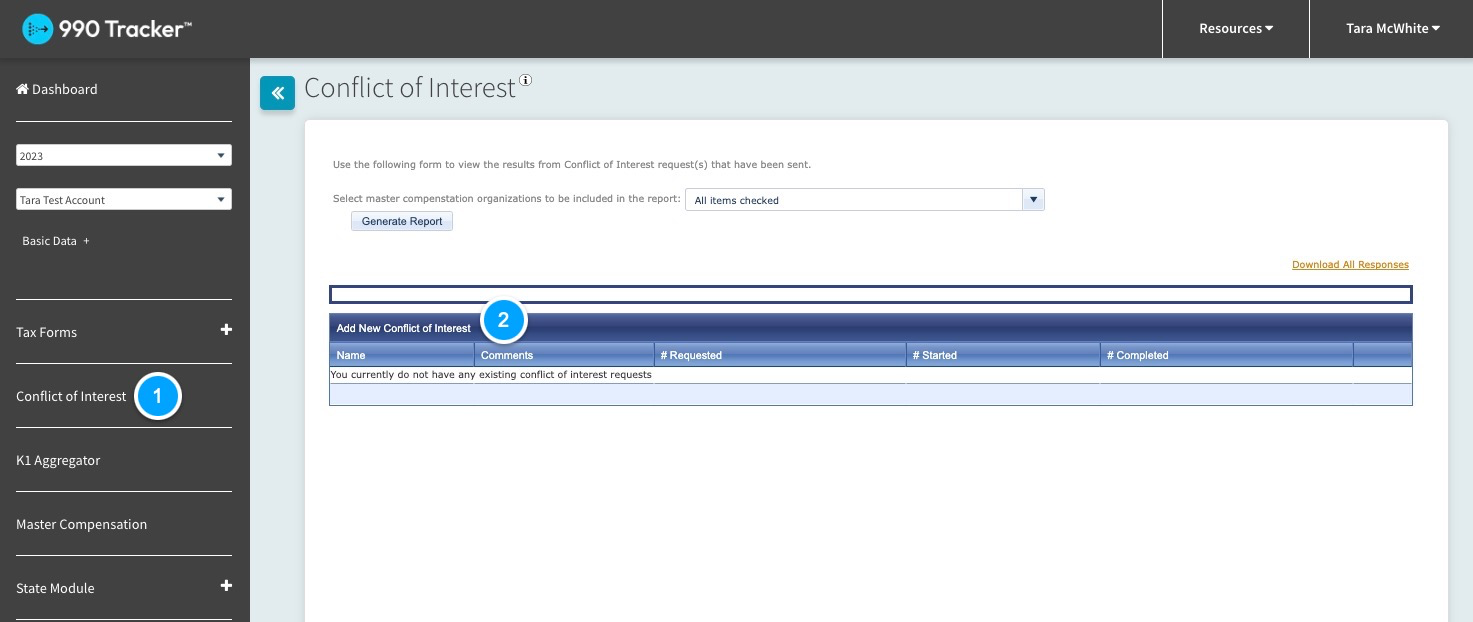

Step 1:

- Navigate to the COI page for the new tax year

- Click the 'Add New Conflict of Interest' button

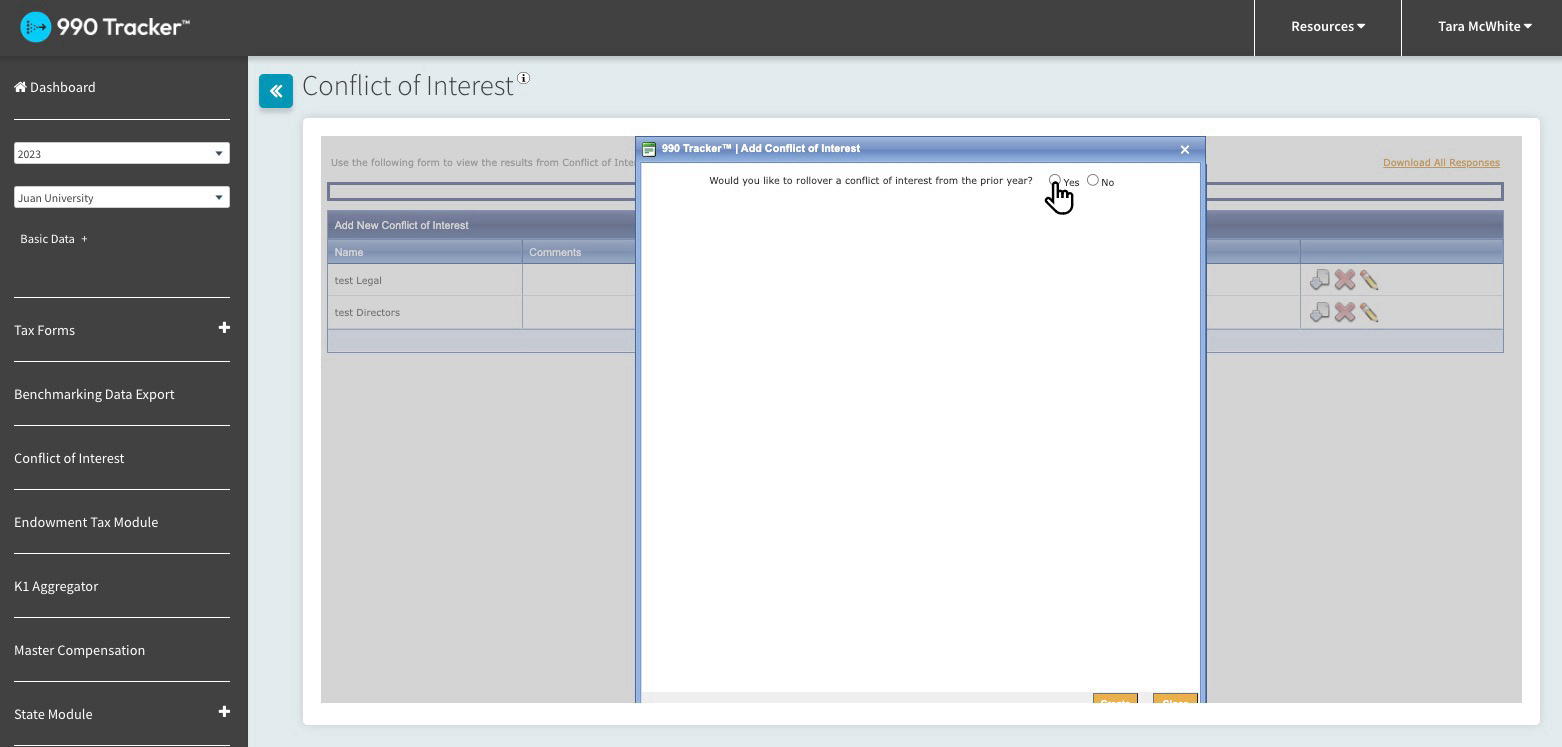

Step 2:

- Choose 'Yes' to Rollover

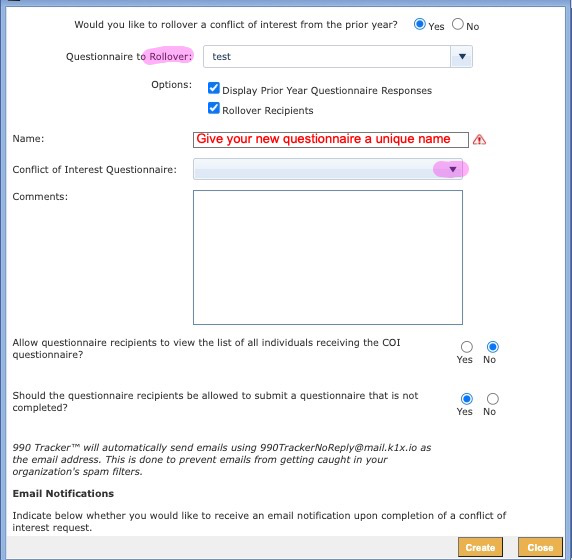

Step 3:

- Check both checkboxes in the 'Options' section (they should be checked by default)

- Display Prior Year Questionnaire Responses

- Rollover Recipients

- Name the Questionnaire

- This should be a unique name

- Select the NEW questionnaire from the dropdown

- This is the most recent version of the COI

- Choose the remaining options that are appropriate for your scenario

- Allow questionnaire recipients to view the list of all individuals receiving the COI questionnaire?

- Should the questionnaire recipients be allowed to submit a questionnaire that is not completed?

- Indicate below whether you would like to receive an email notification upon completion of a conflict of interest request.