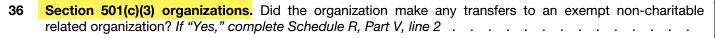

Why is Form 990, Part IV, Line 36 inactive

Form 990, Part IV, Line 36 is not active in the User Interface because the Tax Exempt Status for the engagement is not set to 501(c)(3).

Form 990, Part IV, Line 36 is not active in the User Interface because the Tax Exempt Status for the engagement is not set to 501(c)(3).

How to Resolve:

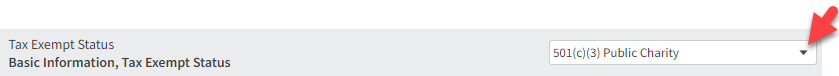

- Navigate to Basic Data -> General Information -> Basic Information -> Tax Exempt Status

- Choose 501(c)(3) from the drop down option

- Click "Save" in the Tools bar