Managing State Tax Data: Apportionment, Adjustments, and Allocations

Overview The State Scenario Builder allows users to derive and adjust state-sourced income from federal data.

Overview

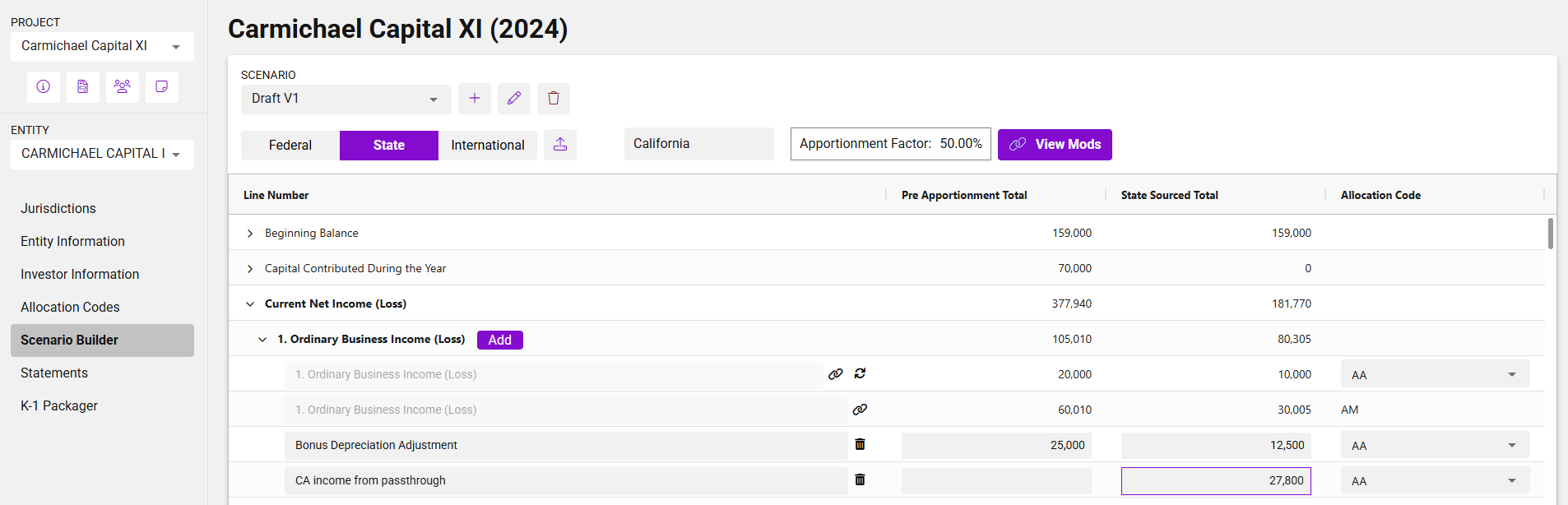

The State Scenario Builder allows users to derive and adjust state-sourced income from federal data. All federal events are carried into each activated jurisdiction, and state-level apportionment percentages are automatically applied to calculate state-sourced amounts. Users can supplement, adjust, or override this information as needed based on the requirements of each jurisdiction.

Note: Inputs for state-specific tax data are available for all states in the April release. However, only California and New York are finalized at this time. Substantial changes may occur for other states in upcoming releases, so we recommend caution when entering data for jurisdictions beyond CA and NY.

Understanding Key Concepts

Two Input Columns: Pre-Apportionment Total vs. State-Sourced Total

Each event row on the State Scenario Builder page includes two number input columns:

-

Pre-Apportionment Total: Reflects income before apportionment is applied.

-

State-Sourced Total: Reflects the final amount that will be reported on the state K-1.

Federal events flow in with pre-apportionment values that are apportioned automatically based on the apportionment percentage for that jurisdiction, producing the state-sourced total.

For federal events, users cannot override the state-sourced total. The only editable field is the allocation code applied to that sourced amount.

Making Adjustments with State-Specific Events

If users need to adjust federal income for a specific jurisdiction (e.g., due to a state disallowance), they can add a state-specific event.

When adding a state-specific event:

-

Enter the adjustment amount in the column (pre-apportionment or state-sourced) that reflects the type of income you're adjusting.

-

For example, if the adjustment affects income before apportionment, enter it in the Pre-Apportionment Total column. If the adjustment affects state-only items, enter it in the State-Sourced Total column.

In cases where only one of the two fields is editable, this is because the K-1 line in question requires either a total pre-apportioned number (e.g., full federal value) or a direct sourced amount (e.g., withholding), not both.

Visual Indicators and Icons

To help users distinguish event types and data overrides, the interface includes visual cues:

-

Link icon: Indicates the event was carried in from Federal

-

Refresh icon: Indicates the allocation code has been changed at the state level. Clicking it reverts to the federal allocation code

-

Trash can icon: Identifies a state-specific event. Clicking removes the event

-

Purple highlight: Shows that the state-sourced total for a state-specific event has been manually overridden

Example line showing pre apportionment adjustment, allocated state income, events carried in from Federal

Helpful Tip

In cases where both input fields are editable but only one value maps to the K-1 form:

-

The Pre-Apportionment Total is provided as a calculation aid.

-

The State-Sourced Total is the value that will flow to the K-1.