Entering Federal K – 1 Tax Data: Building the Foundation

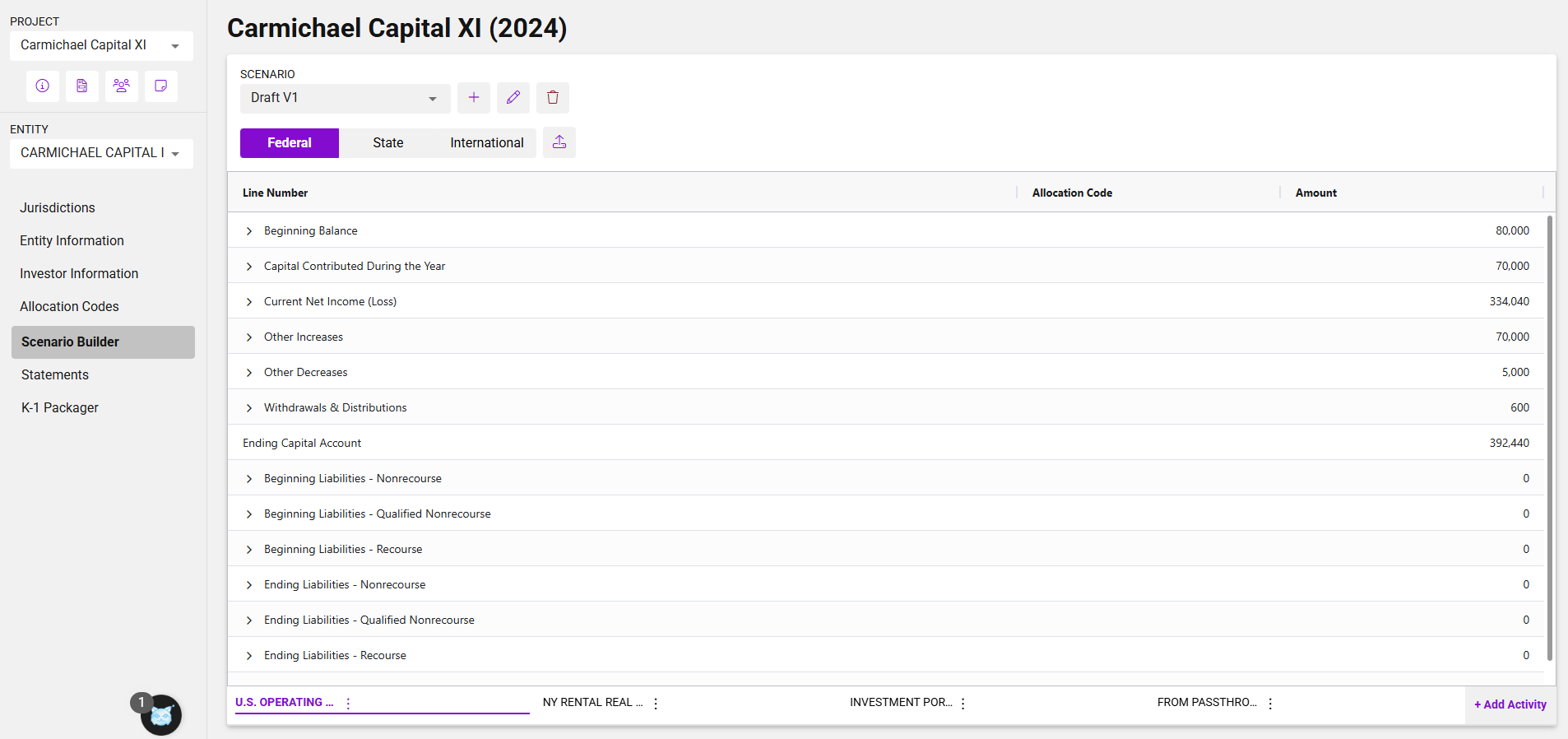

Set Up Allocation Codes Before entering any tax data, users should navigate to the Allocation Codes page to define how amounts will be split among investors.

Step-by-Step Instructions

1. Set Up Allocation Codes

Before entering any tax data, users should navigate to the Allocation Codes page to define how amounts will be split among investors.

Each allocation code can be configured in one of two ways:

-

Amount-based: Enter a specific dollar amount for each applicable investor.

-

Percentage-based: Enter a percentage (in decimal format, up to 8 decimal places) for each applicable investor.

Additional details:

-

Allocation codes are limited to two alphanumeric characters.

-

A default allocation code can be selected to streamline event creation in Scenario Builder.

-

Percentage-based codes are also used to define the beginning and ending profit, loss and capital percentages reported on each investorâs K-1.

-

Allocation codes can be created and updated in bulk via import.

Allocation Codes setup page showing percentage-based code and import option

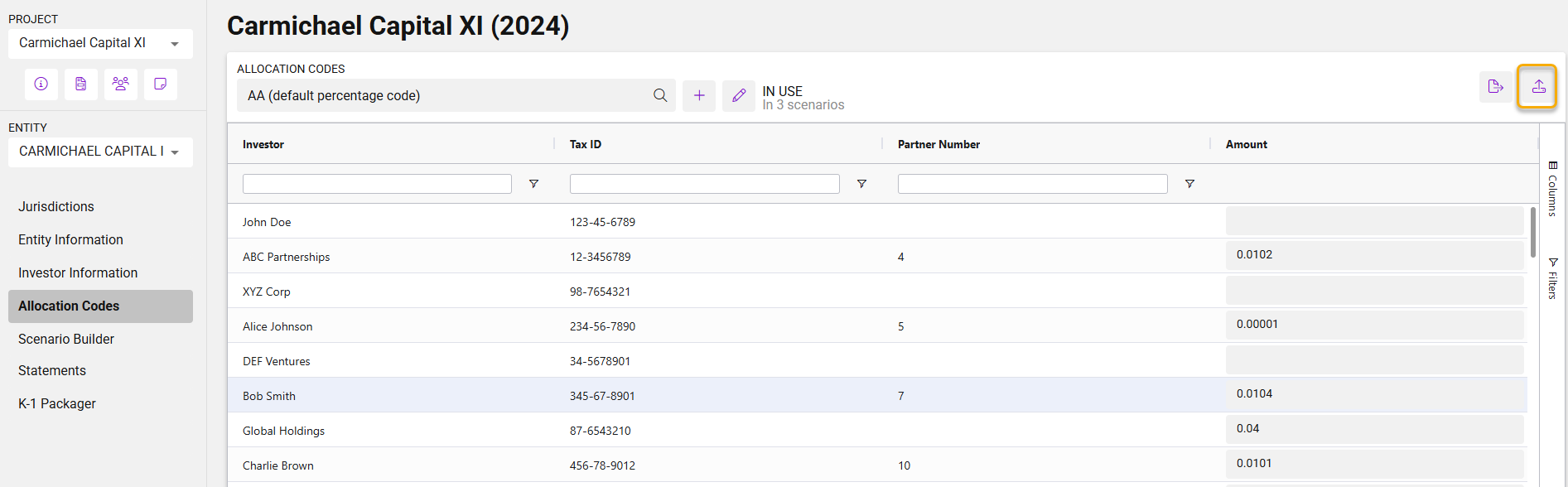

2. Open a Scenario

After allocation codes are defined, users can begin entering federal tax data by opening the Scenario Builder for the relevant entity.

3. Enter Federal Tax Events

Each tax item that will appear on the Federal K-1 is represented by an event in the Scenario Builder. For each event, users enter:

-

A description

-

A total amount (unless using an amount-based allocation code, in which case the total will be automatically populated as the sum of allocated amounts)

-

An allocation code

New in this release:

Events can now be grouped by activity, allowing users to break out items across business lines, types of income, or other categories. Right now, activity groupings are for tracking purposes onlyâamounts will be summed across activities when populating the Federal K-1 and overflow statements. A structured, system-generated schedule of activities will be added in a future release.

Event data can also be entered via import. Instructions for using the import template are included on the first tab of the file.

Event entry screen showing activity breakout