GoSystem Integration: Requirements and Setup for K1 Aggregator

In order to configure the K1 Aggregator to GoSystem Integration before sending data to GoSystem, you will need to set up the connection from K1 Aggregator to GoSystem.

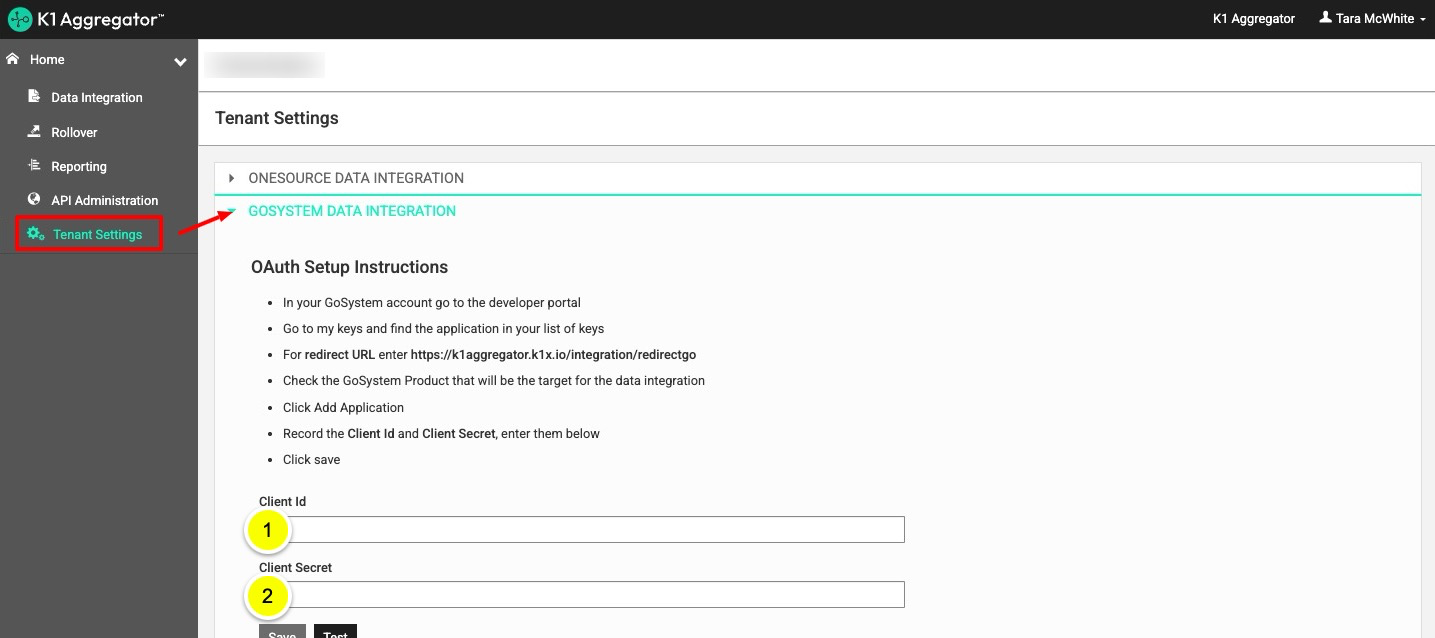

Configure the K1 Aggregator to GoSystem Integration

Before sending data to GoSystem, you will need to set up the connection from K1 Aggregator to GoSystem, you will need to make sure that TR has enabled to K1 Aggregator integration in your GoRS account.

OAuth Setup Instructions

- In your GoSystem account go to the developer portal

- Go to my keys and find the application in your list of keys

- For redirect URL enter https://k1aggregator.k1x.io/integration/redirectgo

- Check the GoSystem Product that will be the target for the data integration

- Click Add Application

- Record the Client Id and Client Secret, enter them in K1 Aggregator Tenant Settings > GoSystem Data Integration fields

- Click save

Required Fields for Successfully Sending Data from K1 Aggregator to GoSystem

Tables can't be imported directly. Please insert an image of your table which can be found here.

K-1 Analyzer Field GoSystem Field Definition Details Navigation1040: Add States/Cities

1041: Add/Delete States

1040: Organizer > States > Add States/Cities

1041: Organizer > States > Add/Delete States

Tips:

- Regularly save your work and verify changes before refreshing or navigating away from the page.

- Document any recurring issues with screenshots and detailed descriptions to assist technical support.

For further assistance, contact the K1x Support Team by clicking on the "Get Help" button on our apps or in our Help Center.