How to Resolve IRS Rejection, Database Validation Error: ExemptOperatingFoundationsInd' checkbox is checked

IRS Rejection Reason Database Validation Error: If Form 990-PF, 'ExemptOperatingFoundationsInd' checkbox is checked, then the organization must have a foundation code "02" in the e-file database.

IRS Rejection Reason

Database Validation Error: If Form 990-PF, 'ExemptOperatingFoundationsInd' checkbox is checked, then the organization must have a foundation code "02" in the e-file database.

RuleNum: F990PF-902-01

Issue: The entity is not an âexempt operating foundationâ. The foundation status should not be â02â which designates that it is exempt from paying excise tax on its investment income.

Resolution:

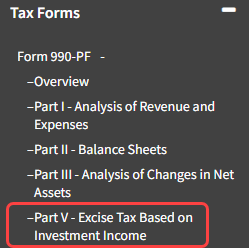

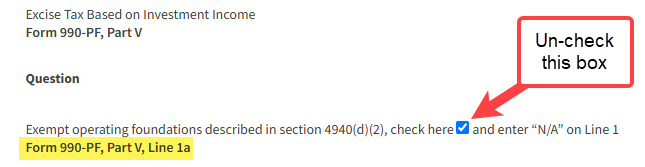

- Navigate to Tax Forms -> Form 990-PF -> Part V, Line 1a

- Uncheck the box in Form 990-PF, Part V, Line 1a

- Click "Save" in the Tools Bar

- Resubmit the Form