990 – T E – file FAQ's

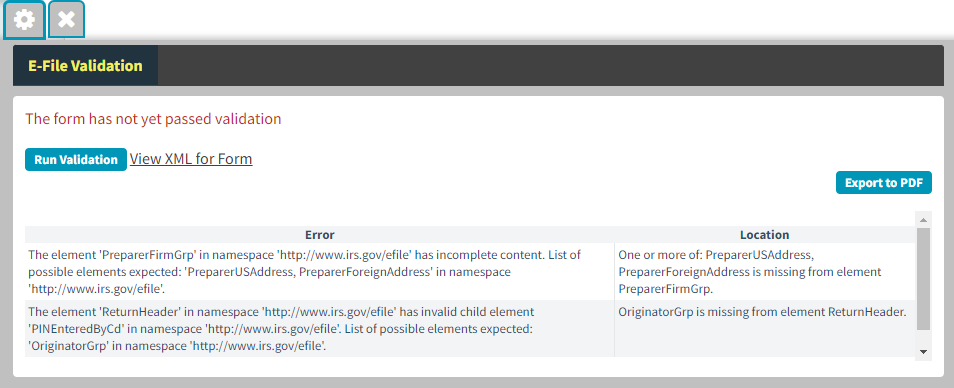

General Validation How do the diagnostics work and how do they compare to the diagnostics for the 990 or state forms?

General

Validation

How do the diagnostics work and how do they compare to the diagnostics for the 990 or state forms?

- There are no diagnostics for the 990-T. To run validation:

- Open the 990-T

- Click the wrench icon at the bottom of the screen

- Click âRun Validationâ.

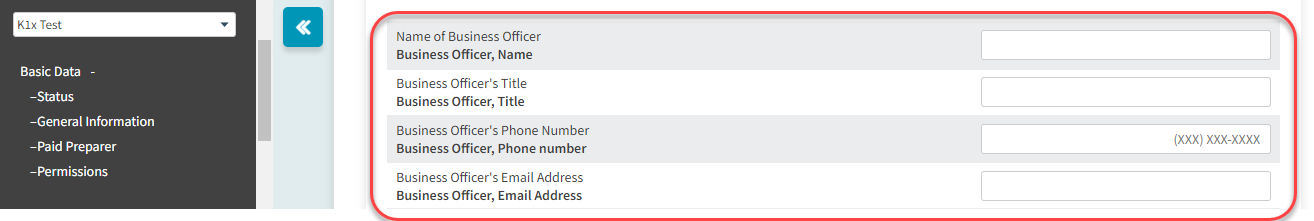

Business Officer Group

There is a new Business Officer section that is used solely for the XML. Please ensure it is completed in order to successfully transmit your 990-T E-file.

- You can find it under Basic Data -> General Information -> Basic Information

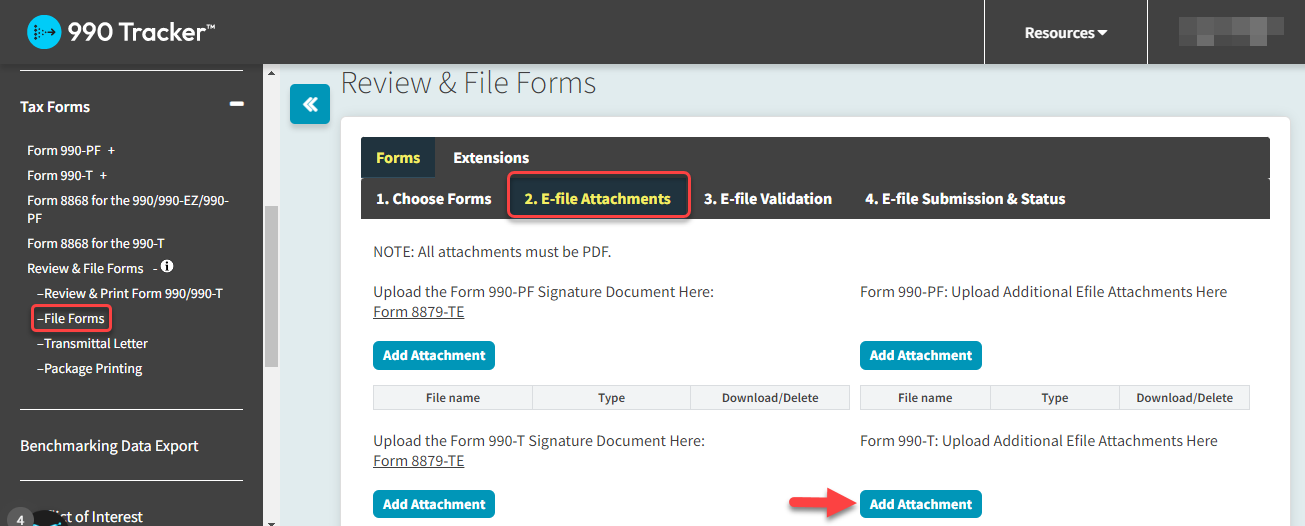

Attachments

Are there size limits for attachments?

- 60 mb

Is there a limit on the number of attachments submitted?

- There is no limit to the number of attachments.

- Each attachment type (ie. Form 5471) can only have one attachment

- The exception to this is the "Other" attachment type

Can we choose the order of the attachments submitted to the IRS?

- No, the IRS provides a specific hierarchy for every form which we need to follow. The order of attachments required for the 990-T can be found in the appendix at the end of this document. Any attachments from the E-file Attachments screen will be considered as binary attachments and appended at the end of the XML.

Which forms must be filed electronically?

- Any form that isnât listed below can be a PDF attachment:

- Form 851

- Form 1116

- Form 1118

- Form 2220

- Form 2439

- Form 3800

- Form 6765 (TY 2023): Credit for Increasing Research Activities.

- Form 8936 (TY 2023): Clean Vehicle Credit.

- Form 8846 (TY 2023): Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips.

- Form 3468 (TY 2023): Investment Credits

- Form 4136

- Form 4562

- Form 4797

- Form 8801

- Form 8827

- Form 8941

- Form 8949

- Form 8995

- Schedule D (Form 1120)

- Schedule D (Form 1041)

- Schedule I (Form 1041)

How should Foreign Forms data/international disclosure forms be transmitted?

- International disclosure forms accompanying the Form 990-T should be attached as a PDF in the E-File attachments page.

IRS Transmission

The following areas will have partial or no transmission to the IRS. This is because the IRS is not expecting this information to be included in the submitted return.

- Schedule D (1041), Part I, Line 6:

-

- Information found in any column will not be electronically transmitted to the IRS.

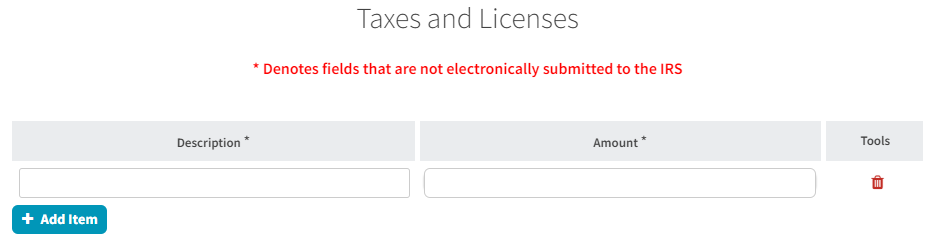

- Form 990-T, Schedule A, Part II, Line 6:

-

- Information entered in the Description and Amount columns will not be electronically transmitted to the IRS

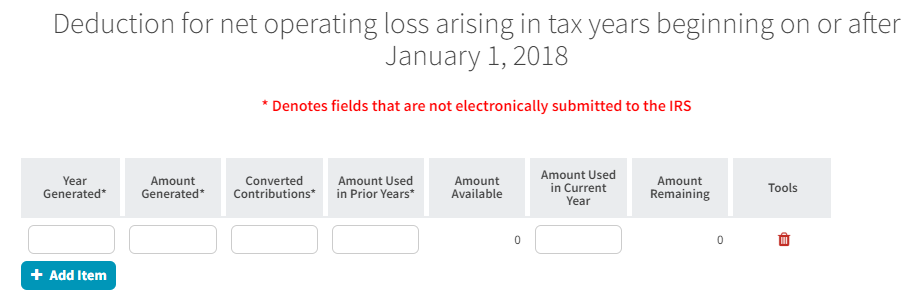

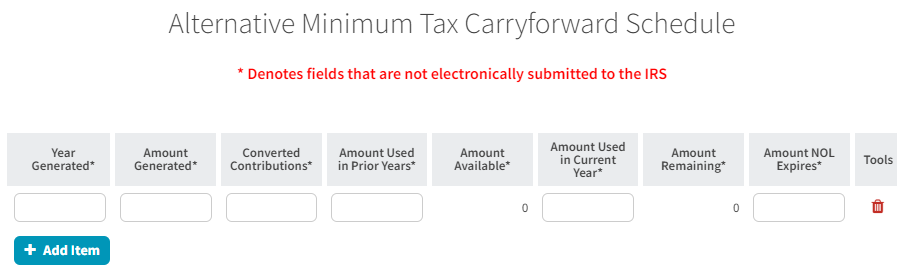

- Form 990-T, Schedule A, Part II, Line 17:

-

- Information entered in the Year Generated, Amount Generated, Converted Contributions, and Amount Used in P/Y columns will not be electronically transmitted to the IRS.

- Form 990-T, Part I, Line 4:

-

- Information found in any column will not be electronically transmitted to the IRS.

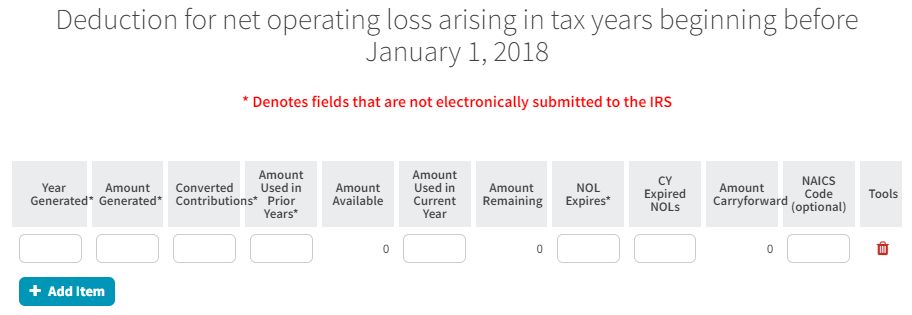

- Form 990-T, Part I, Line 6:

-

- Information entered in the Year Generated, Amount Generated, Converted Contributions, Amount Used in P/Y and NOL Expires columns will not be electronically transmitted to the IRS.

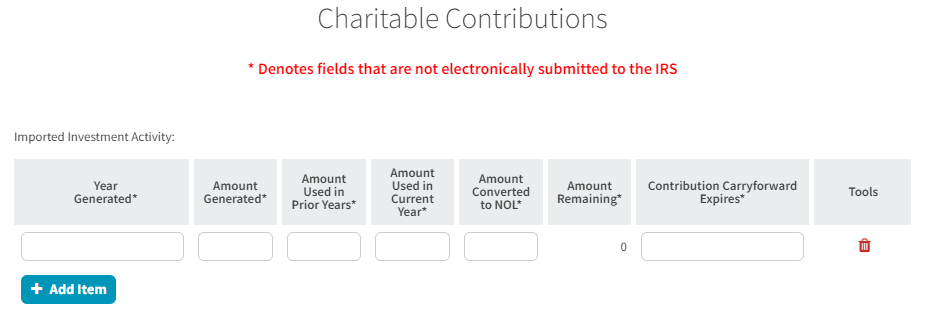

- Form 990-T, Part II, Line 5:

-

- Information found in any column will not be electronically transmitted to the IRS.

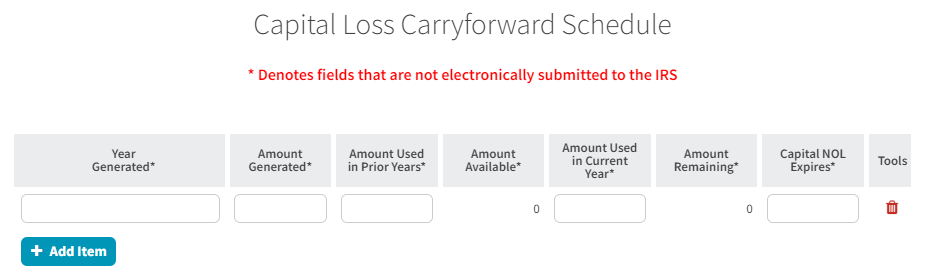

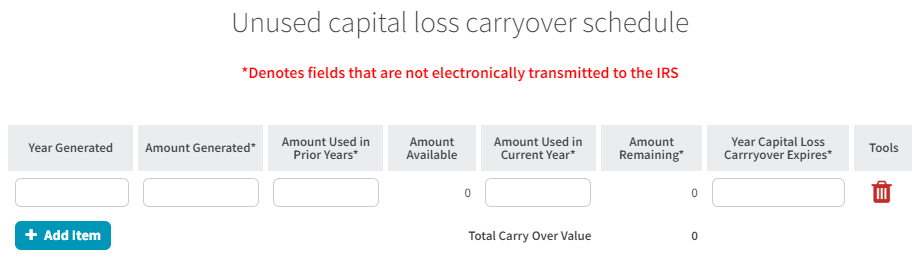

- Schedule D (1120), Part I, Line 6:

-

- Information found in the Amount Generated, Amount Used in Prior Years, Amount Used in Current Year, Amount Remaining, and Year Capital Loss Carryover Expires columns will not be electronically transmitted to the IRS.

- While the following federal forms are supported in 990 Trackerâs user interface, they do not automatically electronically transmit to the IRS. These forms need to be manually uploaded on the E-file Attachments page.

- Form 990-W

- Schedule O (Form 1120)

Appendix

Order of Attachments for the 990-T:

- Form 990-T

- Schedule A

- Schedule D (1041)

- Schedule I (1041)

- Form 1116

- Form 1118

- Form 2220

- Schedule D (1120)

- Form 2439

- Form 3800

- Form 4136

- Form 4255

- Form 4562

- Form 4797

- Form 5471

- Form 5735

- Form 6781

- Form 8582

- Form 8611

- Form 8621

- Form 8697

- Form 8801

- Form 8827

- Form 8834

- Form 8835

- Form 8858

- Form 8865

- Form 8868

- Form 8886

- Form 8912

- Form 8941

- Form 8949

- Form 8990

- Form 8991

- Form 8992

- Form 8993

- Form 926

- Binary Attachments (attachments from the E-File Attachments screen)