How to Resolve IRS Rejection, Missing Data: TentativeTaxAmt must have a value.

Note: To avoid an IRS rejection, ensure that all required fields are filled out.

Note: To avoid an IRS rejection, ensure that all required fields are filled out. No fields should be left blank. If a value is not applicable, enter 0 where allowed.

IRS Rejection Reason

Missing Data: If Form 8868, Item 'ExtensionReturnCd' value is "03" (Form 4720 (individual)), "04" (Form 990-PF), "05" (Form 990-T, section 401(a) or 408(a) trust), "06" (Form 990-T, trust other than above), "07" (Form 990-T corporation), "08"(Form 1041-A), "09" (Form 4720 (other than individual)), or "11" (Form 6069), then 'TentativeTaxAmt' in the 'EOAutomaticExtensionFileTmGrp' must have a value.

RuleNum: F8868-056-01

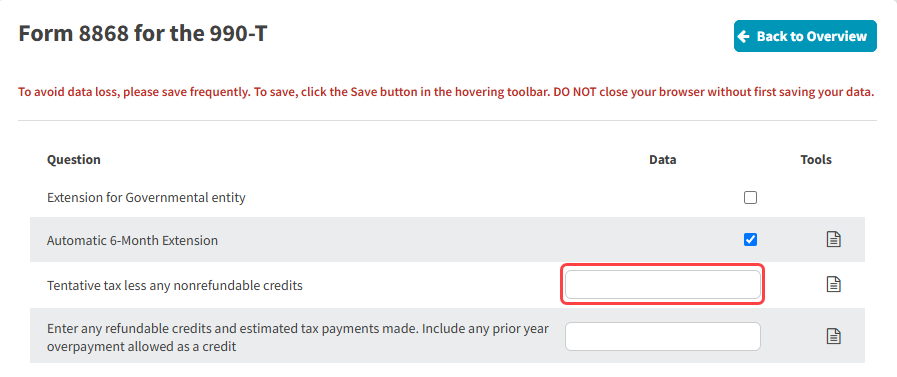

Issue: The client did not fill out all the fields in Form 8868 for the 990-T.

How to Resolve

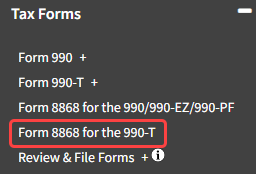

- Navigate to Tax Forms -> Form 8868 for the 990-T

- Fill in data for the second field "Fill in data for the first field "Tentative tax less any nonrefundable credits"

- Click the "Save" button in the Tools bar

- Resubmit your Form