How to Resolve IRS Rejection, Missing Data: Part XIV, Line 2

IRS Rejection Reason Missing Data: If Form 990-PF, [ Item H, checkbox 'Organization501c3ExemptPFInd' or checkbox 'Organization4947a1TrtdPFInd' is checked ] and ['AtLeast5000InAssetsInd' has a choice of 'Yes'.

IRS Rejection Reason

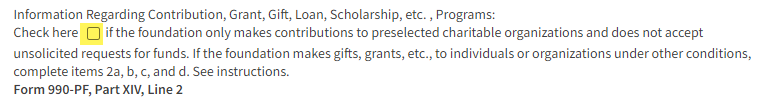

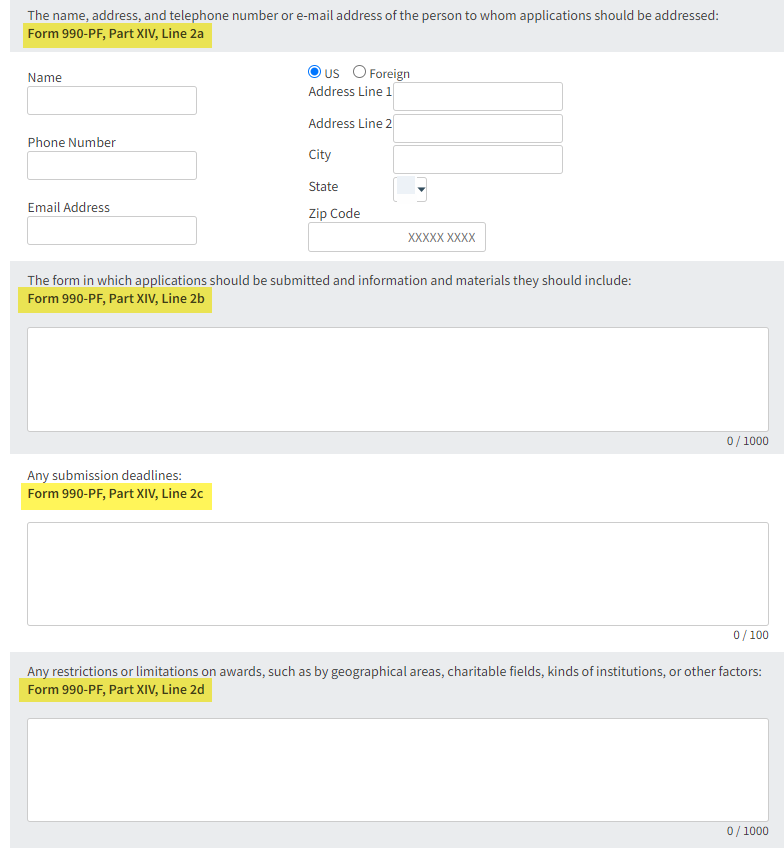

Missing Data: If Form 990-PF, [ Item H, checkbox 'Organization501c3ExemptPFInd' or checkbox 'Organization4947a1TrtdPFInd' is checked ] and ['AtLeast5000InAssetsInd' has a choice of 'Yes' indicated OR 'TotalAssetsEOYAmt' is greater than 5000], then 'OnlyContriToPreselectedInd' checkbox must be checked OR at least one complete entry for submission information (Lines 2a through 2d) must be provided unless 'ForeignOrgMeeting85PctTestInd' box is checked.

RuleNum: F990PF-065-02

Issue: Either the checkbox for Part XIV, Line 2 must be selected, or data must be entered for Part XIV, Lines 2a through 2d.

Resolution:

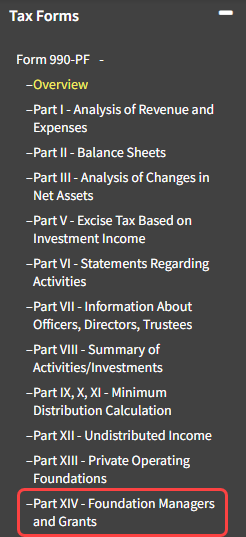

- Navigate to Tax Forms -> Form 990-PF -> Part XIV -> Line 2 / Lines 2a through 2d

- Fill in the checkbox for Line 2 or input data for Lines 2a through 2d

- Click "Save" in the Tools Bar

- Resubmit the return