How to Resolve IRS Rejection, Missing Document: Schedule A

IRS Rejection Reasons #1: Missing Document: If Form 990, Part IV, Line 1, checkbox "Yes" is checked, then Schedule A (Form 990 or 990-EZ) must be present in the return.

IRS Rejection Reasons

#1: Missing Document: If Form 990, Part IV, Line 1, checkbox "Yes" is checked, then Schedule A (Form 990 or 990-EZ) must be present in the return.

RuleNum: F990-111-01

#2: Missing Document: If form 990, either Item I checkbox "501(c)(3)" is checked or Item I checkbox "4947(a)(1)" is checked, then one Schedule A (Form 990 or 990-EZ) must be present in the return.

RuleNum: F990-167-01

Issue: Schedule A is not present in the return. The client did not choose a Public Charity Status.

Resolution:

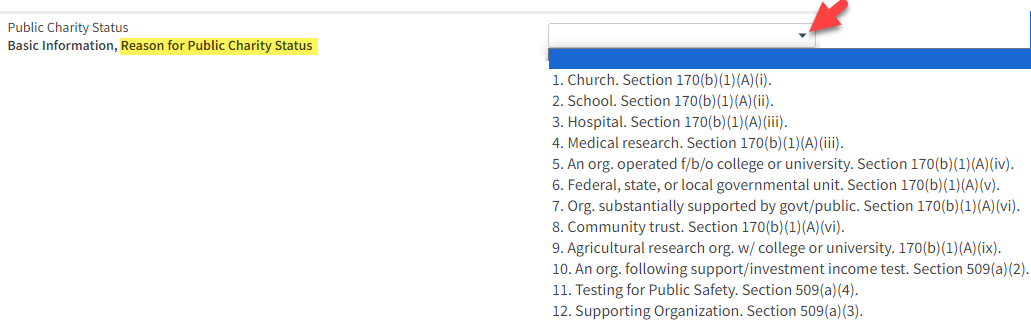

- Navigate Basic Data -> General Information -> Basic Information -> Public Charity Status

- Click on the drop down menu to choose a Public Charity Status

- Click "Save" in the Tools Bar

- Resubmit the return