How to Open Form 8865 and All Schedules

person qualifying under one or more of the Categories of Filers (see below) must complete and file Form 8865.

Overview

Form 8865 is used by U.S. persons who have an interest in a foreign partnership.

A U.S. person qualifying under one or more of the Categories of Filers (see below) must complete and file Form 8865. If you qualify under more than one category for a particular foreign partnership, you must submit all the items required for each category under which you qualify.

Open Form 8865

To create a Foreign Form 8865, open the investment and follow the steps below:

- Click on the 'Foreign Disclosure Forms' tab

- Select the 'Form 8865' tab

- Click the 'Add Transferee' button and add your Transferee record

- In the Transferees/Disposals table, enter relevant information in the table columns (scroll to see all fields)

- Click the 'Pencil' icon to open the form

- Complete or Update the 'Transferee Information' section at the top of the page

- Select 'Form 8865' in the tab navigation

- Complete the 'Form 8865' section based on your partnership scenario

- Be sure to Save Changes by clicking on any other form tab before exiting the Foreign Forms section

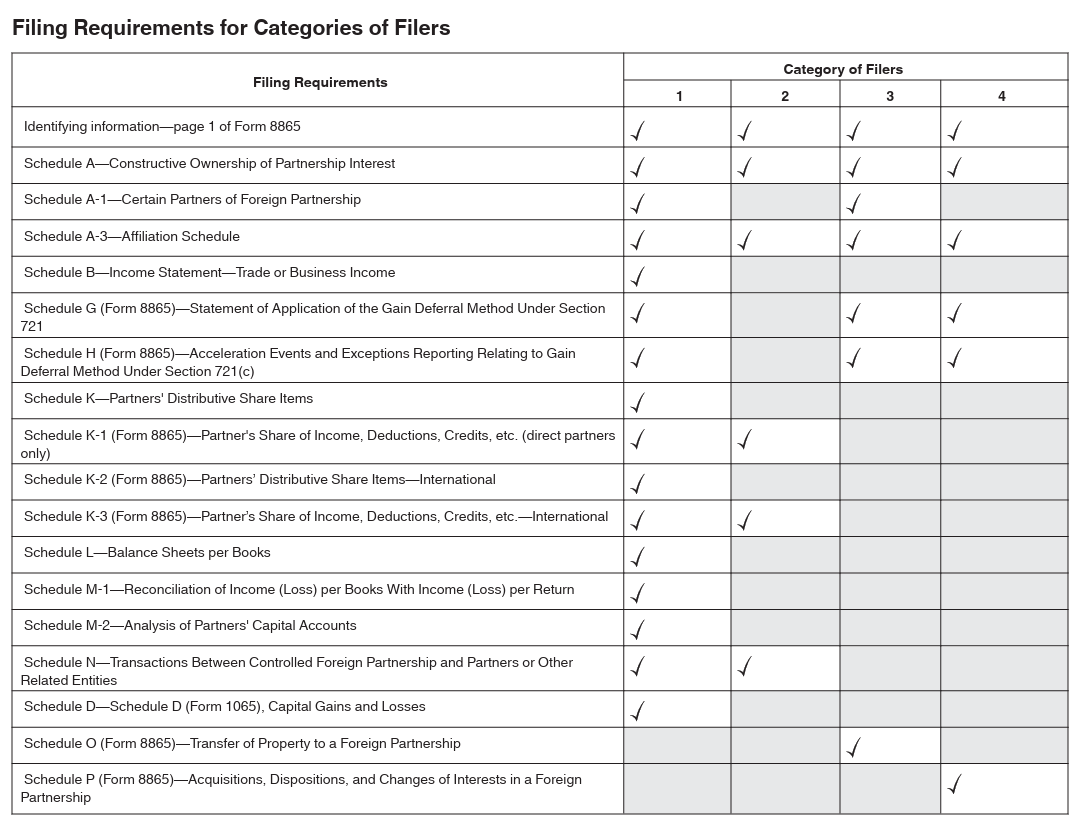

Categories of Filers

From the IRS Instructions, the categories of filers table is shown below. For more detailed information, you are encouraged to view the full instructions.

Opening Required Schedules

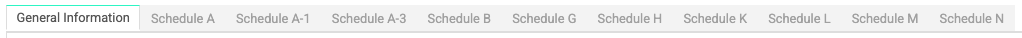

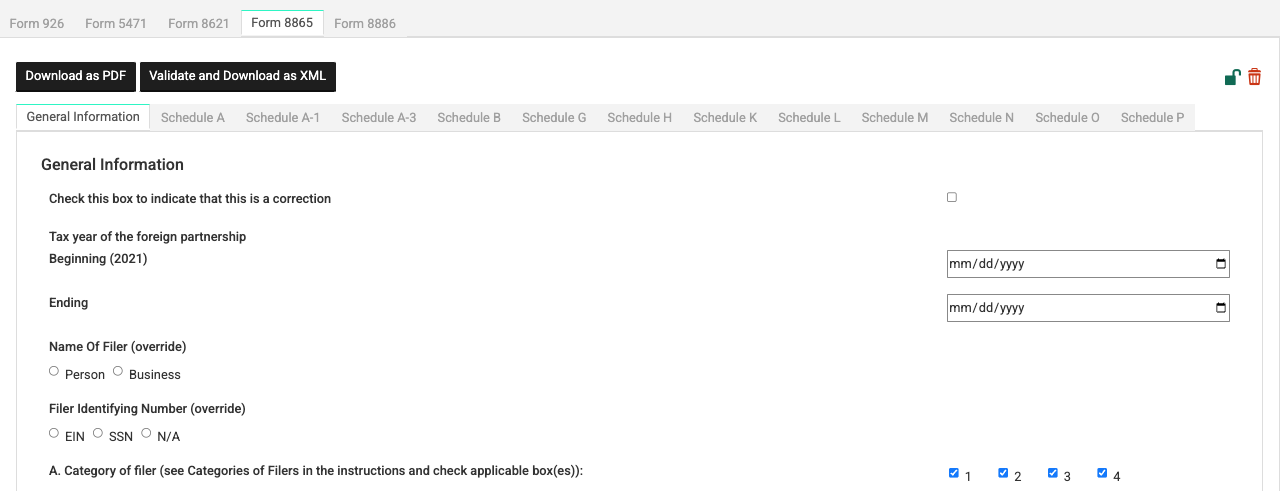

In K1 Aggregator, on the Form 8865 General Information page, you will select the Category of Filer appropriate for your foreign partnership.

Category 1

Category 1 will open Schedules A, A-1, A-3, B, G, H, K, L, M and N.

Category 2

Category 2 will open Schedules A, A-3 and N.

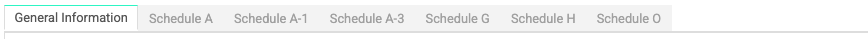

Category 3

Category 3 will open Schedules A, A-1, A-3, G, H and O.

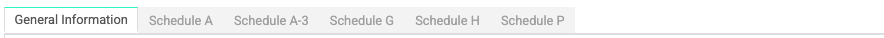

Category 4

Category 4 will open Schedules A, A-3, G, H and P.

More Than One Category of Filer

If your partnership falls under more than one Category of Filer, you can select all applicable Categories to open all necessary Schedules.

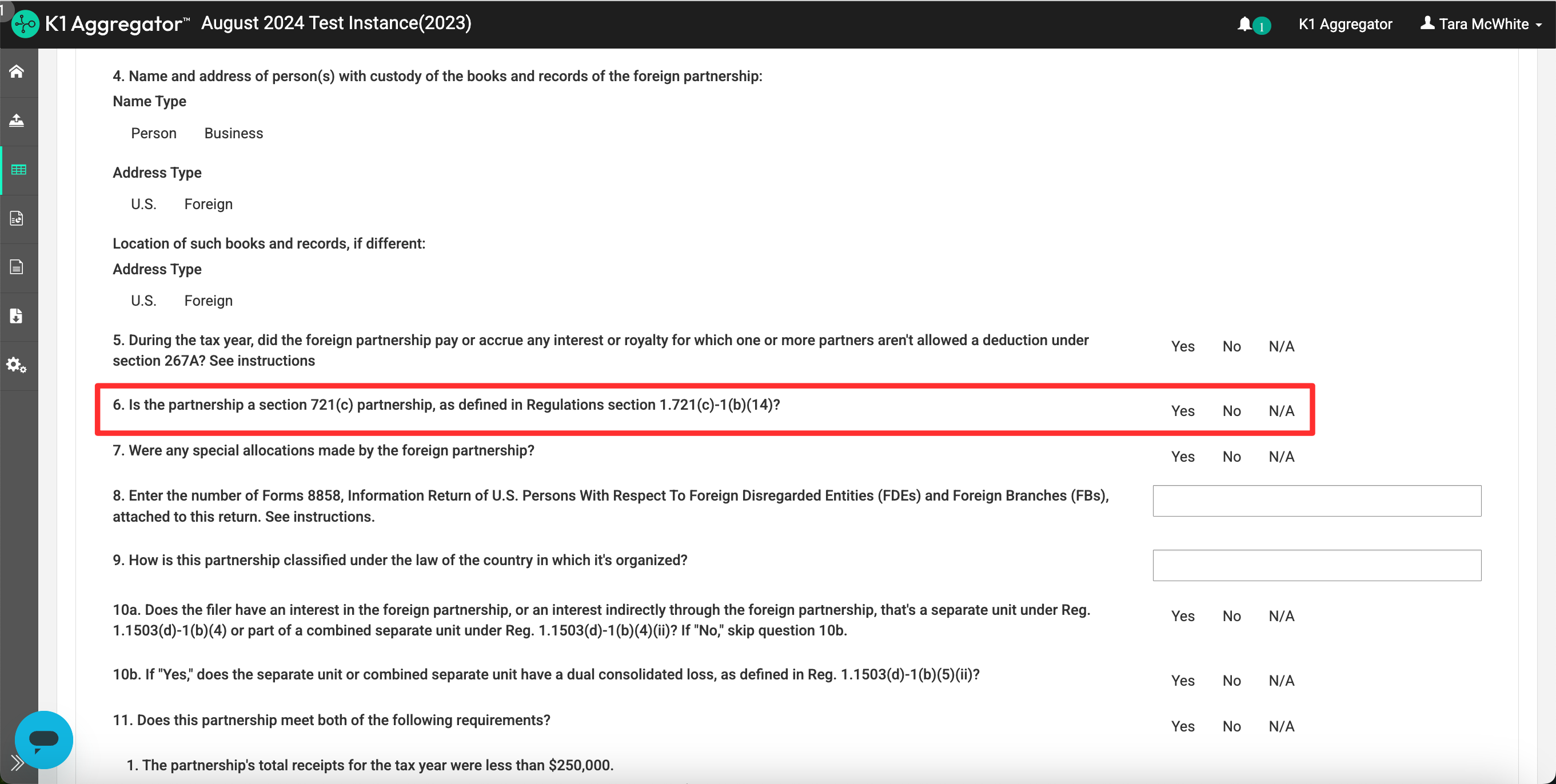

How to Open Schedule A-2

To open Form 8865 Schedule A-2, you must answer "Yes" to question H6 on the Form 8865 General Information page:

Tips:

- Regularly save your work and verify changes before refreshing or navigating away from the page.

- Document any recurring issues with screenshots and detailed descriptions to assist technical support.

For further assistance, contact the K1x Support Team by clicking on the "Get Help" button on our apps or in our Help Center.