How to Resolve IRS Rejection, Incorrect Data: Schedule B, Address Not Applicable

IRS Rejection Reason Incorrect Data: If Schedule B (Form 990, 990-EZ, or 990-PF), Part I, col (b) "Address" contains the value "AddressNotApplicableCd", then 'Organization501cInd' checkbox must be checked and.

IRS Rejection Reason

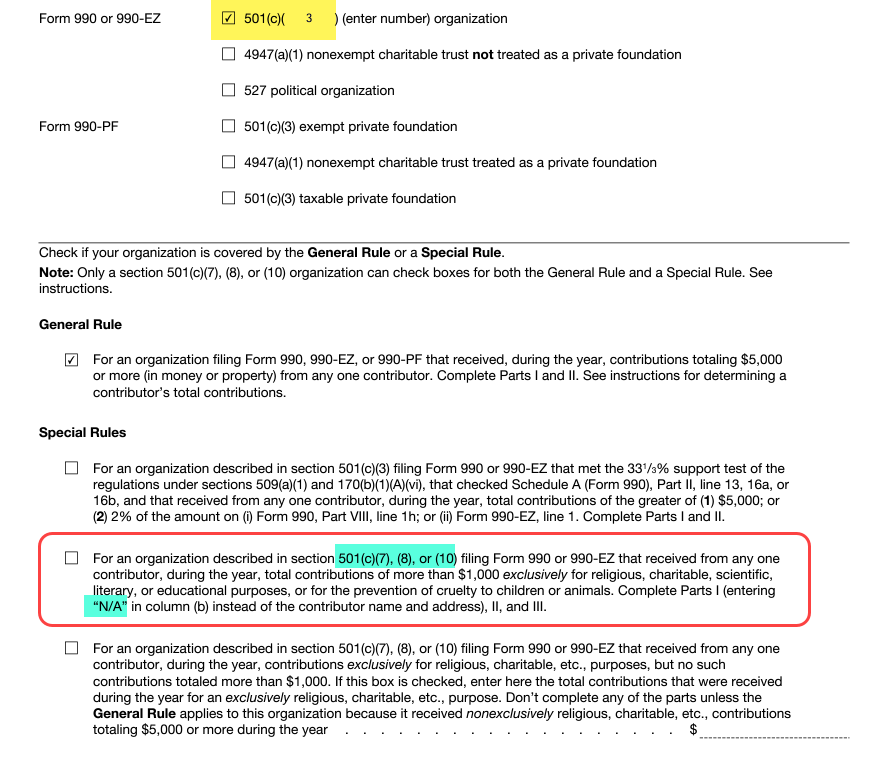

Incorrect Data: If Schedule B (Form 990, 990-EZ, or 990-PF), Part I, col (b) "Address" contains the value "AddressNotApplicableCd", then 'Organization501cInd' checkbox must be checked and 'organization501cTypeTxt' must not equal "3".

RuleNum: SB-F990-015

Issue: A 501(c)(3) organization type has to fill in the addresses for their contributors. It cannot use N/A or leave the address blank.

Resolution:

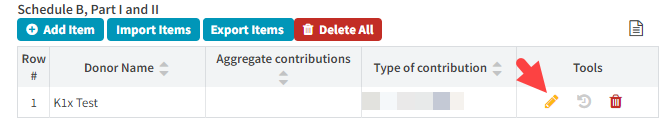

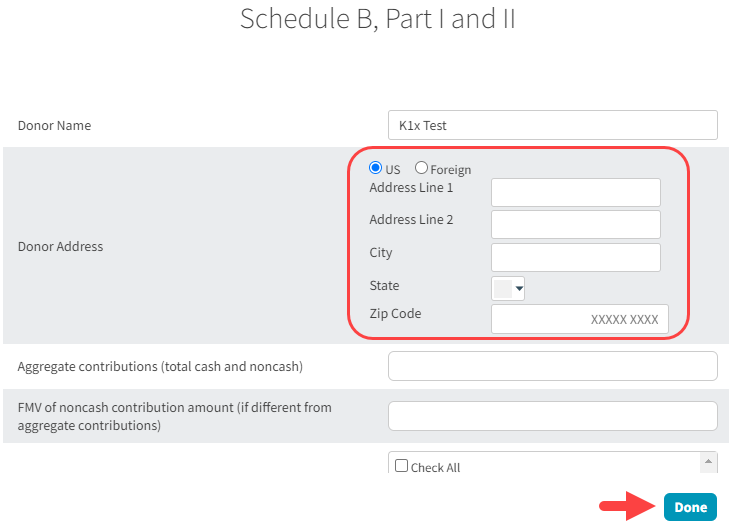

- Navigate to Tax Forms -> Form 990 -> Schedule B

- Enter any missing addresses

- Click Done

- Click "Save" in the Tools Bar

- Resubmit the return

IRS Form: N/A is applicable for 501(c)(7), (8), or (10)