How to Resolve IRS Rejection, Database Validation Error: Form 8868, AccountingPeriodChangeInd

Note: A Database Validation Error indicates that the IRS database does not match the information submitted.

Note: A Database Validation Error indicates that the IRS database does not match the information submitted. The provided solution may not always resolve the issue. In such cases, you will need to contact the IRS directly for further assistance.

IRS Rejection Reason

Database Validation Error: The tax year ending date ('TaxPeriodEndDt' in the Return Header) must match data in the e-file database unless Form 8868, Item 'ExtensionReturnCd' is any value other than: 1. "03" (Form 4720 individual), 2. "08" (Form 1041-A), 3. "10" (Form 5227), 4. "13" (Form 5330 individual), or 5. "14" (Form 5330 other than individual), or 6. ['InitialReturnInd', 'FinalReturnInd', or 'AccountingPeriodChangeInd' checkbox] in 'EOAutomaticExtensionFileTmGrp' is not checked.

RuleNum: F8868-908-01

Issue: The client's Current Year Beginning and Ending dates differ from the Prior Year.

How to Resolve

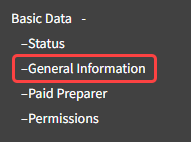

- Navigate to Basic Data -> General Information -> Basic Information -> Basic Information, Check if Applicable

- Fill in the checkbox for "Change in Accounting Period"

- Click the Save Button

- Resubmit the Form 8868