How Do I Utilize the CCH Axcess Integration?

Configuration CCH Axcess Configuration On 9/18/23, K1x's CCH integration was updated to use the CCH Marketplace integration.

Configuration

CCH Axcess Configuration

On 9/18/23, K1x's CCH integration was updated to use the CCH Marketplace integration. As part of this, no configuration is needed by clients in CCH to send data.

K1 Aggregator Configuration

All clients who use the CCH integration must have a subscription for the integration added to their tenant for K1 Aggregator. Without the subscription, you will not have the option to send K-1 data to CCH.

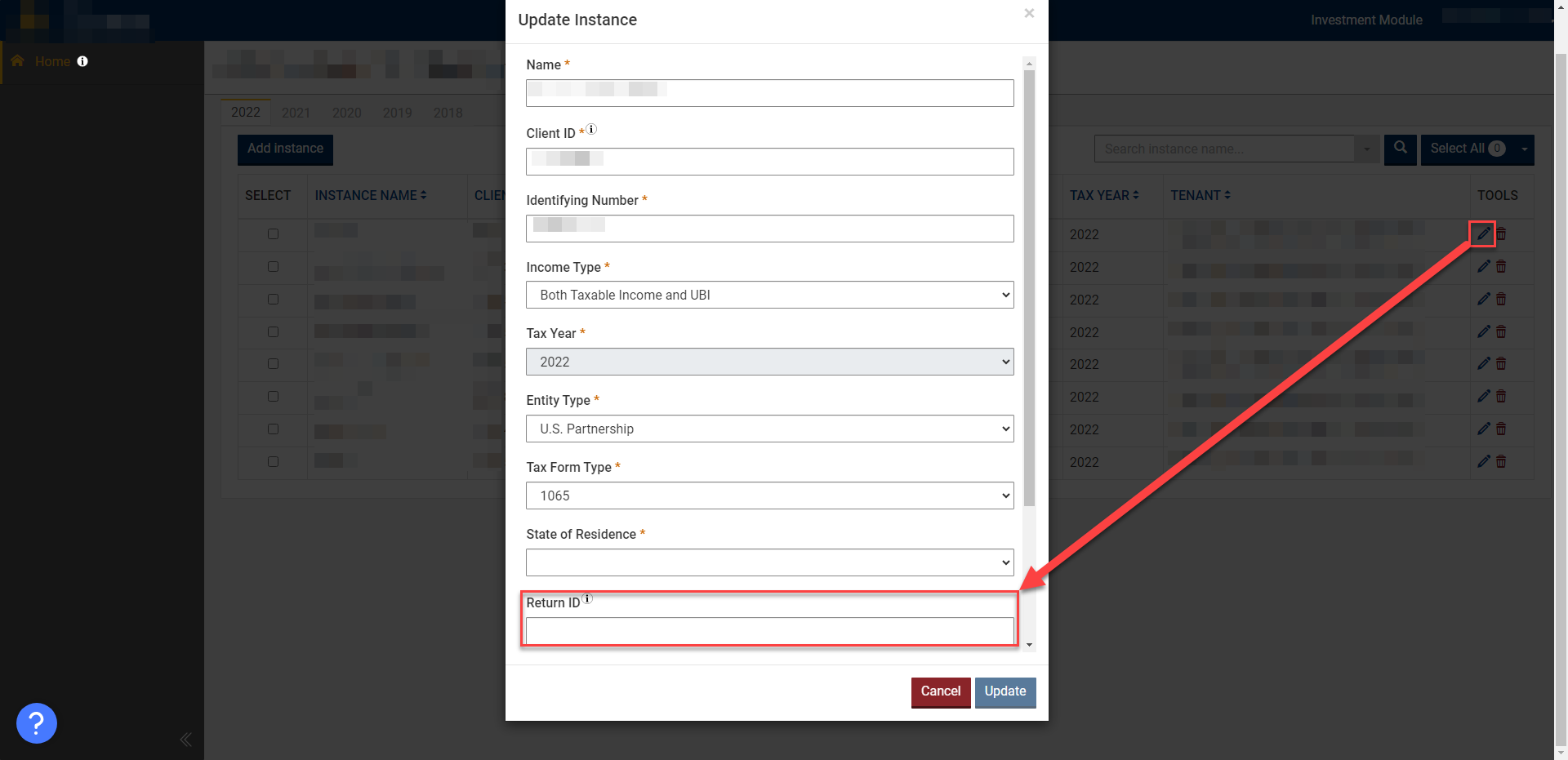

In order to send K-1 data to CCH for an instance, the CCH Return ID needs to be entered for each instance in K1 Aggregator. If the Return ID is missing for any instance, an error will occur when attempting to send data for that instance.

K1 Creator Configuration

The K1 Creator configuration is done entirely by a Support Admin or during onboarding. All clients who use the CCH integration must have a subscription for the integration added to their tenant for K1 Creator. Without the subscription, you will not have the option to send K-1 data to CCH.

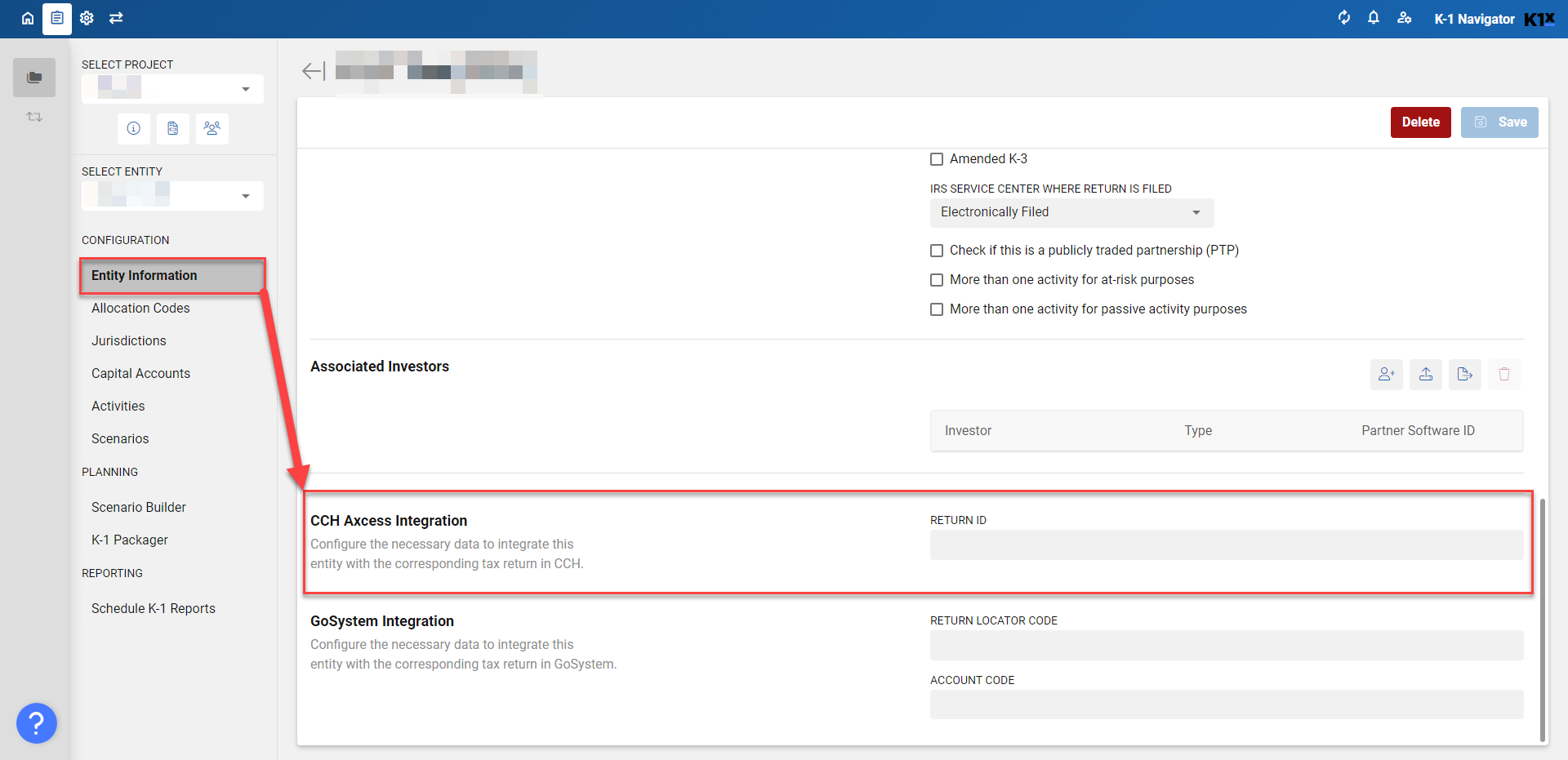

Once enabled, the CCH Return ID will need to be entered for each entity in the project.

Sending K-1 Data to CCH

K1 Aggregator

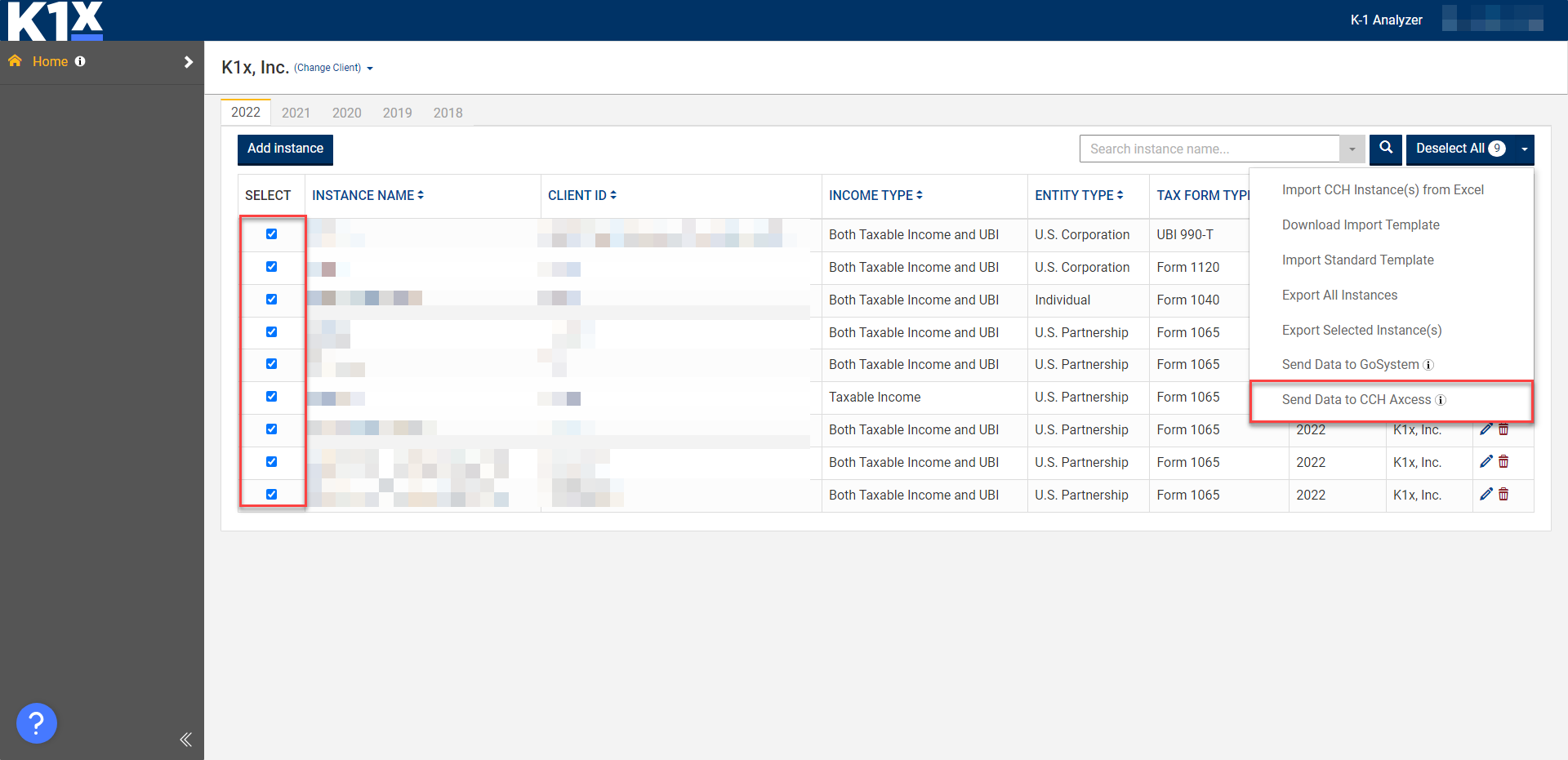

Once all work is done in K1 Aggregator and you are ready to send K-1 data to CCH, navigate to the Home page. To start the integration process, select which instances you would like to include and then select the bulk menu and Send Data to CCH Axcess.

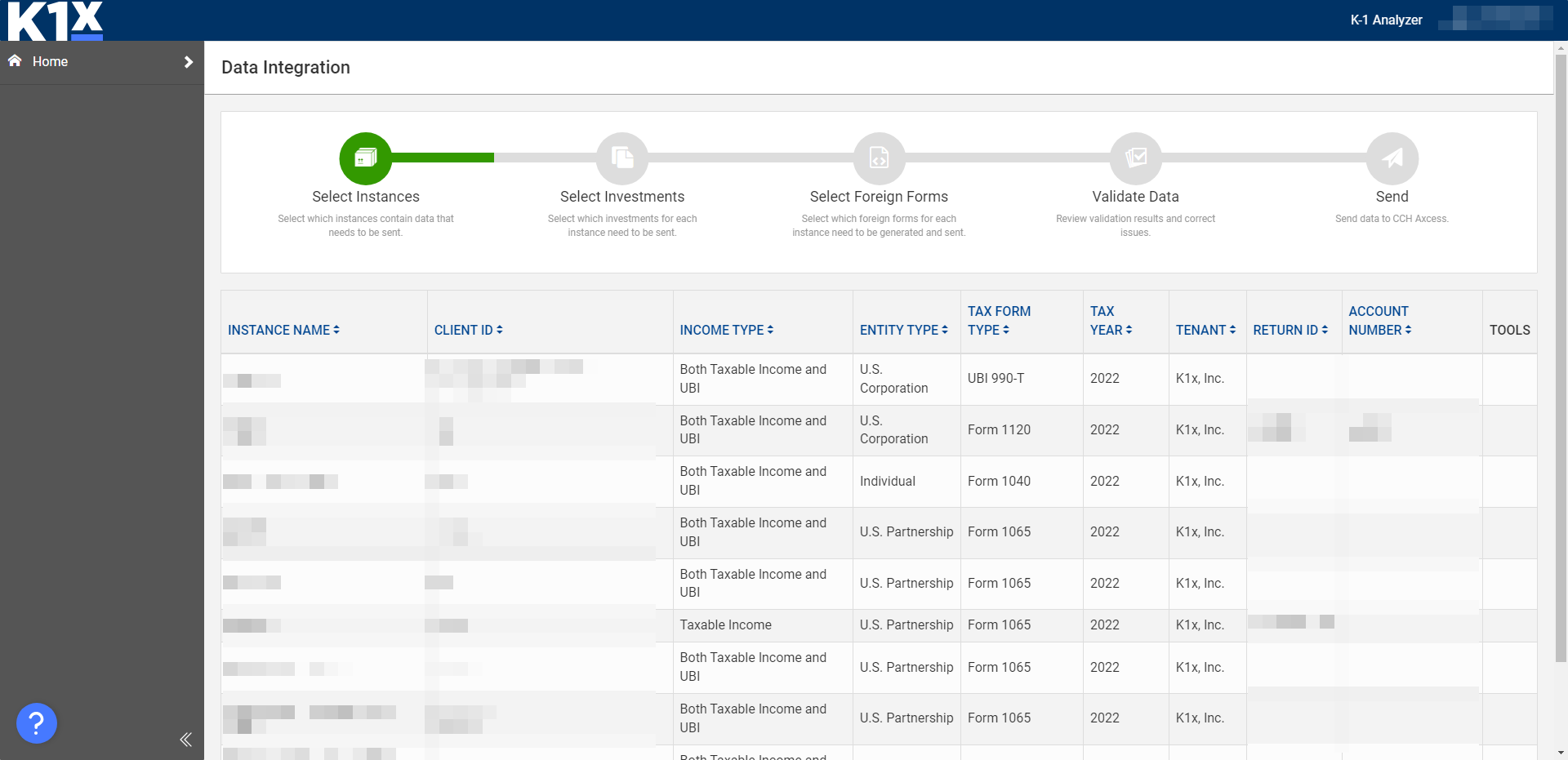

This will initiate the integration request and take you to the integration wizard. The first step of the wizard is confirming the instances you selected to include in the integration request.

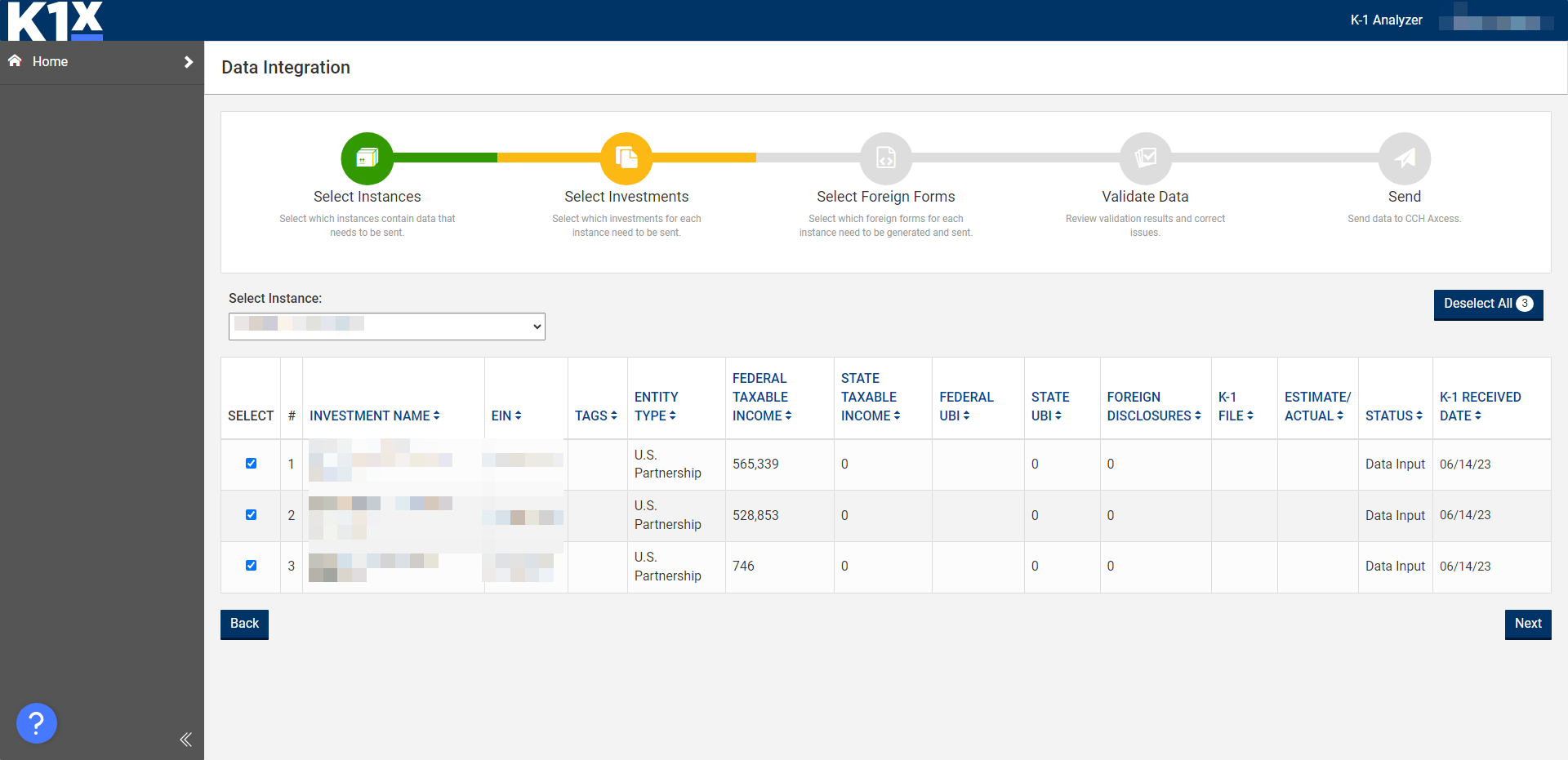

The next step will be to select which investments to include. A dropdown allows you to switch between instances being sent and investments for each instance can be checked/unchecked to include/exclude. By default, all investments are included.

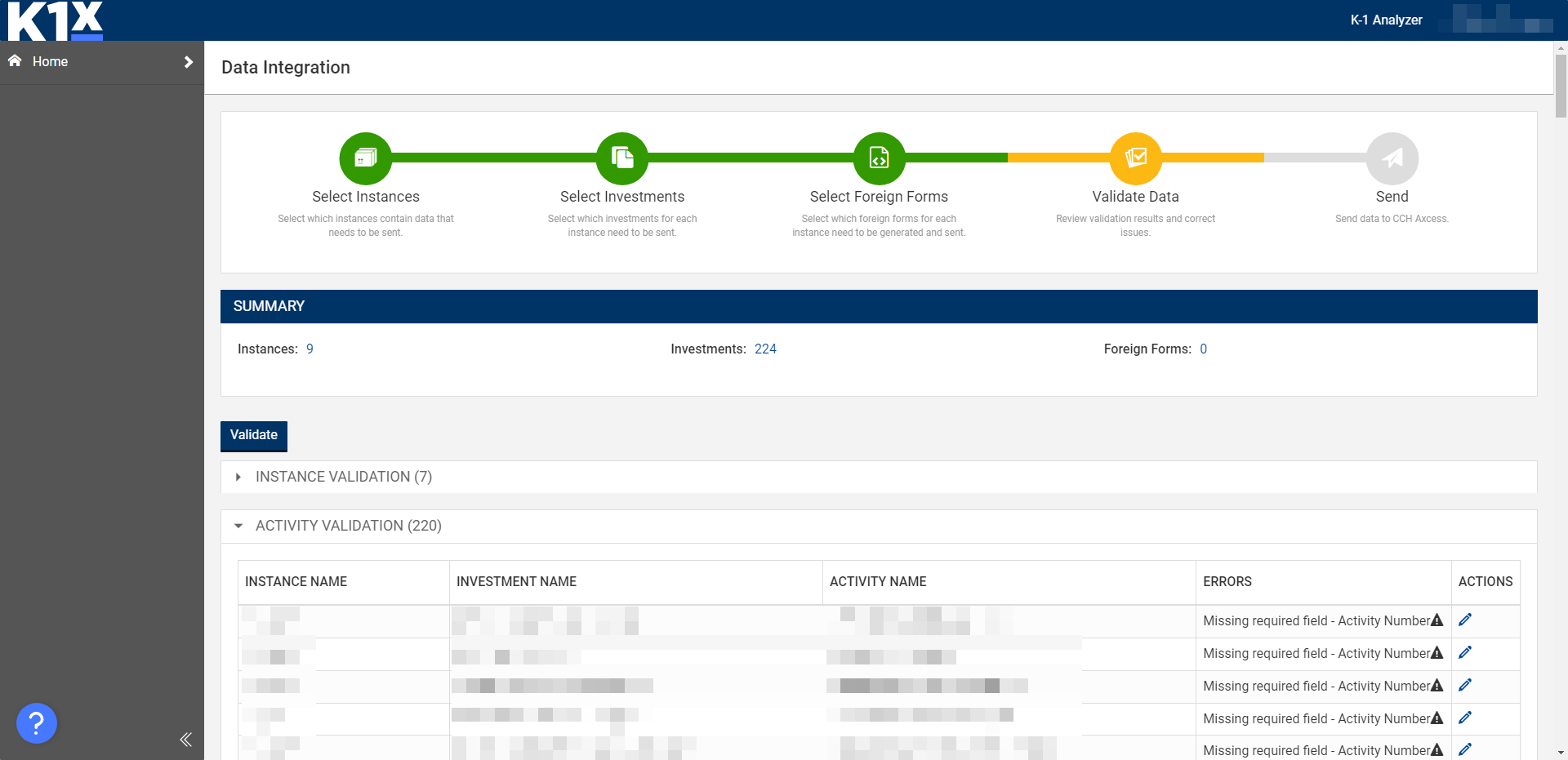

The Foreign Forms step is currently not part of the integration and can be ignored. Select Next to go onto the validation. The validation step will check that the required fields for the integration are populated with data. This step does not validate the required fields match CCH, only that they are present in K1 Aggregator.

Data will not be able to be sent until validation happens. If any required fields are missing, you can correct them on this page and revalidate.

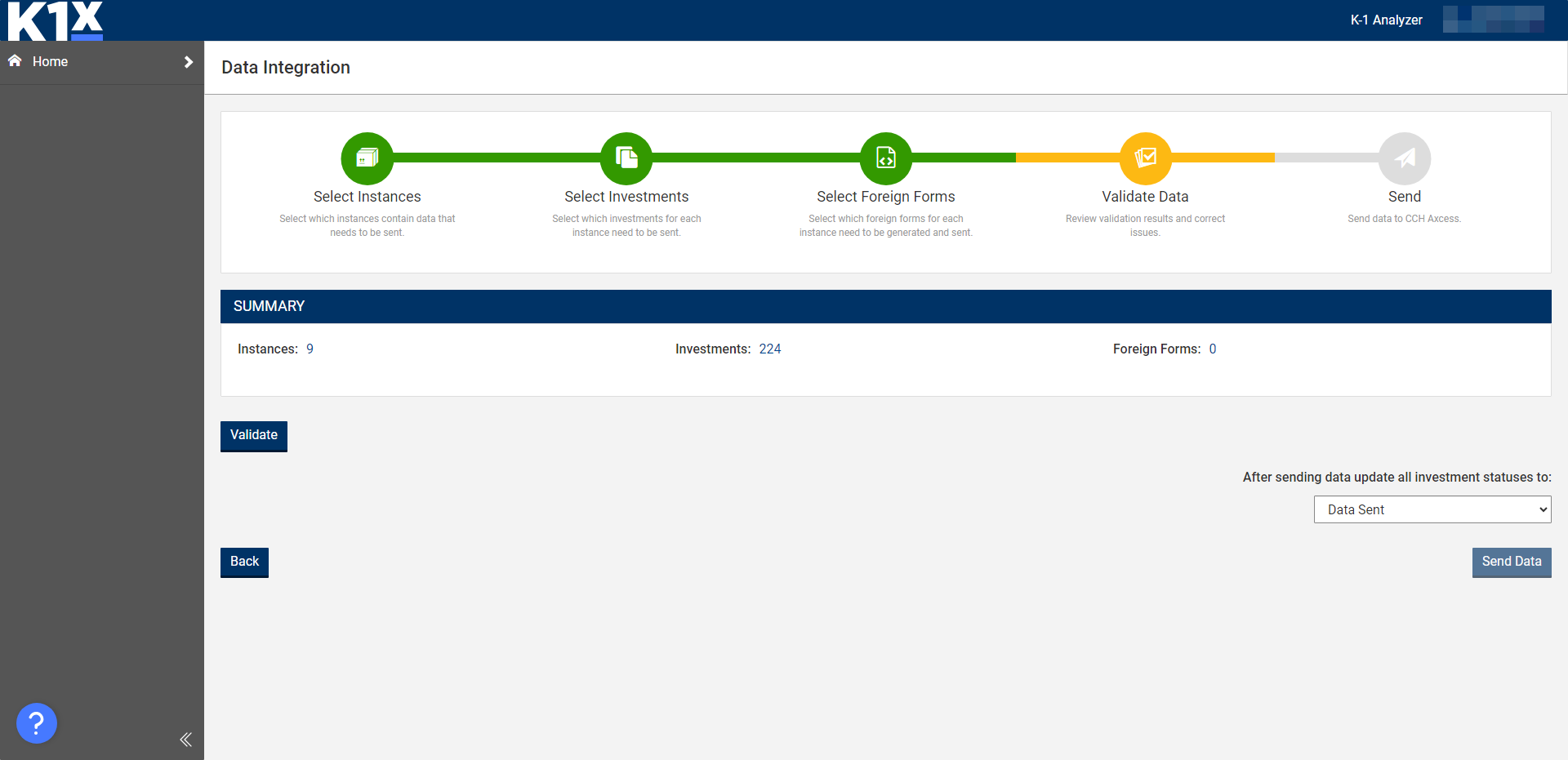

Once all validation errors are addressed, you can select which status to update the investments to and send. The send page will provide a status of the integration request and, if there are any errors or warning, will display those once the integration completes.

K1 Creator

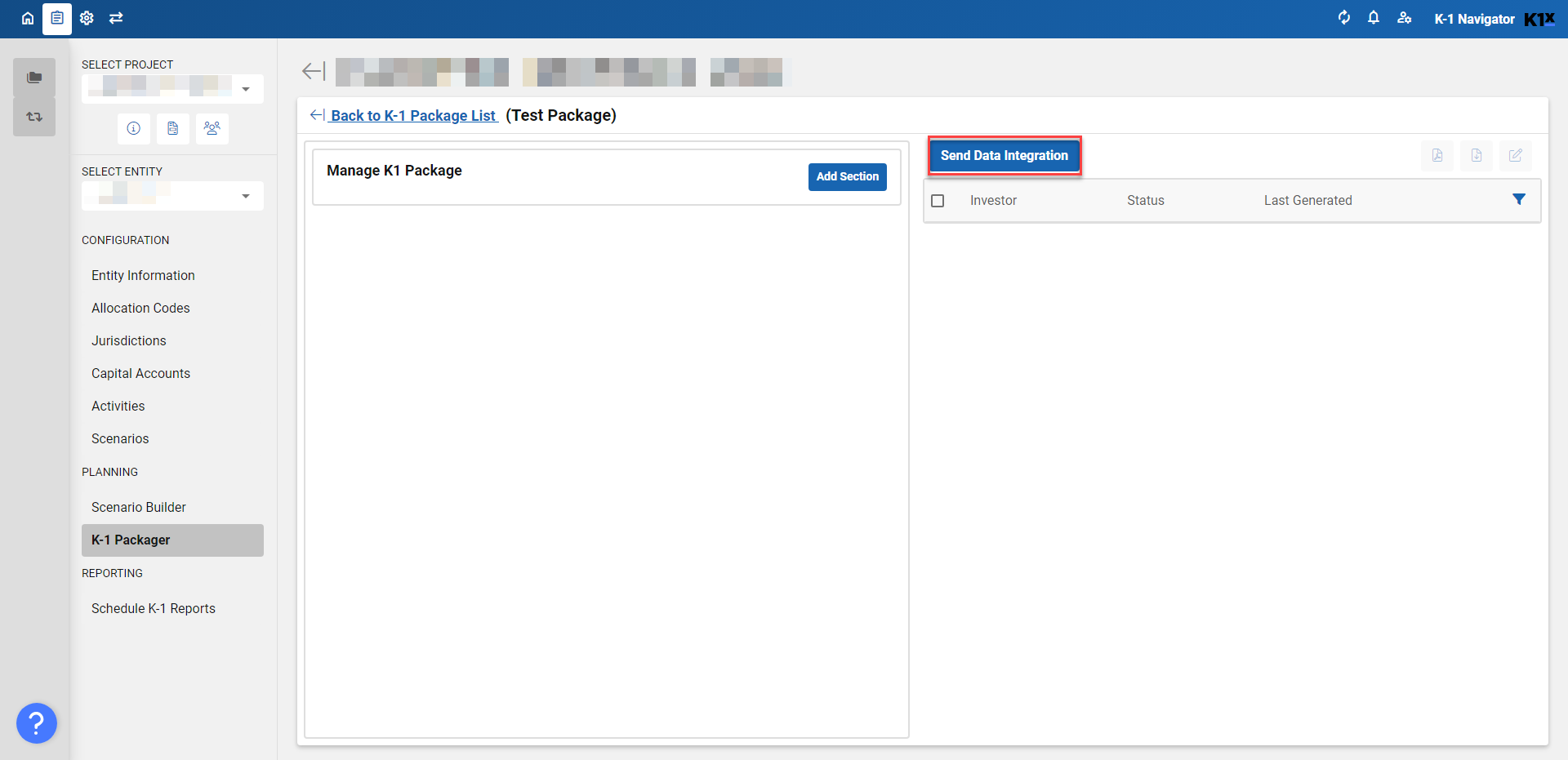

Once all work is done in K1 Creator and you are ready to send K-1 data to CCH, navigate to the K-1 Packager page for the entity. To start the integration process, select which investors you would like to include and then select the Send Data Integration button.

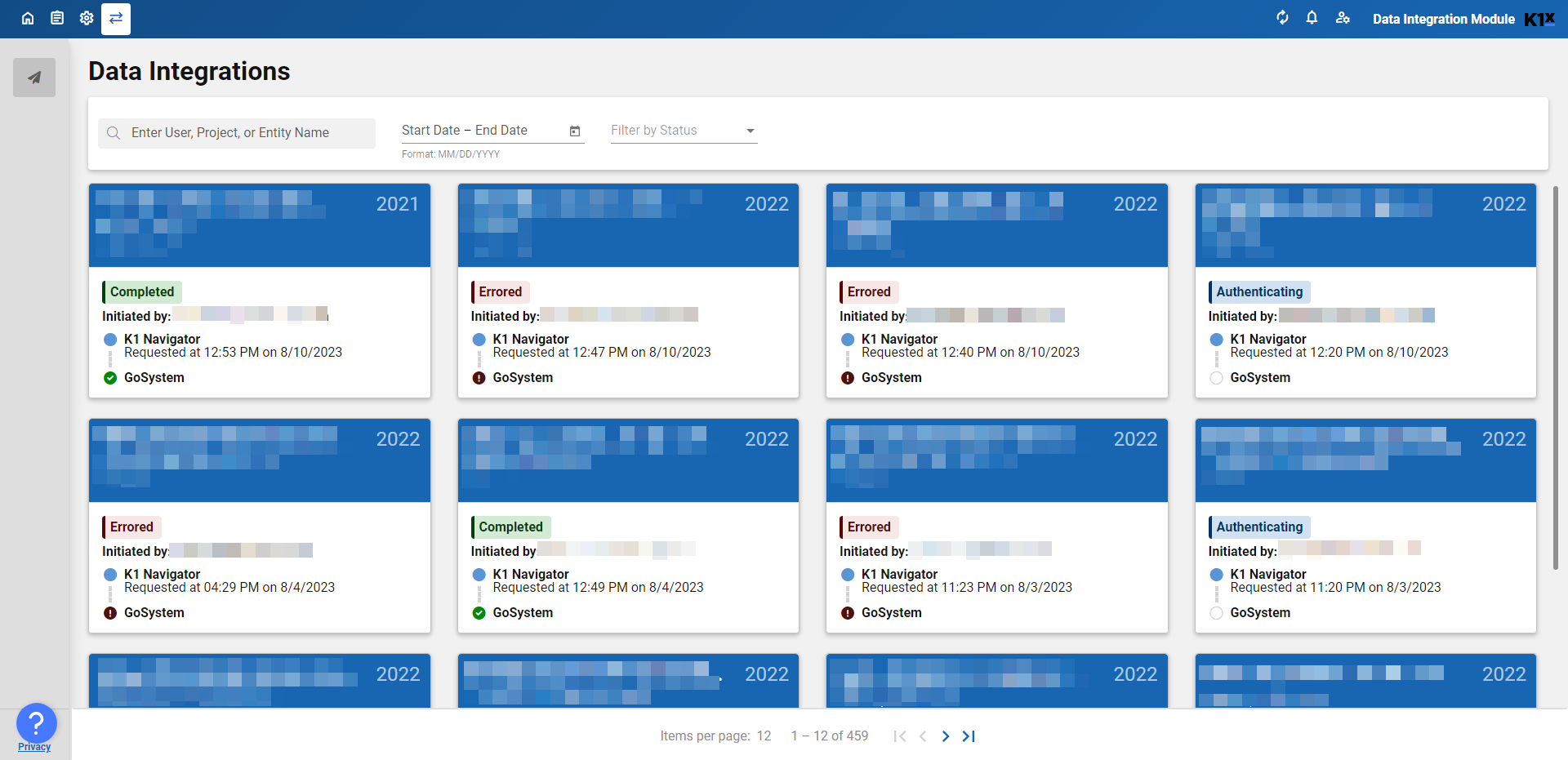

This will open a window to select where to send the data. Select Send to CCH Axcess. The send will begin and you will be able to wait and see status updates, or can close the window and check status later on the Data Integration Module page.

Troubleshooting

FAQs

- What fields are required in K1 Aggregator to send K-1 data to CCH?

- Investment Name, Investment EIN, and Activity Number for each activity being sent must be entered in K1 Aggregator and match CCH. For each instance being sent, the Return ID from CCH must also be entered.

- Do I need to have the activity created in CCH before sending an activity from K1 Aggregator?

- Yes, the activities must already exist in CCH and the activity numbers entered in K1 Aggregator must match the activity you want to send K-1 data into.

- What's an Integrator Key and is it required?

- Early users of the CCH integration may have entered an integrator key with their Client ID and Client Secret. The use of the integrator key will be going away, but instructions on obtaining it for use can be found on CCH's Registering the Open Integration Kit page.

- All investments must have a unique name, otherwise you will receive an error during the validation step.

Supported Worksheets

K1 Aggregator

- Federal 1065 Returns

- Federal

- Income

- Sch E, p 2 - Fiduciary Passthrough (K-1 1041)

- General

- Activity

- Activity (Continued)

- Sch E, p 2 - Partnership Passthrough (K-1 1065)

- General

- Activity

- Activity (Continued)

- Sch E, p 2 - Fiduciary Passthrough (K-1 1041)

- Income

- Federal

- Federal 1040 Returns

- Federal

- Income

- Sch E, p 2 - Fiduciary Passthrough (K-1 1041)

- General

- Activity

- Activity (Continued)

- Sch E, p 2 - Partnership Passthrough (K-1 1065)

- General

- Activity

- Activity (Continued)

- Including K-3

- Sch E, p 2 - S Corporation Passthrough (K-1 1120S)

- General

- Activity

- Activity (Continued)

- Sch E, p 2 - Fiduciary Passthrough (K-1 1041)

- Income

- Federal

- Federal 1041 Returns

- Federal

- Income

- Sch E, p 2 - Fiduciary Passthrough (K-1 1041)

- General

- Activity

- Activity (Continued)

- Sch E, p 2 - Partnership Passthrough (K-1 1065)

- General

- Activity

- Activity (Continued)

- Including K-3

- Sch E, p 2 - S Corporation Passthrough (K-1 1120S)

- General

- Activity

- Activity (Continued)

- Sch E, p 2 - Fiduciary Passthrough (K-1 1041)

- Income

- Federal

- Federal 1120 Returns

- Federal

- Income

- Fiduciary Passthrough (K-1 1041)

- Fiduciary Passthrough (K-1 1041)

- Partnership Passthrough (K-1 1065)

- Partnership Passthrough (K-1 1065)

- Fiduciary Passthrough (K-1 1041)

- Income

- Federal

- Federal 1120-S Returns

- Federal

- Income

- Fiduciary Passthrough (K-1 1041)

- Fiduciary Passthrough (K-1 1041)

- Partnership Passthrough (K-1 1065)

- Partnership Passthrough (K-1 1065)

- Fiduciary Passthrough (K-1 1041)

- Income

- Federal

K1 Creator

- Federal 1065 Returns

- Federal

- Partners

- Schedule K-1 Overrides

- 1 - Federal/State Schedule K-1 Overrides

- 2 - Schedule K-1 L11A Other Portfolio Income

- 3 - Schedule K-1 L11I Other Income

- 4 - Schedule K-1 L13W Other Deductions

- 5 - Sch K-1 L15P Other Credits

- 7 - Sch K-1 L17F Other AMT

- 8 - Sch K-1 L20AH Other Information

- 9 - Alabama Schedule K-1 Overrides

- 10 - Arkansas Schedule K-1 Overrides

- 11 - California Schedule K-1 Overrides

- 12 - California Source Schedule K-1 Overrides

- 13 - Illinois Schedule K-1 Overrides

- 14 - Illinois Source Schedule K-1 Overrides

- 15 - Massachusetts Schedule K-1 Overrides

- 16 - Mississippi Schedule K-1 Overrides

- 17 - New Jersey Schedule K-1 Overrides

- 18 - New Jersey Source Schedule K-1 Overrides

- 19 - New York Schedule K-1 Overrides

- 20 - Pennsylvania Schedule K-1 Overrides

- 21 - Wisconsin Schedule K-1 Overrides

- 22 - Wisconsin Source Schedule K-1 Overrides

- Schedule K-1 Overrides

- Partners

- Federal