How to Resolve IRS Rejection, Missing Document: 8453 Signature Document (YMCAs)

IRS Rejection Reason If 'SignatureOptionCd' in the Return Header has the value "Binary Attachment 8453 Signature Document", then a binary attachment with description "8453 Signature Document" must be present in.

IRS Rejection Reason

If 'SignatureOptionCd' in the Return Header has the value "Binary Attachment 8453 Signature Document", then a binary attachment with description "8453 Signature Document" must be present in the return.

RuleNum: R0000-055-02

Issue: The user forgot to attach the 8453 Signature Form.

Resolution

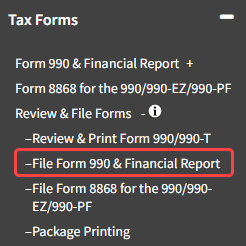

- Navigate to Tax Forms -> Review & File Forms -> File Form 990 & Financial Report

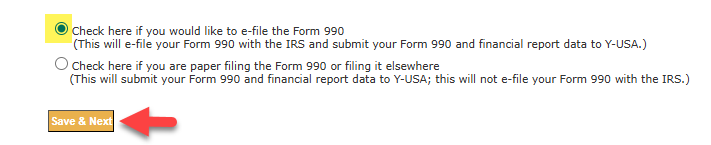

- Choose the top radio button "Check here if you would like to e-file the Form 990"

- Click Save & Next

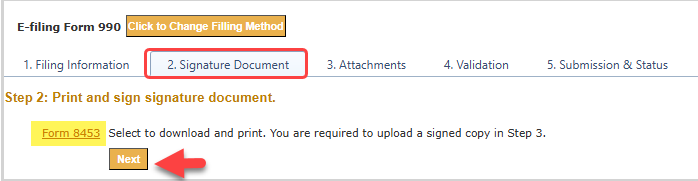

- Click on Tab 2. Signature Document

- Click on the Form 8453 link to download the signature form to your local machine

- Print and Sign the Form 8453

- Save the signed Form 8453 to your local machine

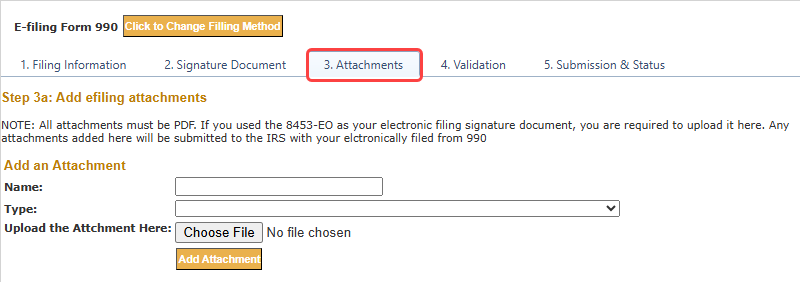

- Click on Step 3. Attachments

- Fill in the Name field (do not use special characters)

- Choose "Form 8453-TE Signature Document" in the Type drop down menu

- Click the "Choose File" button to upload the signed Form 8453 from your local machine

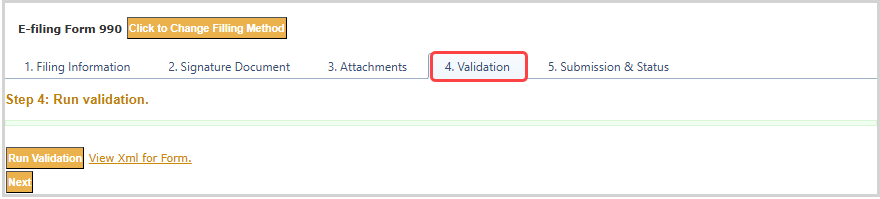

- Once attached, Click on Tab 4. Validation

- Click the "Run Validation" button

- Click Next

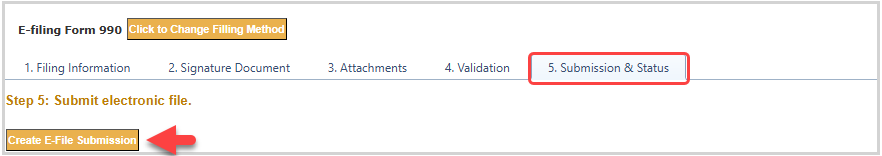

- Click the Create E-file Submission button