How to find K1 counts in CCH Axcess

A Step-by-Step Guide on Finding K1 counts in CCH Axcess

- Set the filters to find your return counts as described below (can be set for one return, all returns, or subsets of returns)

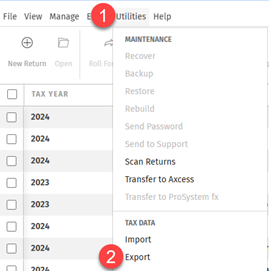

- Once that's done, select 'Utilities' at the top ribbon, and then 'Export.' This will create a .dat file that can then be parsed

- On the next screen, select 'Returns' selected in Return Manager

- On the next screen, select 'include input data' and press 'Export' in the bottom right

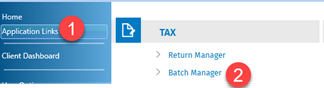

- Navigate to your Batch Manager (found under Tax in the CCH Dashboard)

- You should see a Job with the status âReady for Downloadâ like the example below. Pressing 'Refresh Job Status' may be required.

- Save the file to a convenient location. Right-click on the file, and choose 'Open with'. You may need to search for Excel by clicking on 'More apps' at the bottom and using the search box in the upper right of the dialog that opens up to find Excel.

- Once clicked, the file should open in with default settings in Excel

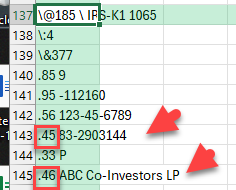

- Then do a Find (CTRL + F) for' IRS-K1 1065' which is the row indicator for 1065 K-1 entries. Click on one of the results to see the file navigate to the cell in which this information was found.

- Within 5-10 rows, you should see an entry for the Investment EIN and the Investment Name. In the example below, the Investment Name is ABC Co-Investors LP and it is preceded with code '.46'

- Now do a Find ALL for '.46' which will return all 1065 investments for which a name entry appears in CCH. Look for the number of cells found. This is a reasonable count of the number of K1s in your CCH ecosystem.

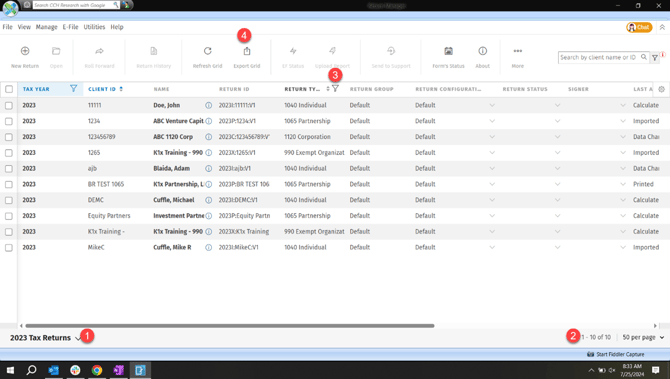

Find tax return counts in CCH:

In the return manager for CCH Axcess:

- Select the view for the tax year you want to get a return count for

- The total return count should appear here right away if that's all that's needed

- Set the filter for the type of return that is being counted and refer back to the area labeled '2' for the count

- Export filtered or unfiltered data to do any manual counts, analysis, adjustments, or other via Excel

It is highly recommended that you perform the above steps for each return type (i.e. once for 1040s, once for 1065s, etc.) and that you also set a filter on the Return ID Column for 'Contains V1' to avoid duplicate reporting through multiple versions of returns.