How to resolve, Form 990 – PF, E – File Validation Error, Incorrect Tax Exempt Status

Error The element 'IRS990PF' in namespace 'http://www.irs.gov/efile' has invalid child element 'FMVAssetsEOYAmt' in namespace 'http://www.irs.gov/efile'.

Error

The element 'IRS990PF' in namespace 'http://www.irs.gov/efile' has invalid child element 'FMVAssetsEOYAmt' in namespace 'http://www.irs.gov/efile'. List of possible elements expected: 'SpecialConditionDesc, ApplicationPendingInd, ForeignOrganizationInd, ForeignOrgMeeting85PctTestInd, PFStatusTermSect507b1AInd, PF60MonthTermSect507b1BInd, InitialReturnInd, InitialReturnFormerPubChrtyInd, FinalReturnInd, AmendedReturnInd, AddressChangeInd, NameChangeInd, Organization501c3ExemptPFInd, Organization4947a1TrtdPFInd, Organization501c3TaxablePFInd' in namespace 'http://www.irs.gov/efile'. SpecialConditionDesc is missing from element IRS990PF.

Issue

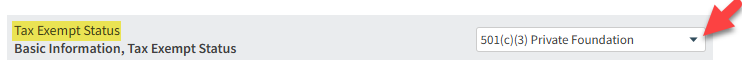

The Private Foundation has an incorrect Tax Exempt Status

Solution

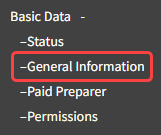

- Navigate to Basic Data -> General Information -> Tax Exempt Status

- Choose one of the two Private Foundation tax exempt statuses

- Taxable Private Foundation

- 501(c)(3) Private Foundation

- Click the "Save" button in Tools Bar