What is included in Legacy K – 1 Navigator Rollover?

A rollover is a process to allow the customer/account to start a project for the current tax year using the previous yearâ´s data/settings for the account.

What is a rollover in Legacy K-1 Navigator? A rollover is a process to allow the customer/account to start a project for the current tax year using the previous yearâs data/settings for the account.

What is included in the rollover? The legal entities and investor data rolls over to the new year-this includes the LE and Investor names, as well as all associated demographic data, as well as which investors associated with which LEâs.

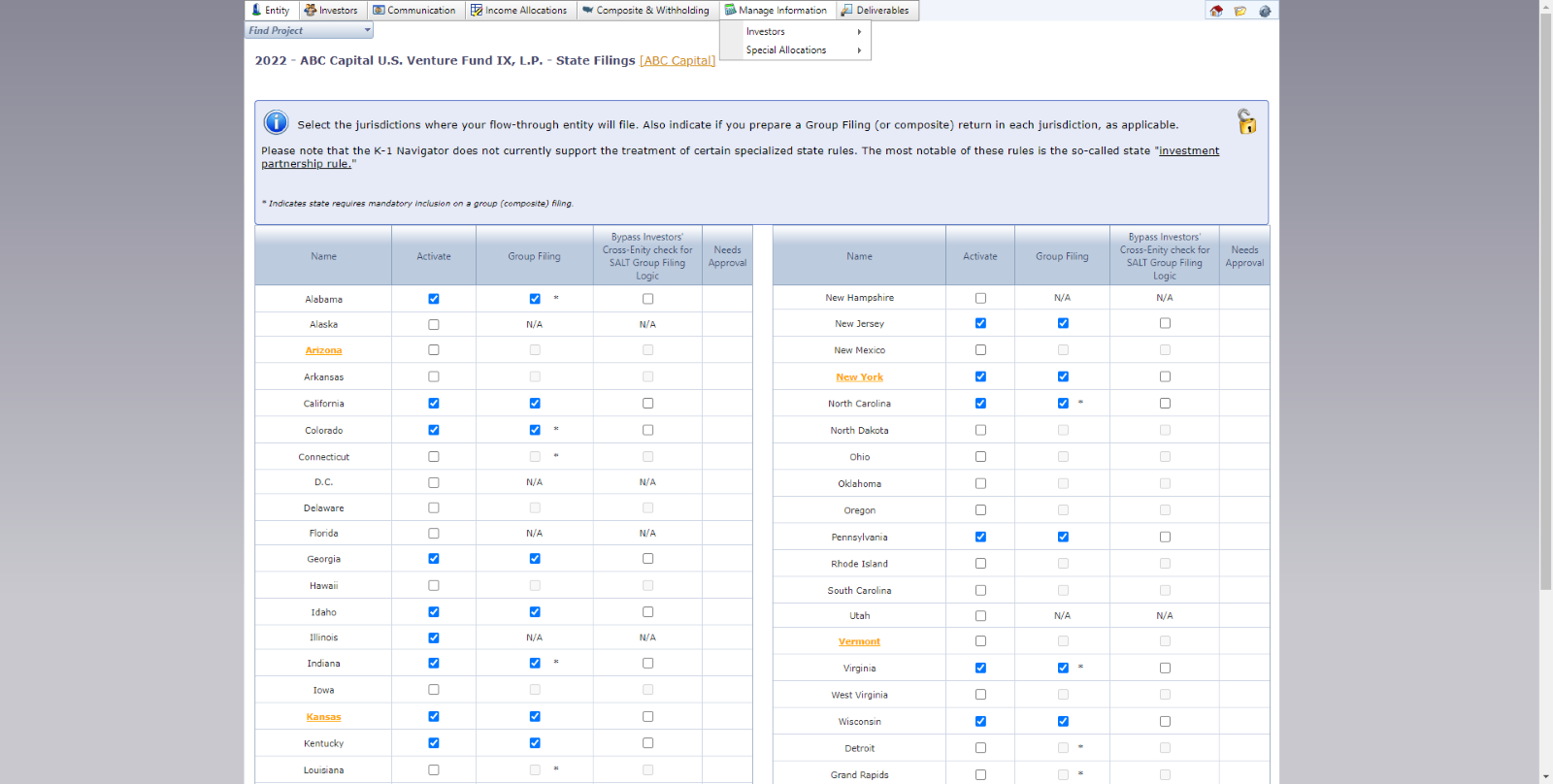

The State Logic selections from the PY also roll over to the new project that gets rolled over.

Full List:

- General Information about the entity and State Filings populate according to the previous yearâs information.

- Entity tax year will automatically update.

- For 52/53 week filers, please make sure to update tax year end.

- All investor information from the previous yearâs K-1 Navigator information. If you have made changes to partner information subsequent to accessing K-1 Navigator in the prior year, as best practice, you should export the information out of Go System and re-import it to K-1 Navigator to ensure all partner information is accurate.

- All Composite and N/R withholding forms collected through a portal or uploaded by the Crowe team.

- Income allocation information:

- Multiple date breaks and activities, if present last year;

- Schedule K line items, including user-created fields, with amounts excluded;

- Allocation code assignments;

- State modifications with all settings kept in place but amounts excluded.

- Special Allocation codes:

- Amount-based codes with values set to zero;

- Percentage-based codes associated with the same line items as last year;

- Investor questionnaire configurations.

- Entity information configurations for the composite and N/R withholding forms.