How to Resolve IRS Rejection, Form 8868, Not on Time.

Note: Form 8868 must be e-filed before the original returnâ´s due date to be accepted.

Note: Form 8868 must be e-filed before the original returnâs due date to be accepted. If the deadline has passed, the IRS will not grant an extension, and the return must be filed as soon as possible to minimize penalties and interest.

For further assistance, consult a tax professional or refer to IRS guidelines on extension requests.

IRS Rejection Reason

Not On Time: Form 8868, Application for extension must be received on or before the due date of the return to which the extension is requested.

RuleNum: F8868-053

Issue: The IRS rejected Form 8868 because the extension request was submitted after the original due date of the return.

Resolution:

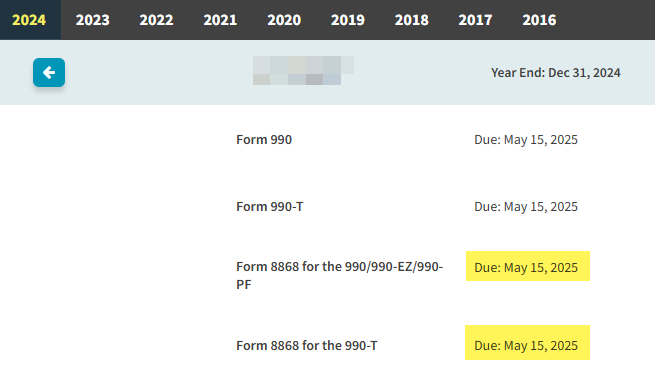

- Navigate to your engagement's Dashboard

- Note the Form 8868 Due Date

- If the Due Date is incorrect, submit a ticket with Support to correct the Due Date

- If the Due Date is correct, please contact the IRS "See Note at the top of this page"