How do I Import Data Into Form 990 Parts?

Step-by-step guide to importing K1x data into Form 990 Parts for faster, cleaner nonprofit tax prep.

Importing data for Form 990 Parts and Schedules can streamline your workflow and ensure accuracy when filing. This guide covers the available import options for different parts and schedules of Form 990, helping you efficiently transfer information while reducing manual entry. Whether you're working with financial data, governance details, or supplemental schedules, understanding these import methods will save time and improve data consistency.

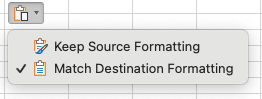

For ALL inputs, please paste 'VALUES', or paste and 'Match Destination Formatting'. Otherwise, the import may fail.

We encourage you to always download the most recent version of each import template by clicking the 'Import' button and selecting 'Get Template File' on Line 1 of the instructions window.

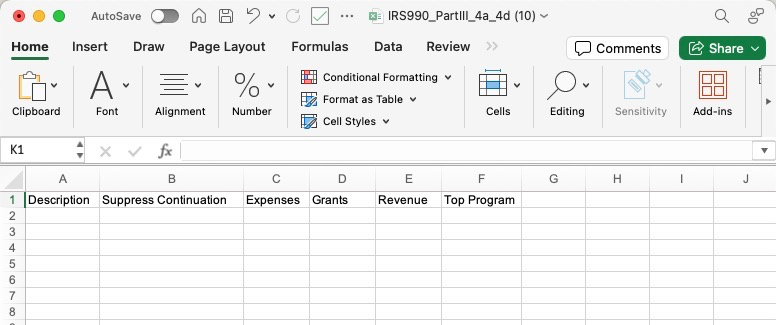

Core Form, Part III, Lines 4a - 4d

Line Instructions: Describe the organization's program service accomplishments for each of its three largest program services, as measured by expenses. Section 501(c)(3) and 501(c)(4) organizations are required to report the amount of grants and allocations to others, the total expenses, and revenue, if any, for each program service reported.

Available Columns:

- Description

- Suppress Continuation (True or False)

- Expenses

- Grants

- Revenue

- Top Program (True or False)

Core Form, Part VII

Section A - Current & Former Employees

Below are a list of possible input fields for Current and Former employees' compensation data:

Individual

- Last Name

- First Name

- Middle Prefix

- Suffix

- Email Address

- Employee ID

- Vendor ID

Organization

- Organization Name

- Organization (EIN, 9 digits NO dashes)

- Title

- Average hours per week

Position

- Individual trustee or director

- Institutional Trustee

- Officer

- Key Employee

- Highest compensated employee

- Do not report on Form 990 Former

- Former

Percent of Time Devoted

- Program Services

- Management and General

- Fundraising

Filing Organization

- Form W-2 Box 1

- Form W-2 Box 5

- Form 1099 Box 6

- Form 1099-NEC Box 1

- Deferred Compensation

- Nontaxable Benefits

- Bonus & Incentive

- Other Reportable Compensation

- Compensation Already reported in prior year Form 990

Unrelated Organizations

- Form W-2 Box 1

- Form W-2 Box 5

- Form 1099 Box 6

- Form 1099-NEC Box 1

- Deferred Compensation

- Nontaxable Benefits

- Bonus & Incentive

- Other Reportable Compensation

- Compensation Already reported in prior year Form 990

- Name of Unrelated Organization

- Type of Unrelated Organization

Fiscal Year Compensation Reporting

- Use Calendar Year or Fiscal Year numbers? (For Calendar Year put a C, for Fiscal year put an F) Salaries & Wages

- Pension Plan

- Accruals and Contributions

- Other Employee Benefits

For Former Officers

- Employment Begin Date MM/DD/YYYY

- Terminated or Transferred? Options: 'Terminated' or 'Transferred'

- Transferred To? (Organization EIN, 9 digits NO dashes)

- Termination or Transfer Date MM/DD/YYYY

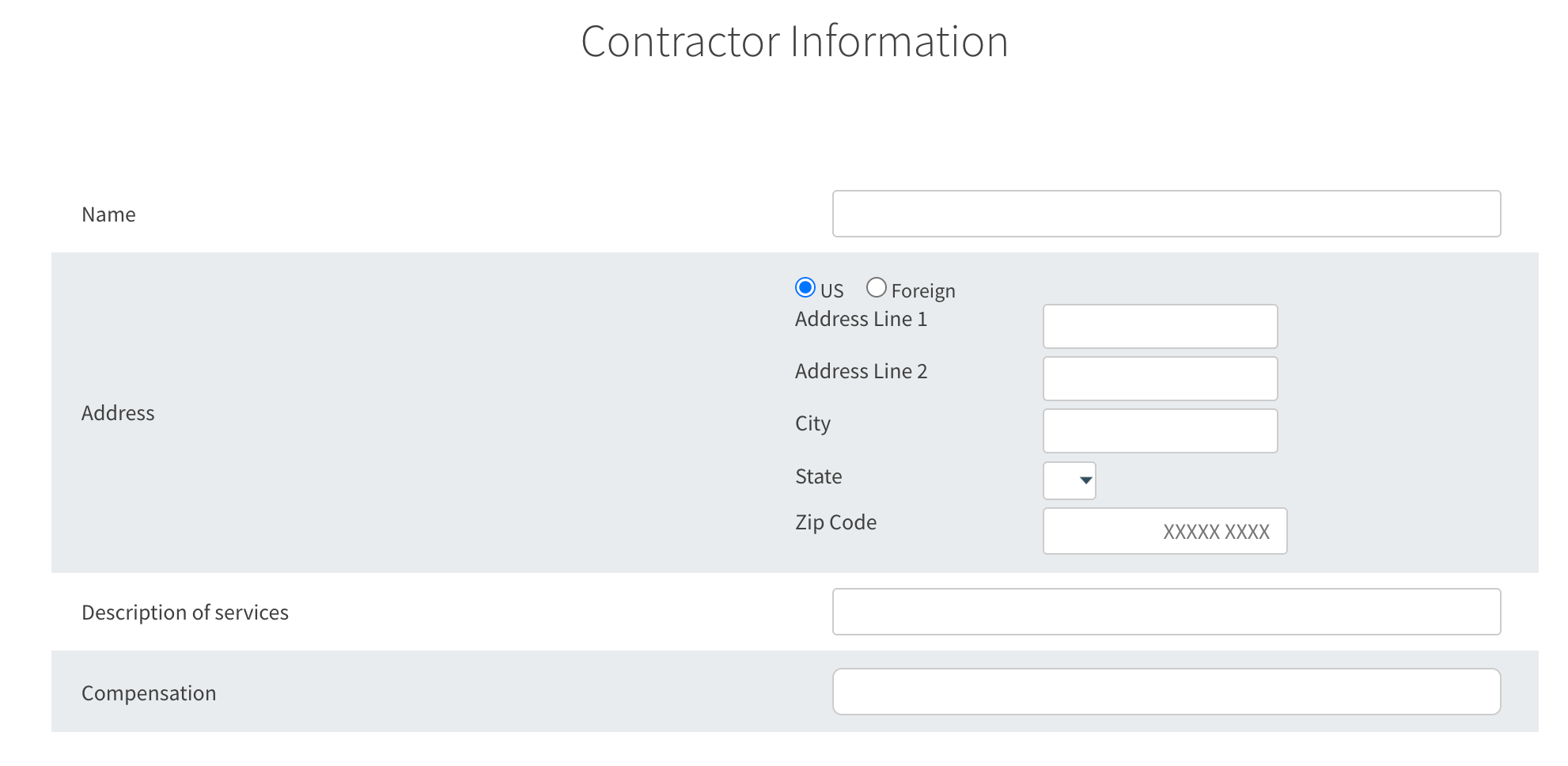

Section B - Independent Contractors

Below are a list of possible input fields for Independent Contractors compensation data:

Contractor Form Fields

- Name

- Address

- Description of services

- Compensation

Tips:

- Regularly save your work and verify changes before refreshing or navigating away from the page.

- Document any recurring issues with screenshots and detailed descriptions to assist technical support.

For further assistance, contact the K1x Support Team by clicking on the "Get Help" button on our apps or in our Help Center.