How to Resolve IRS Rejection, Missing Document: 8453 Signature Document

IRS Rejection Reason Missing Document: If 'SignatureOptionCd' in the Return Header has the value "Binary Attachment 8453 Signature Document", then a binary attachment with description "8453 Signature Document".

IRS Rejection Reason

Missing Document: If 'SignatureOptionCd' in the Return Header has the value "Binary Attachment 8453 Signature Document", then a binary attachment with description "8453 Signature Document" must be present in the return.

RuleNum: R0000-055-02

Issue: The user forgot to attach the 8453 Signature Form.

Resolution:

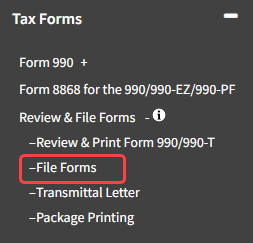

- Navigate to Tax Forms â Review & File Forms â File Forms

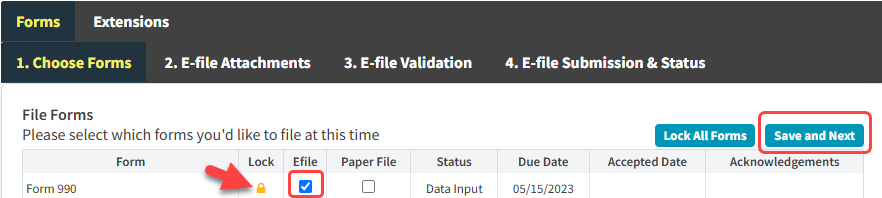

- Locate the form that needs to be resubmitted and unlock then lock it

- Check the E-File checkbox.

- Click Save and Next.

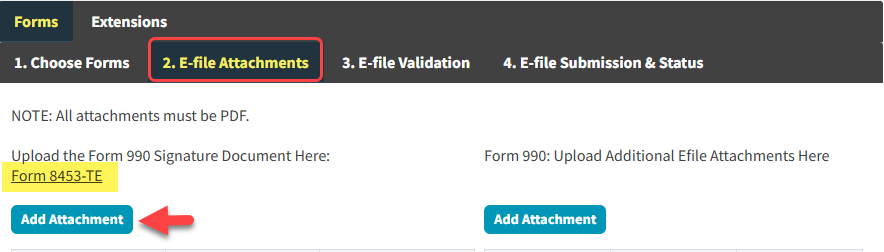

- Click the provided link to download Form 8453-TE.

- Print and sign the form.

- Save the signed Form 8453-TE to your local machine.

- Click the "Add Attachment" button.

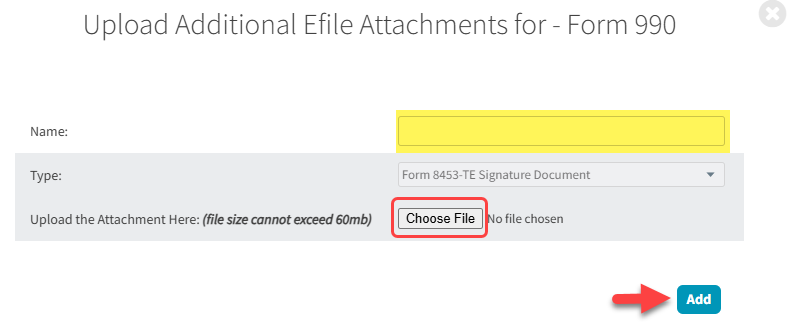

- Fill in the Name field (do not use special characters).

- Click "Choose File" and select the signed Form 8453-TE from your local machine.

- Click "Add" to upload the form.

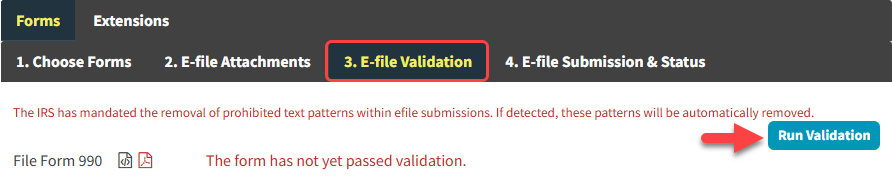

- Navigate to Tab 3: E-File Validation.

- Click "Run Validation".

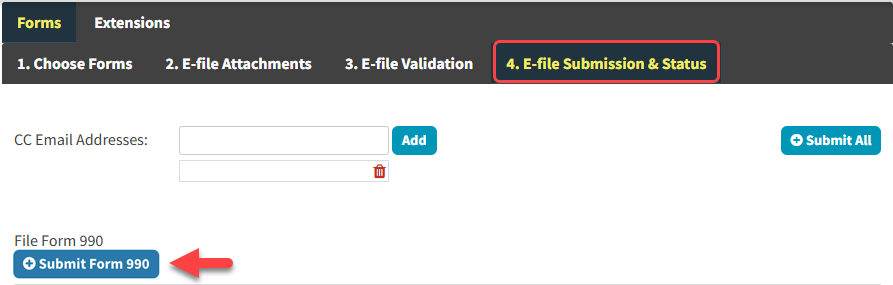

- Navigate to Tab 4: E-File Submission & Status.

- Click the appropriate Submit Form button.