Multiple K1s with the Same EIN

How to upload and extract duplicate-EIN K-1s without overwriting investment records

Overview

If you are working with multiple K1s with the same Partnership EIN, uploading them through the main Reader dropzone will cause the extraction to overwrite existing data instead of creating new investments.

There is a workaround that will support uploading and extraction of multiple K1s with the same EIN without overwriting existing investment data.

Option 1

If you only have a few K-1s with duplicate EINs, this is likely the best method to follow.

Here are the steps to take:

Manually Create Your Investment

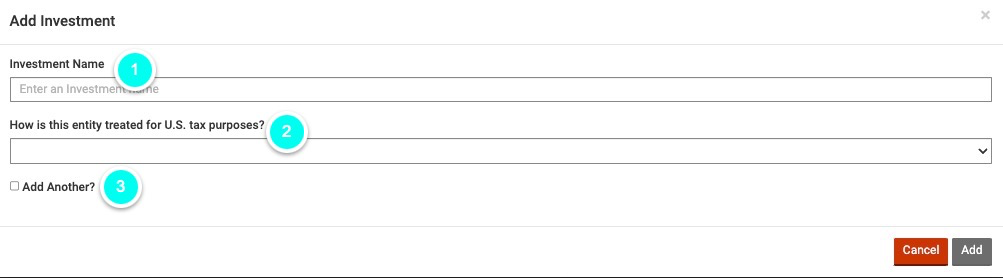

Click the "Add Investment" button

Enter investment name

Choose entity type

Click "Add" button to create the investment

If you have multiple investments to enter, check the "Add Another" box

Upload the K1 and Extract the Data

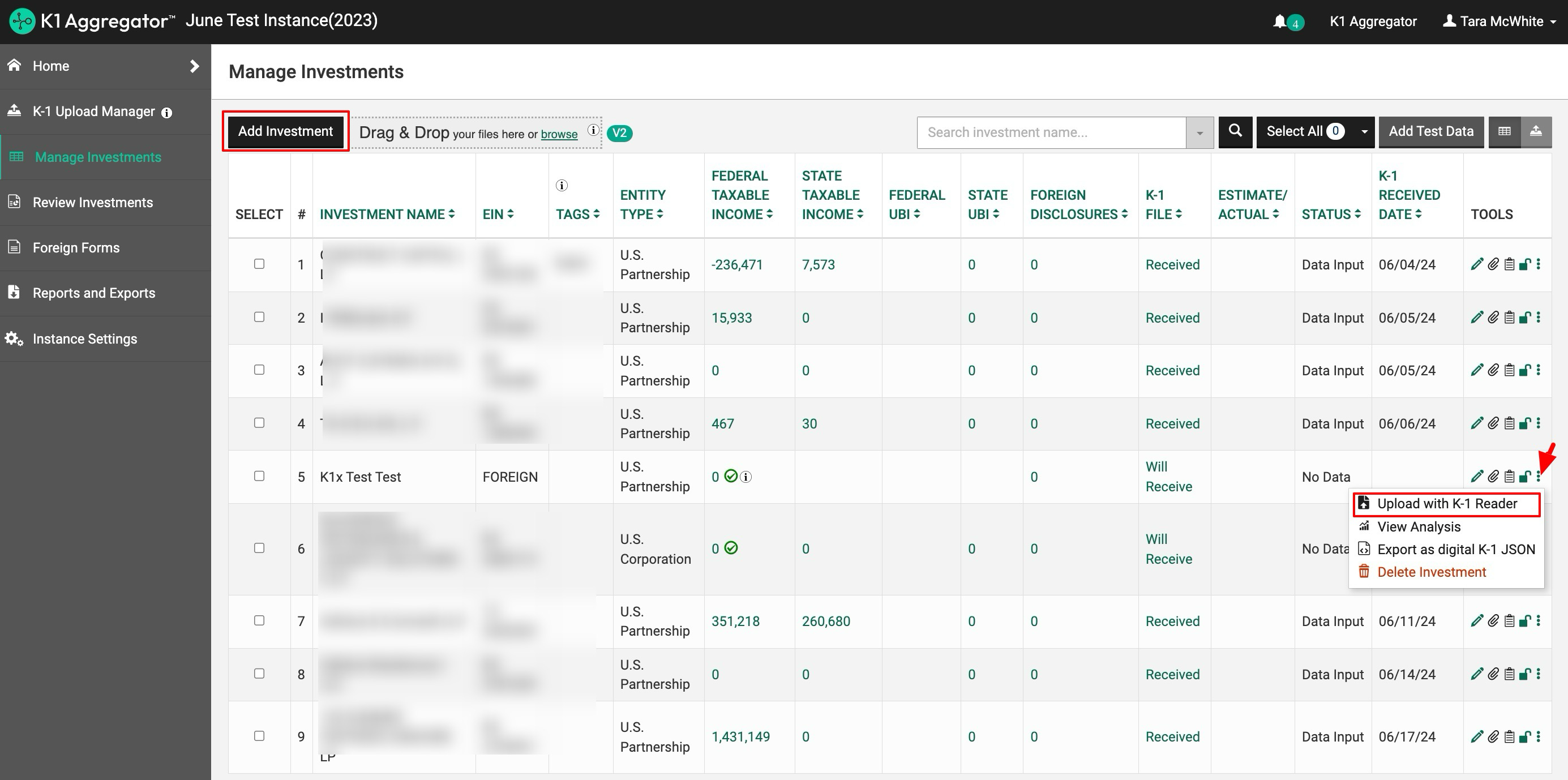

Find the new investment record in the table

Click on the last icon in the tools (3-dots)

Choose "Upload with K1 Reader"

Take this action for each additional K-1

Option 2

If you have a high volume of K-1s that fall under this scenario this is your best option.

Create Instance Silos

For example, each set contains 3 K-1s (taxpayer, spouse and SMLLC) with the same EIN. Create three instances, one for each type.

- Client 1 Taxpayer

- Client 1 Spouse

- Client 1 SMLLC

When creating the instances, you will need to enter unique a client number in the Client ID field. So, for example, 12345-01, 12345-02 and 12345-03.

You can then drop the K-1s through the Reader into their corresponding instance.

This option WILL NOT work for instances that are integrated with 990 Tracker.

Integration Tip

If you separate the K-1 income in CCH by Spouse and Taxpayer, you must also update the ownership type in K1 Aggregator for the Spouse K-1s before sending the data to CCH.