How to Resolve IRS Rejection, Math Error, negative number, treat the value as zero.

IRS Rejection Reason Math Error: Form 990-T, Part I, 'TotalUBTIComputedAmt' must equal the sum of all Form 990-T, Schedule A, Part II 'UnrelatedBusinessTaxblIncmAmt'.

IRS Rejection Reason

Math Error: Form 990-T, Part I, 'TotalUBTIComputedAmt' must equal the sum of all Form 990-T, Schedule A, Part II 'UnrelatedBusinessTaxblIncmAmt'. For each entry where 'UnrelatedBusinessTaxblIncmAmt' is a negative number, treat the value as zero.

RuleNum: F990T-056

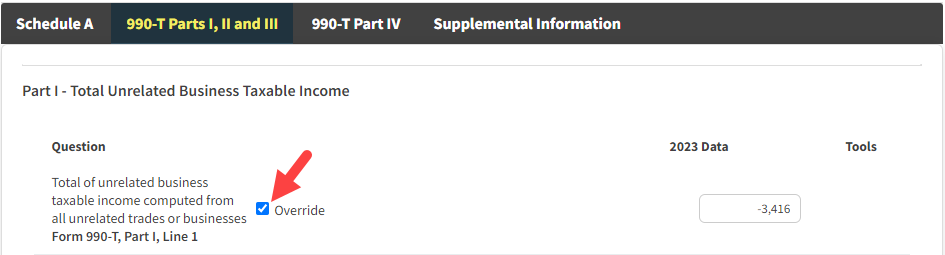

Issue: Form 990-T, Part I, Line 1 must be treated as zero if the amount on Schedule A, Part II, Line 18 is negative value. The client used the override feature in Form 990-T, Part I, Line 1 to input a negative value.

Resolution:

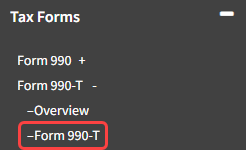

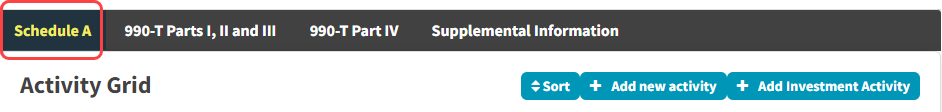

- Navigate to Tax Forms -> Form 990-T -> Form 990-T, Schedule A, Part II, Line 18

- Confirm negative value

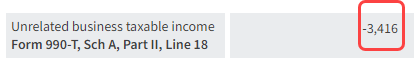

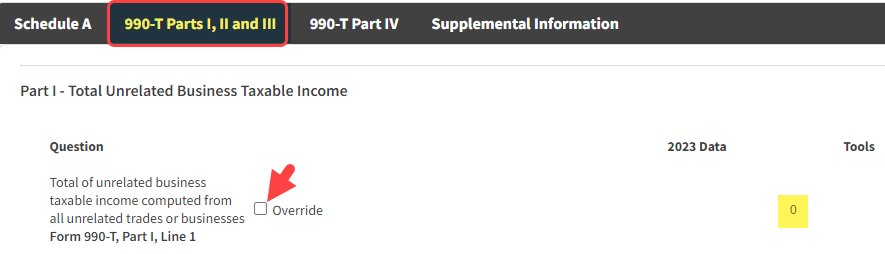

- Navigate to Form 990-T, Part I, Line 1

- Note the negative value

- Clear the "Override" checkbox

- The value for Form 990-T, Part I, Line 1 should now be "0"

- Click "Save" button in the Tools Bar

- Resubmit the return