990 Tracker Guide | E – File Workflow

E-FILE SUBMISSION FEATURES

ICON Glossary

| XML Icon Click this icon to download a copy of the file transmitted to the IRS. The file is in XML format. |

|

| PDF Icon Click this icon to access a PDF copy of the return. The PDF is not transmitted to the IRS. |

|

| Zip File Icon Click this icon to download a zip file of the XML and attachments submitted to the IRS. |

|

| Acknowledgments Icon* Click this icon to download the IRS acceptance or rejection transmissions. |

E-FILING FEDERAL AND STATE EXTENSIONS

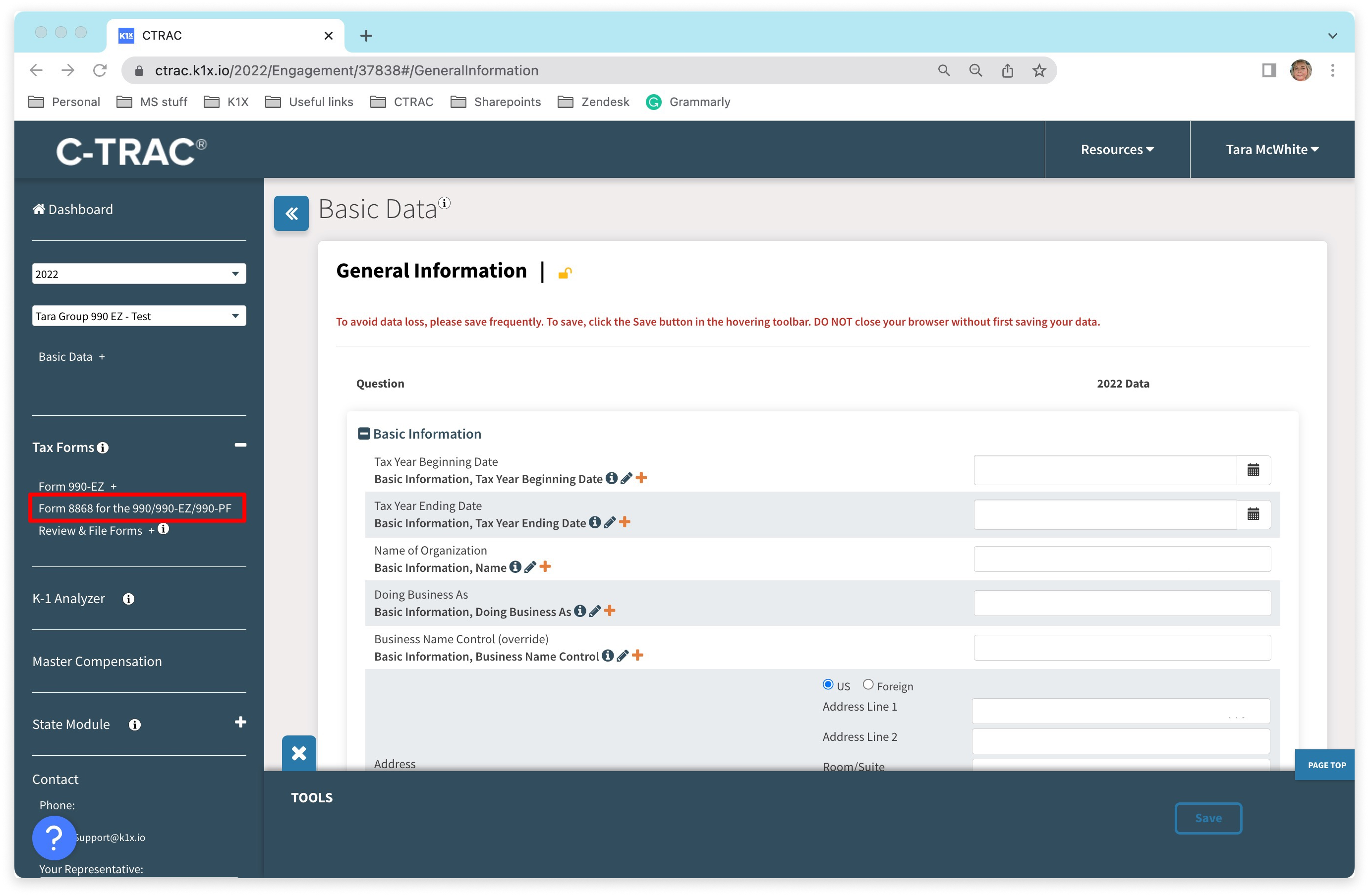

Select the Form 8868 option from the left-hand navigation under the Tax Forms list.

Check the checkbox for the type of extension(s) you need in the Form 8868 view.

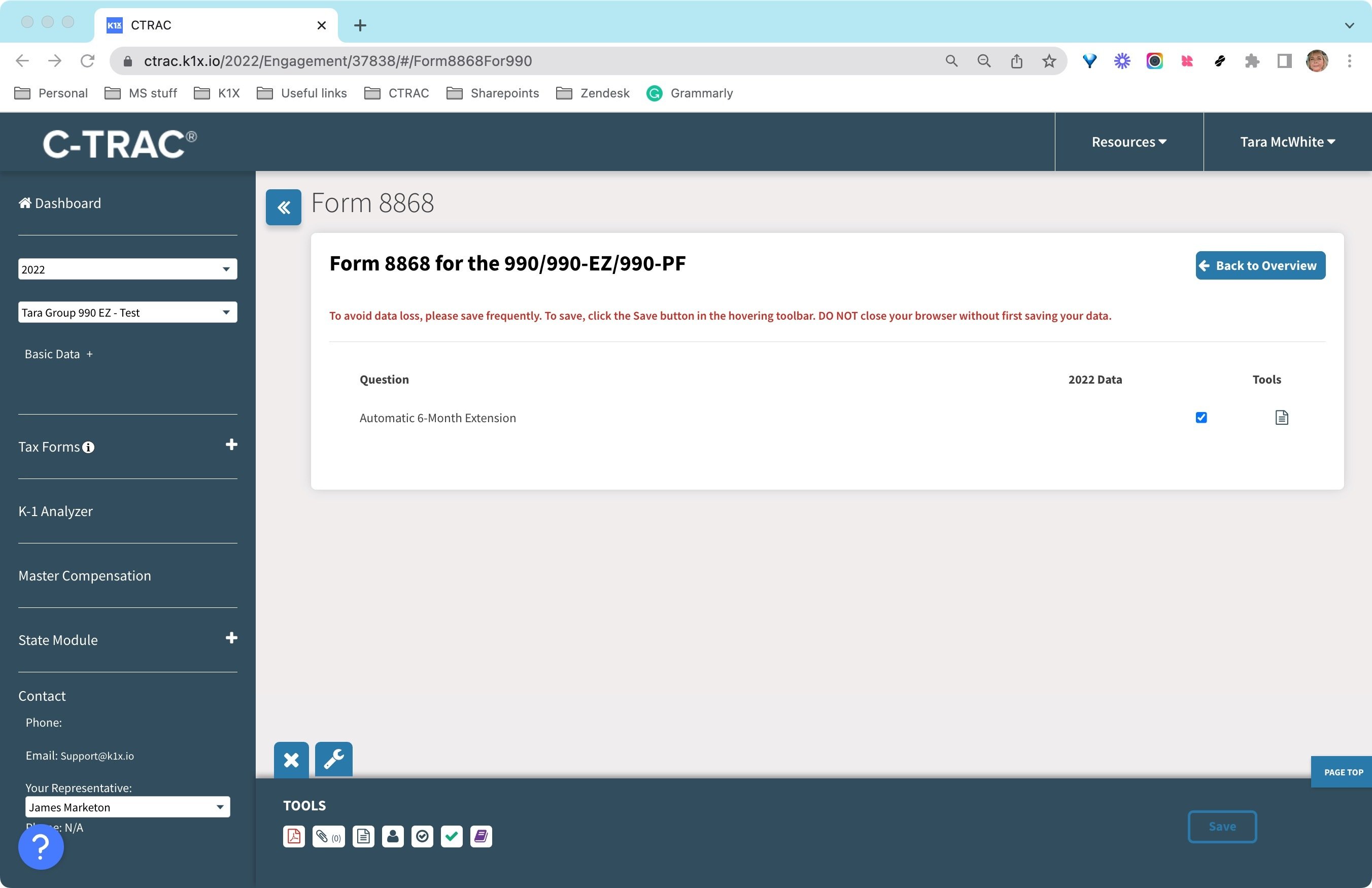

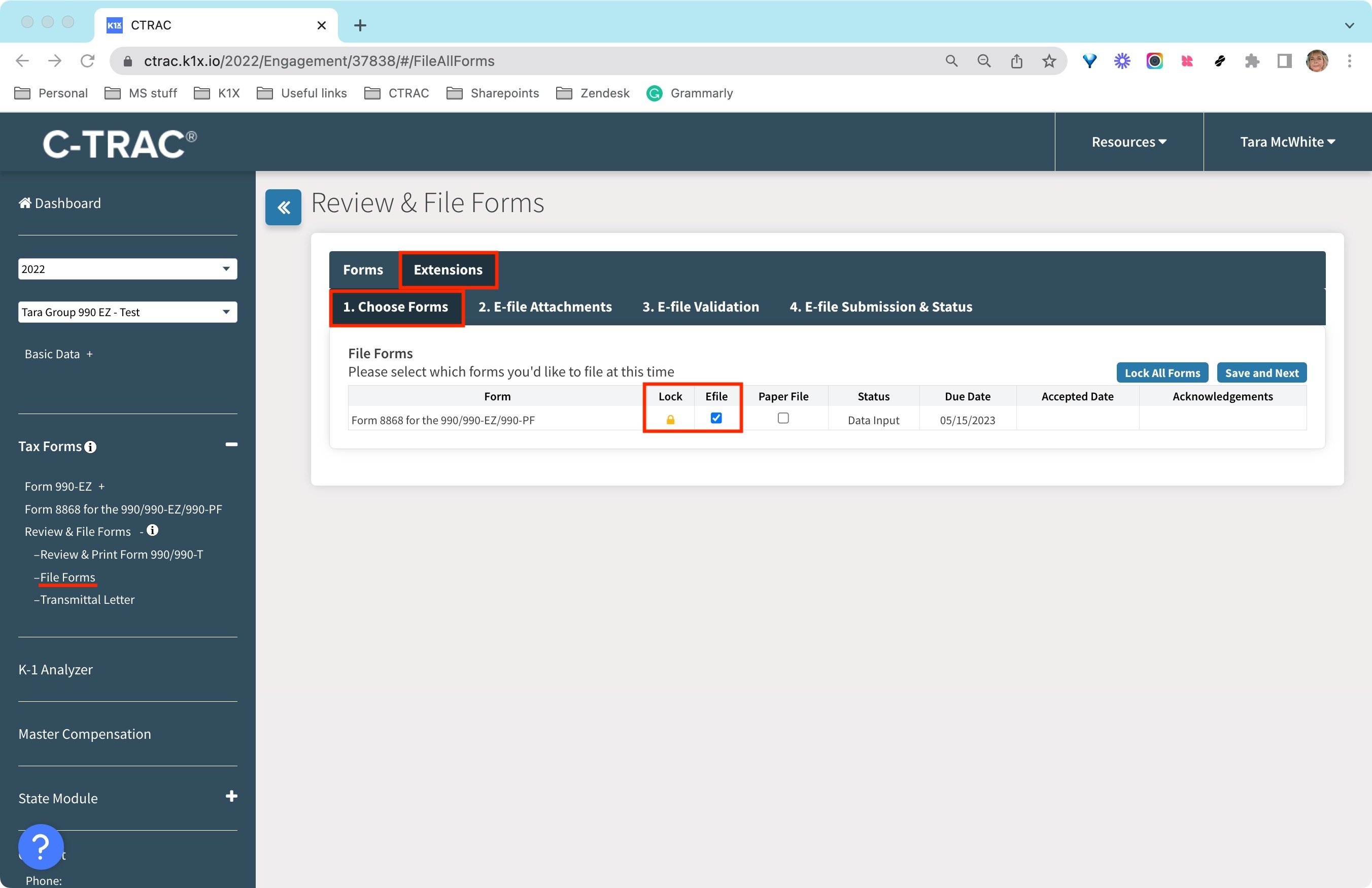

On the left navigation panel, click on Tax Forms > Review & File Forms > File Forms

Before the extension can be electronically filed, you must lock the return.

|

Choose Forms Tab Lock the extension file(s) that you are filing and ☑ the e-file checkbox |

|

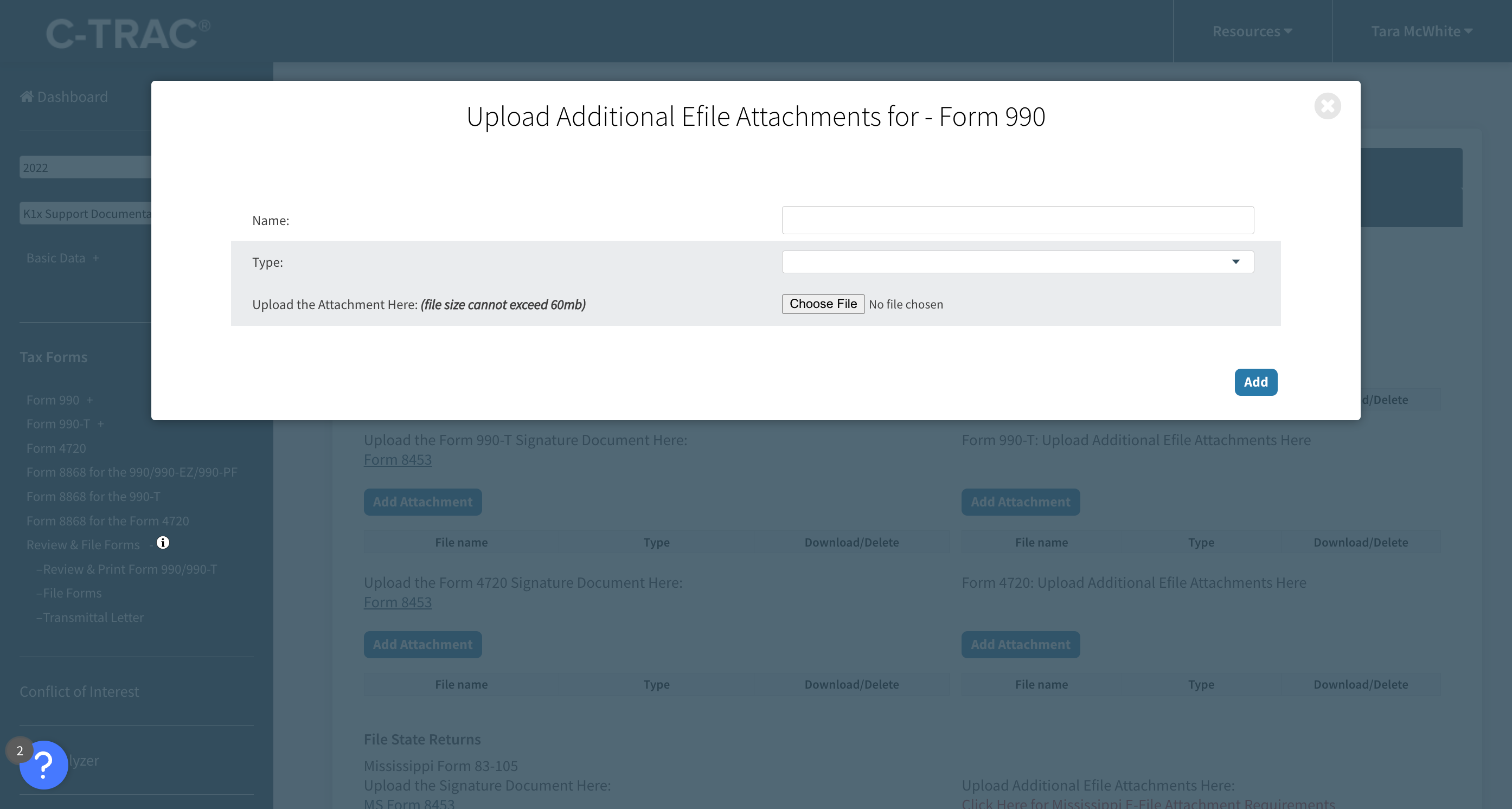

E-File Attachments Tab Attach any necessary attachments. (File must be PDF and 60MB or less) |

|

E-file Validation Tab Before the extension(s) can be transmitted to the IRS/State DOR, they must pass validation. Validation ensures that the extensions contain all the required elements for acceptance.

|

|

Submission & Status Tab |

After submitting the extension, the status will show 'Submission Pending' on the Choose Forms tab. You will receive an e-mail from the system notifying you that your extension has been transmitted.

Upon acceptance, the status will update to 'Accepted' and you will receive an e-mail confirmation of acceptance.

If the extension is rejected, you will receive an e-mail notification with the rejection reason. Click on the IRS acknowledgments icon to view reason(s) for the rejection, correct the errors, and resubmit.

E-FILING FEDERAL & STATE TAX FORMS

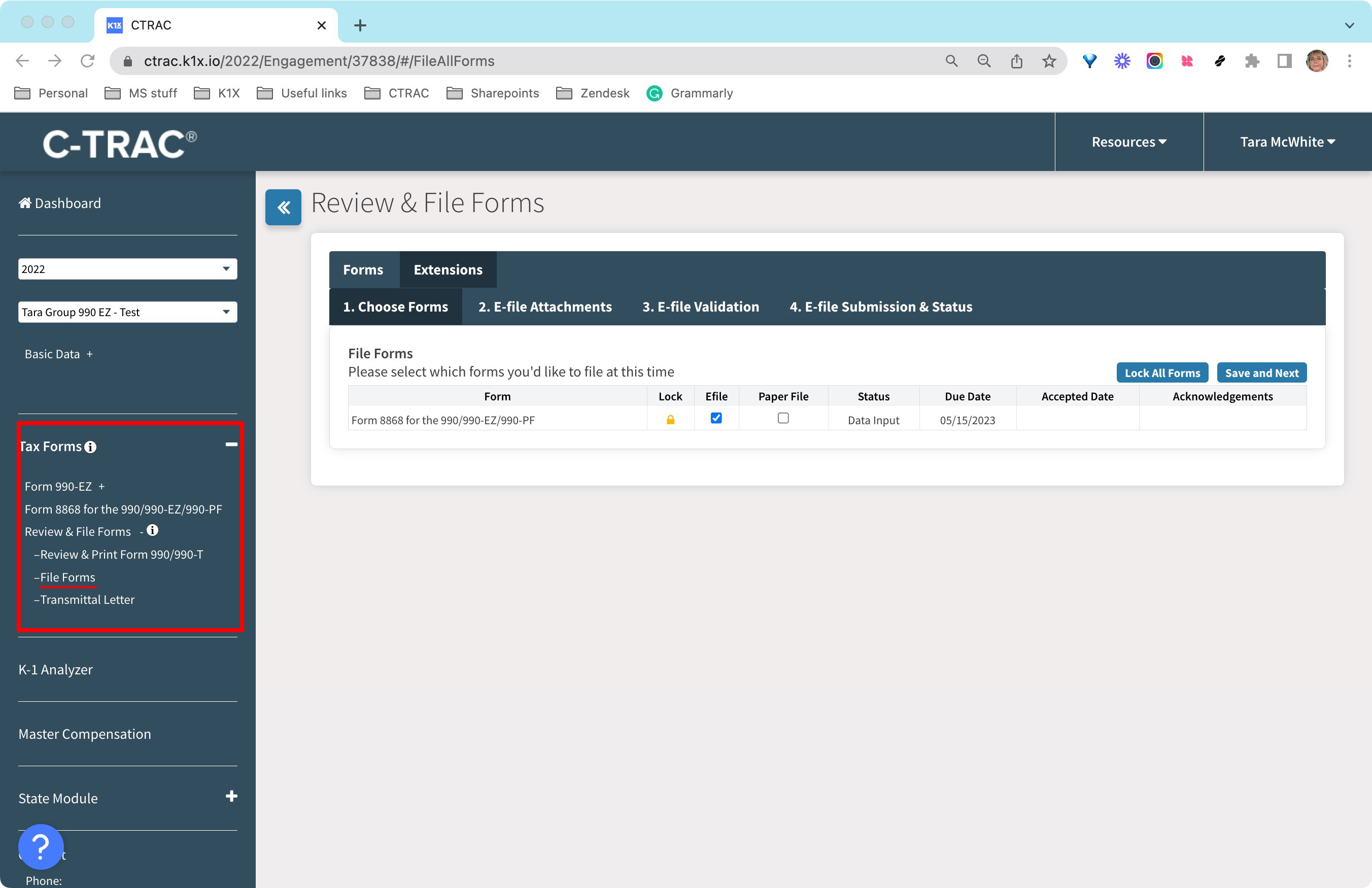

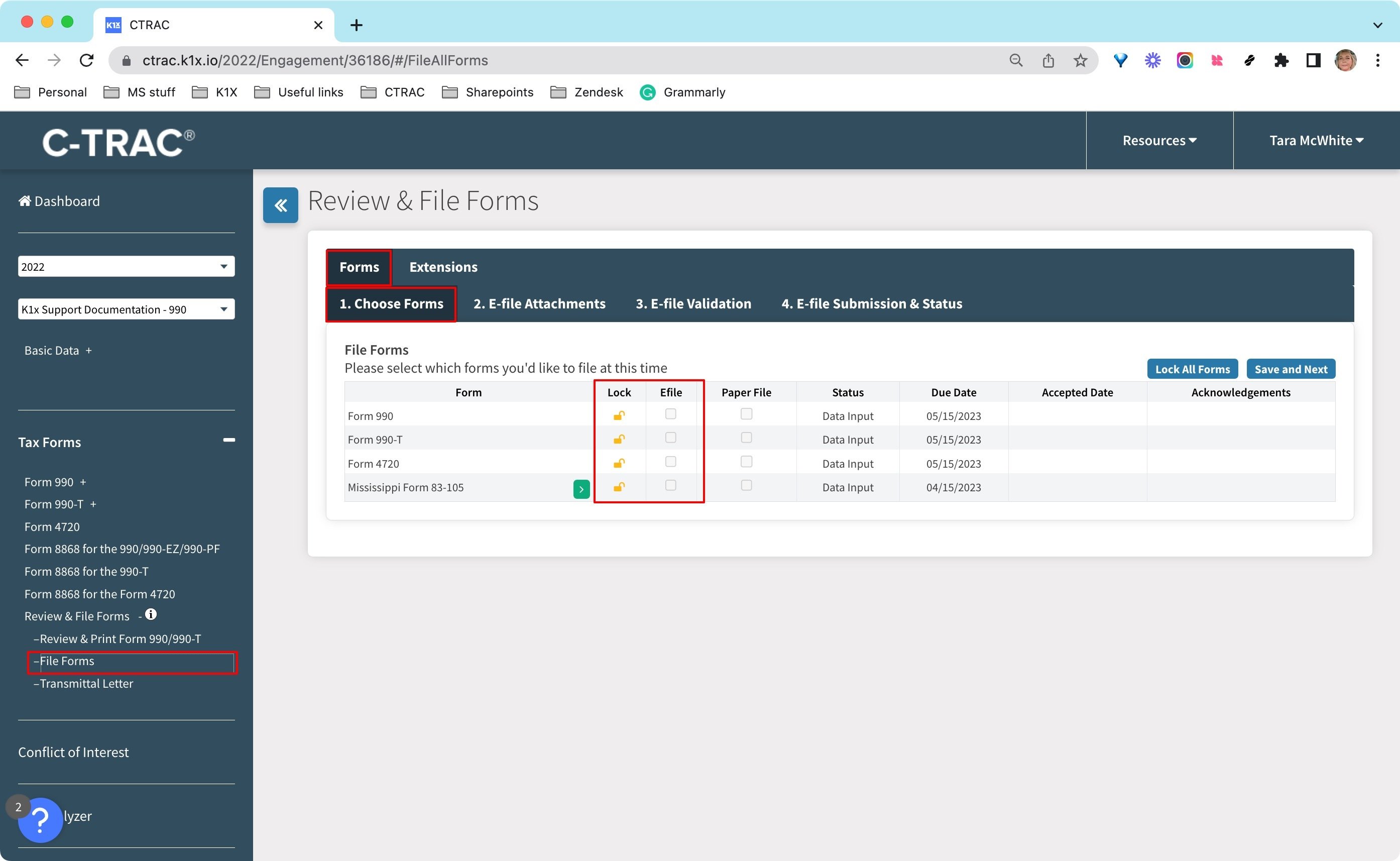

To e-file a form, navigate to the File Forms link located under the Review & File Forms menu in the left-hand navigation panel.

Once the appropriate return is prepared, select the File Forms link and navigate to the Forms tab.

|

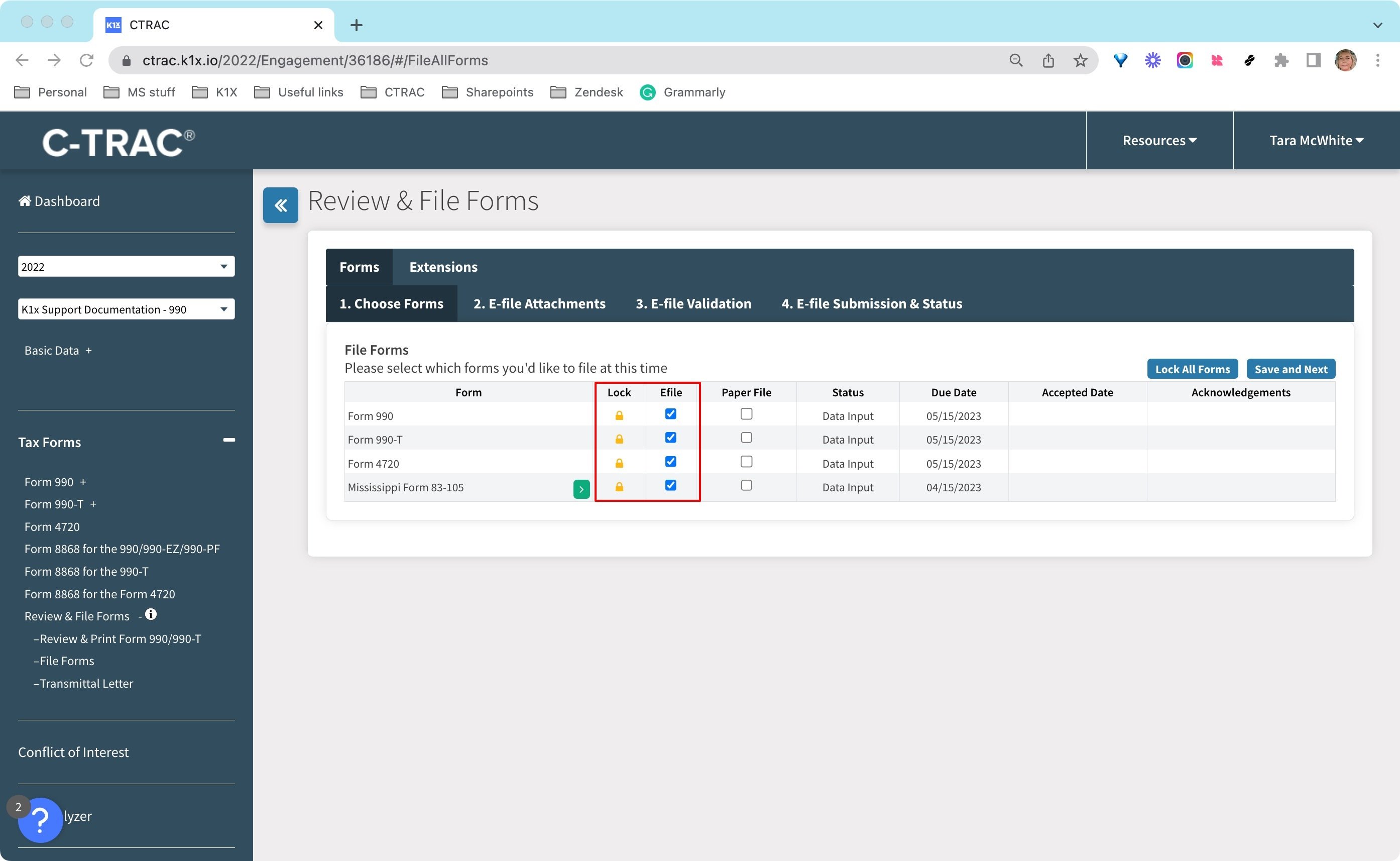

Choose Forms Tab Lock the form(s) that you are e-filing and ☑ the e-file checkbox |

|

E-File Attachments Tab

|

|

E-file Validation Tab Before the form(s) can be transmitted to the IRS/State DOR, the form(s) must pass validation. This will ensure that the form(s) contains all the required elements for IRS/State DOR acceptance.

|

|

Submission & Status Tab Federal forms will be submitted to the IRS and State forms will be submitted to the proper State Department of Revenue. |

Detailed View of Each Screen

Lock Forms and Check Efile

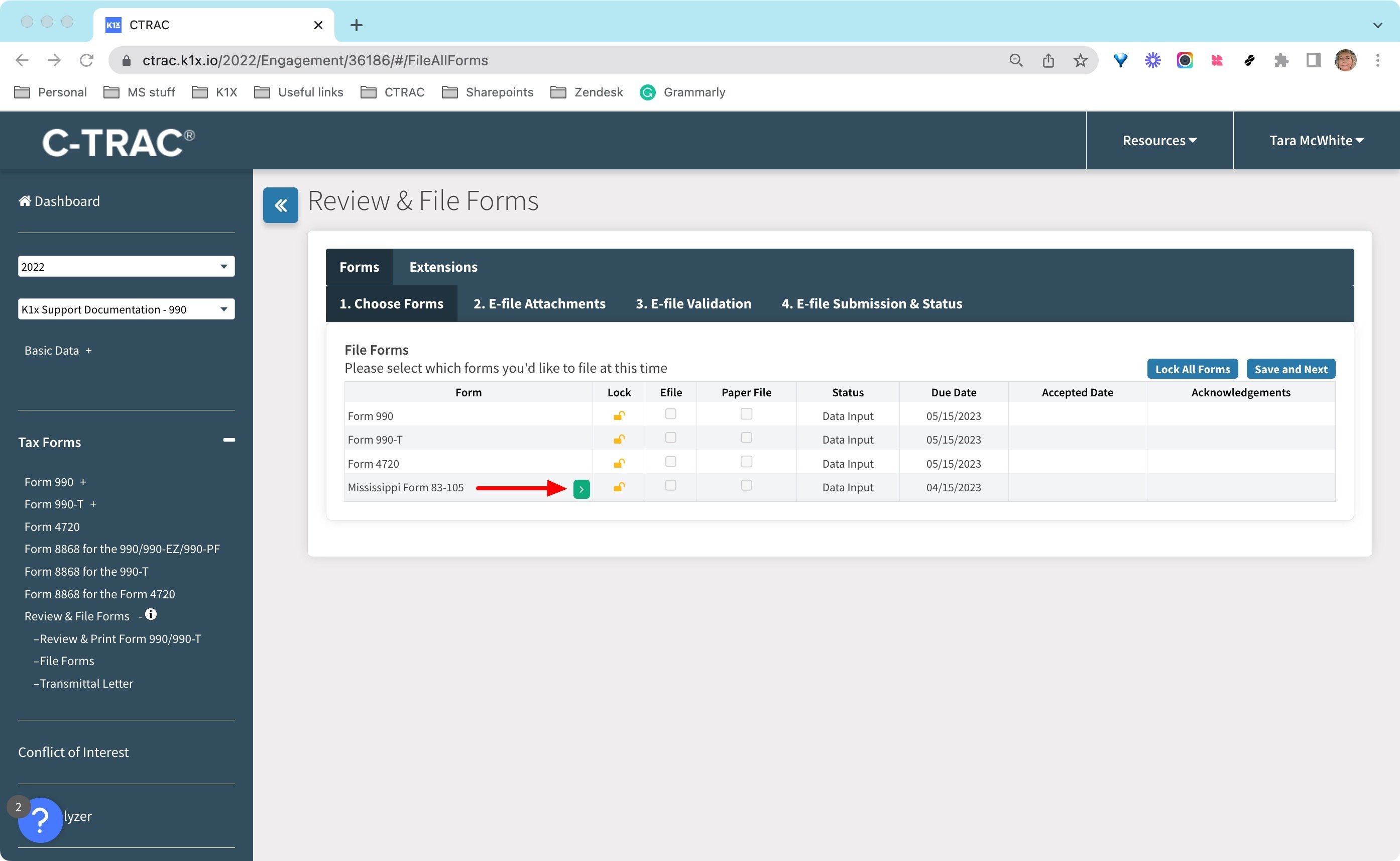

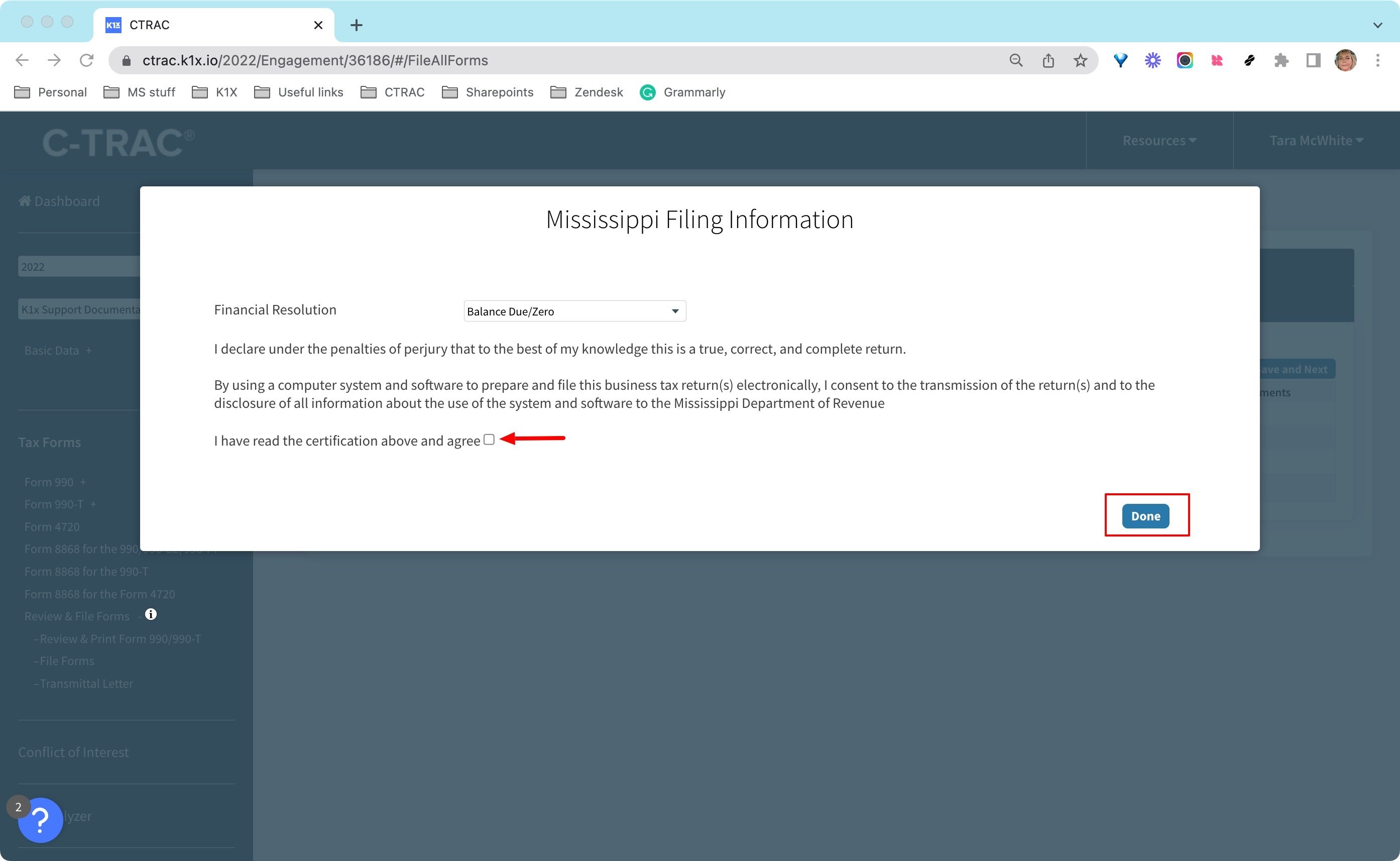

Some states require an additional acknowledgment, click the green icon to open the acknowledgment

Agree and click save on all state-required acknowledgments

Attach form 8453 and any additional files necessary. Each file that you have selected will have its own section for attachments.